Verizon Communications dividend – Verizon’s Upcoming Quarterly Results: What Dividend Investors Should Know

April 20, 2023

Trending News 🌥️

Verizon Communications ($NYSE:VZ) Inc. is a global leader in delivering broadband and other wireless and wireline communications services to consumer, business, government and wholesale customers. The company’s stock is traded on the New York Stock Exchange under the symbol VZ. As a dividend investor, it is important to take into account key factors when evaluating Verizon’s dividend returns and the company’s upcoming quarterly results. One of the most important factors to consider when evaluating Verizon’s dividend performance is its current dividend yield. This indicates that the company is committed to rewarding its shareholders for their investments. When examining Verizon’s upcoming quarterly results, investors should pay attention to the company’s performance in terms of revenue, earnings, and cash flow. If Verizon reports strong numbers in these areas, it could be a sign of a healthy dividend payout in the future.

Additionally, investors should also keep an eye on the company’s balance sheet and debt levels, as a higher debt load could increase the risk of dividend cuts in the future. By taking these factors into consideration, investors can make informed decisions when evaluating Verizon’s dividend returns and its upcoming quarterly results. With proper research and analysis, dividend investors can benefit from owning Verizon stock and its potentially rewarding dividend payouts in the future.

Dividends – Verizon Communications dividend

VERIZON COMMUNICATIONS is an attractive option for dividend investors, as it has issued annual dividends per share of 2.58 USD for the past three years. This has resulted in dividend yields of 5.23% over the same period. As such, the average dividend yield for VERIZON COMMUNICATIONS is 5.23%, making it a suitable option for dividend investors. Investors should be aware of the upcoming quarterly results from VERIZON COMMUNICATIONS, as this can affect the dividend yield and return from the stock. Those looking to invest in VERIZON COMMUNICATIONS should assess the current and upcoming quarterly results in order to make an informed decision.

In addition, investors should be mindful of any changes to the dividend policy that could affect the yield offered by the company’s stock.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Verizon Communications. More…

| Total Revenues | Net Income | Net Margin |

| 136.84k | 21.26k | 16.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Verizon Communications. More…

| Operations | Investing | Financing |

| 37.14k | -28.66k | -8.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Verizon Communications. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 379.68k | 287.22k | 20.83 |

Key Ratios Snapshot

Some of the financial key ratios for Verizon Communications are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.2% | -0.0% | 23.3% |

| FCF Margin | ROE | ROA |

| 7.6% | 22.3% | 5.2% |

Market Price

Verizon Communications is set to report its upcoming quarterly results on Wednesday, and dividend investors should take note of what the report could mean for the company. On Wednesday, the stock opened at $38.9 and closed at $38.6, down by 0.9% from the previous closing price of 38.9. This could mean that investors are expecting a weaker-than-expected performance from the telecommunications titan in its upcoming earnings report.

This could lead to a decrease in the company’s dividend payouts, which could have a direct impact on dividend investors. As such, it is important for investors to pay close attention to Verizon’s upcoming earnings report and to consider how any changes in dividend payouts might affect their investments. Live Quote…

Analysis

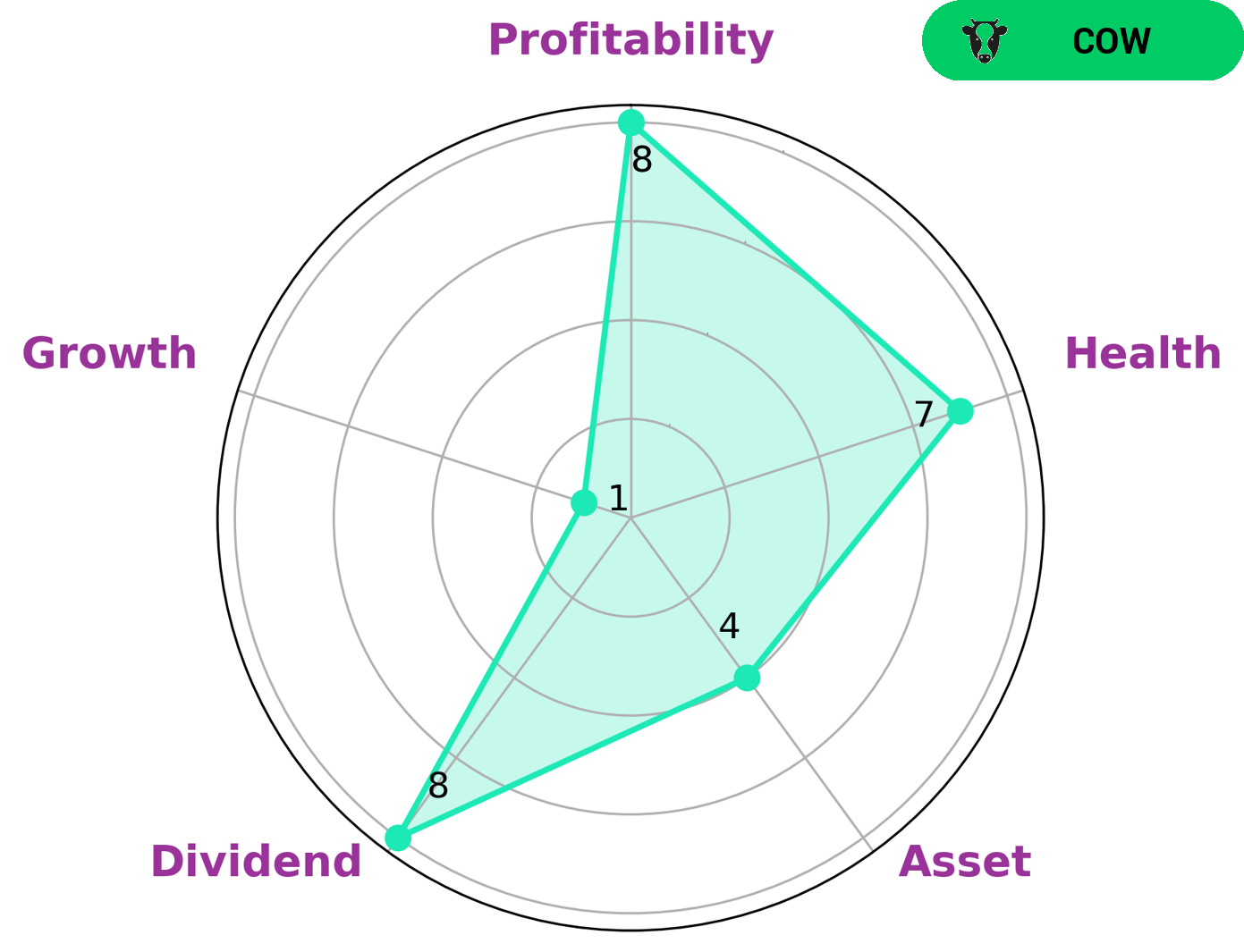

At GoodWhale, we recently conducted an analysis of the wellbeing of VERIZON COMMUNICATIONS. Our Star Chart ratings indicate that, when considering dividend, profitability, assets and growth, the company is strong in dividend and profitability, and medium in assets. We have classified VERIZON COMMUNICATIONS as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes them particularly attractive to investors who are looking for reliable growth, such as those looking for income through dividends. Furthermore, our health score for VERIZON COMMUNICATIONS is 7/10, indicating that the company is in a good position to withstand future market fluctuations and sustain operations in times of crisis. More…

Peers

Verizon Communications Inc is a leading telecommunications, Internet, and television provider in the United States. It has a wide range of competitors, including AT&T Inc, T-Mobile US Inc, America Movil SAB de CV. Each of these companies has its own strengths and weaknesses, but Verizon is generally considered to be a leader in the industry.

– AT&T Inc ($NYSE:T)

AT&T Inc. is an American multinational conglomerate holding company headquartered at Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company, the second largest provider of mobile telephone services, and the largest provider of fixed telephone services in the United States through AT&T Communications. Since June 14, 2018, it also owns the media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue. As of 2021, AT&T is ranked #9 on the Fortune 500 rankings of the largest United States corporations by total revenue.

AT&T Inc. has a market cap of 110.74B as of 2022 and a Return on Equity of 12.91%. AT&T is the world’s largest telecommunications company and the second largest provider of mobile telephone services. The company also owns the media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue.

– T-Mobile US Inc ($NASDAQ:TMUS)

T-Mobile US, Inc., together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the U.S. Virgin Islands. The company offers voice, messaging, and data services to approximately 79 million customers as of the end of 2019. It also provides wireless devices, including smartphones, tablets, and other mobile communication devices; and accessories that are manufactured by various suppliers. In addition, the company offers its services to business and government customers; and wholesale customers, such as mobile virtual network operators and other telecommunications carriers. T-Mobile US, Inc. was founded in 1994 and is headquartered in Bellevue, Washington.

– America Movil SAB de CV ($OTCPK:AMXVF)

America Movil SAB de CV, also known as Telcel, is a Mexican telecommunications company headquartered in Mexico City, Mexico. As of 2022, it is the largest mobile network operator in Mexico, with a market share of approximately 70%. Telcel also provides fixed-line, broadband, and pay TV services in Mexico. The company was founded in 1972 and is a subsidiary of America Movil.

Summary

Verizon Communications is a telecommunications giant that is scheduled to release its quarterly results soon. For dividend investors, there are some important considerations they should take into account. Some of these include Verizon’s current dividend yield, the company’s debt levels, the revenue and EPS growth compared to previous quarters, and the expected dividend payout ratio. Investors should also examine the company’s financial performance, such as the return on assets, free cash flow, and net income.

Additionally, they should look at trends in the stock price and general market outlook, as this will affect their investment decision. Finally, it is important to stay up-to-date with any news or announcements from the company itself. By doing so, investors can gain a better understanding of how Verizon Communications is performing and decide if it is worth investing in.

Recent Posts