Vici Properties dividend calculator – VICI Properties Inc Announces Dividend of 0.39 Cash

March 11, 2023

Dividends Yield

VICI Properties Inc has announced a dividend of 0.39 cash on March 10, 2023. This dividend is part of the company’s long-term commitment to providing shareholders with a steady income and returns. Over the past three years, VICI PROPERTIES ($NYSE:VICI) has consistently issued an annual dividend per share of 1.5 USD, resulting in dividend yields of 4.8%, 4.8% and 4.94% from 2021 to 2023 respectively. This solidifies the company’s commitment to providing shareholders with reliable dividend returns and speaks to the strength of their investments. For investors looking for a reliable dividend stock, VICI PROPERTIES would be a great consideration.

The company has a long track record of providing steady returns and the annual dividend yield of 4.85% makes it an attractive option for income-seeking investors. Furthermore, the ex-dividend date for this company is March 22, 2023, meaning investors who purchase before that date will be eligible to receive the dividend. All in all, VICI PROPERTIES looks to be a great addition to any investor’s income portfolio.

Share Price

The announcement was met with a decline in the stock price, with the stock opening at $33.1 and closing at $31.9, a decrease of 4.0% from the previous closing price of 33.2. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vici Properties. More…

| Total Revenues | Net Income | Net Margin |

| 2.6k | 1.12k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vici Properties. More…

| Operations | Investing | Financing |

| 1.94k | -9.3k | 6.83k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vici Properties. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 37.58k | 15.29k | 21.21 |

Key Ratios Snapshot

Some of the financial key ratios for Vici Properties are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 62.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

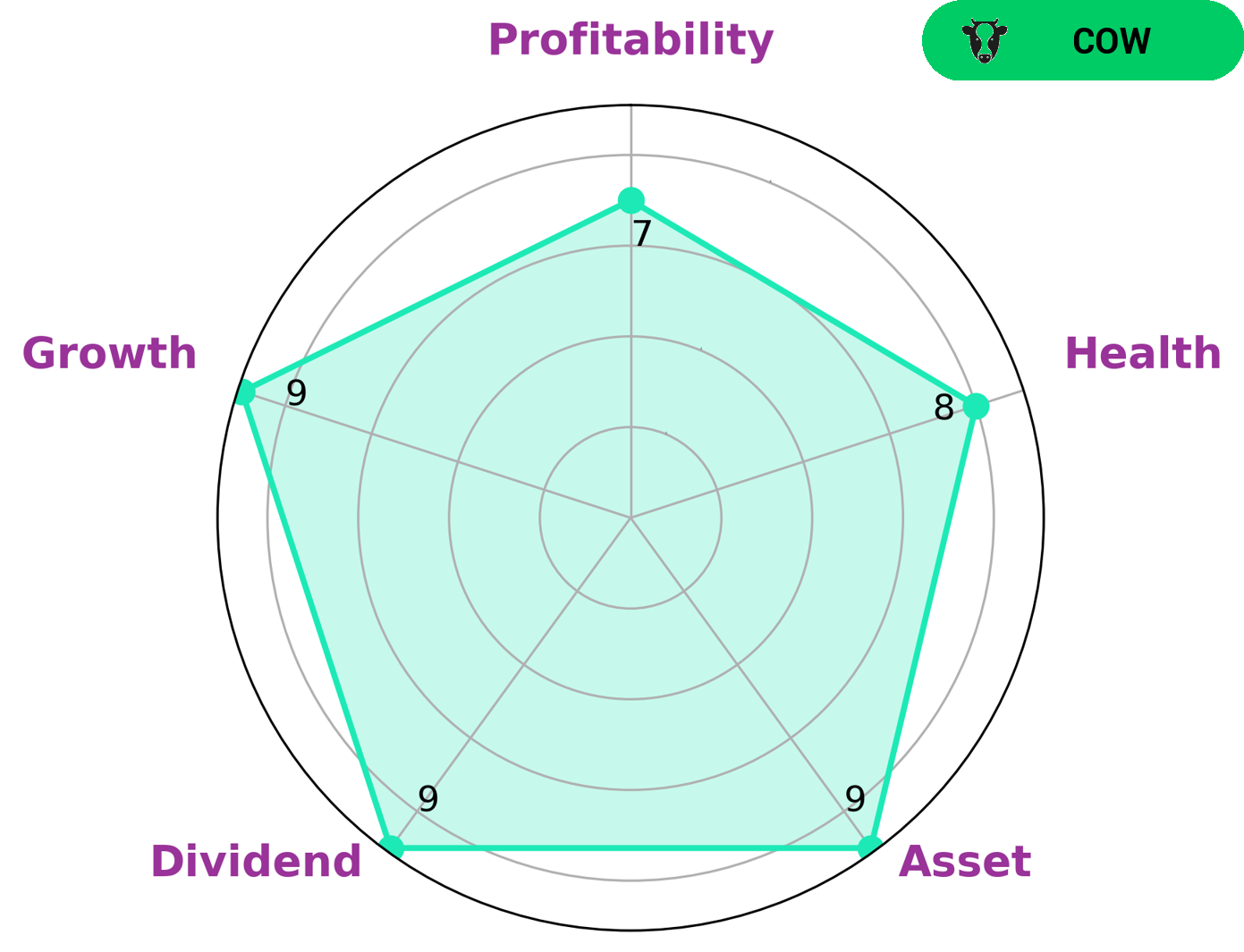

GoodWhale is here to help investors analyze VICI PROPERTIES‘s fundamentals. Using our Star Chart, VICI PROPERTIES is classified as a ‘cow’, which means that it has a track record of paying out consistent and sustainable dividends. This type of company may be especially attractive to dividend investors who are looking for long-term investments that provide reliable income. When it comes to VICI PROPERTIES’ performance, we can see that it is strong in asset, dividend, growth, and profitability. It also has an impressive health score of 8/10, which shows that it is capable of safely riding out any crisis without the risk of bankruptcy. All this makes VICI PROPERTIES an attractive investment for those seeking a safe and profitable returns. More…

Peers

The commercial real estate market is highly competitive. Its main competitors are Realty Income Corp, W.P. Carey Inc, and STORE Capital Corp. All of these companies are well-established and have a significant presence in the market. VICI Properties Inc has a competitive advantage in terms of its size and scale, as well as its experience and expertise.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation, together with its wholly-owned subsidiaries, is a real estate investment trust that focuses on the acquisition of net-leased commercial properties in the United States. As of December 31, 2020, the Company’s portfolio consisted of 5,741 properties leased to 492 commercial tenants in 48 states.

– W.P. Carey Inc ($NYSE:WPC)

W.P. Carey Inc is a real estate investment trust that owns and operates a diversified portfolio of properties across the United States. The company has a market cap of 15.41B as of 2022. The company’s portfolio consists of office buildings, warehouses, retail properties, and hotels. The company’s properties are leased to a variety of tenants, including Fortune 500 companies, government agencies, and non-profit organizations.

– STORE Capital Corp ($NYSE:STOR)

As of 2022, STORE Capital Corporation has a market capitalization of $8.94 billion. The company is a real estate investment trust that primarily invests in single-tenant net-leased properties across the United States.

Summary

VICI PROPERTIES is an attractive option for dividend stock investors as it has consistently paid out a dividend per share of 1.5 USD for the past three years, resulting in yields of 4.8%, 4.8% and 4.94%. This yields an average yield of 4.85%, which is a highly competitive rate of return for dividend investors. With no signs of slowing down, VICI PROPERTIES should remain a top pick for dividend investors looking to diversify their portfolio.

Recent Posts