Ventia Services stock dividend – Ventia Services Group Ltd Declares 0.0828 Cash Dividend

March 25, 2023

Dividends Yield

On March 1 2023, Ventia Services ($ASX:VNT) Group Ltd announced that it would be paying a 0.0828 cash dividend to its shareholders. The next ex-dividend date to receive the dividend is March 1st 2023. This means that any shareholders who own the stock before this date will receive the dividend on March 1st 2023.

The dividend will be paid out on April 1st 2023 for those who continue to hold the stock after the ex-dividend date. With the upcoming ex-dividend date, now is the time to invest and reap the rewards of a reliable dividend stock.

Market Price

This dividend is in line with the company’s long term strategic plan to reward shareholders for their loyalty and investment. On Wednesday, VENTIA SERVICES stock opened at AU$2.3 and closed at AU$2.3, down by 1.7% from prior closing price of 2.4. This could be due to the announcement of the dividend, as investors may have chosen to take their profits rather than reinvest them in the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ventia Services. More…

| Total Revenues | Net Income | Net Margin |

| 5.17k | 191.2 | 3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ventia Services. More…

| Operations | Investing | Financing |

| 289.9 | -50.1 | -139.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ventia Services. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.86k | 2.34k | 0.61 |

Key Ratios Snapshot

Some of the financial key ratios for Ventia Services are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 4.8% |

| FCF Margin | ROE | ROA |

| 4.9% | 34.2% | 5.5% |

Analysis

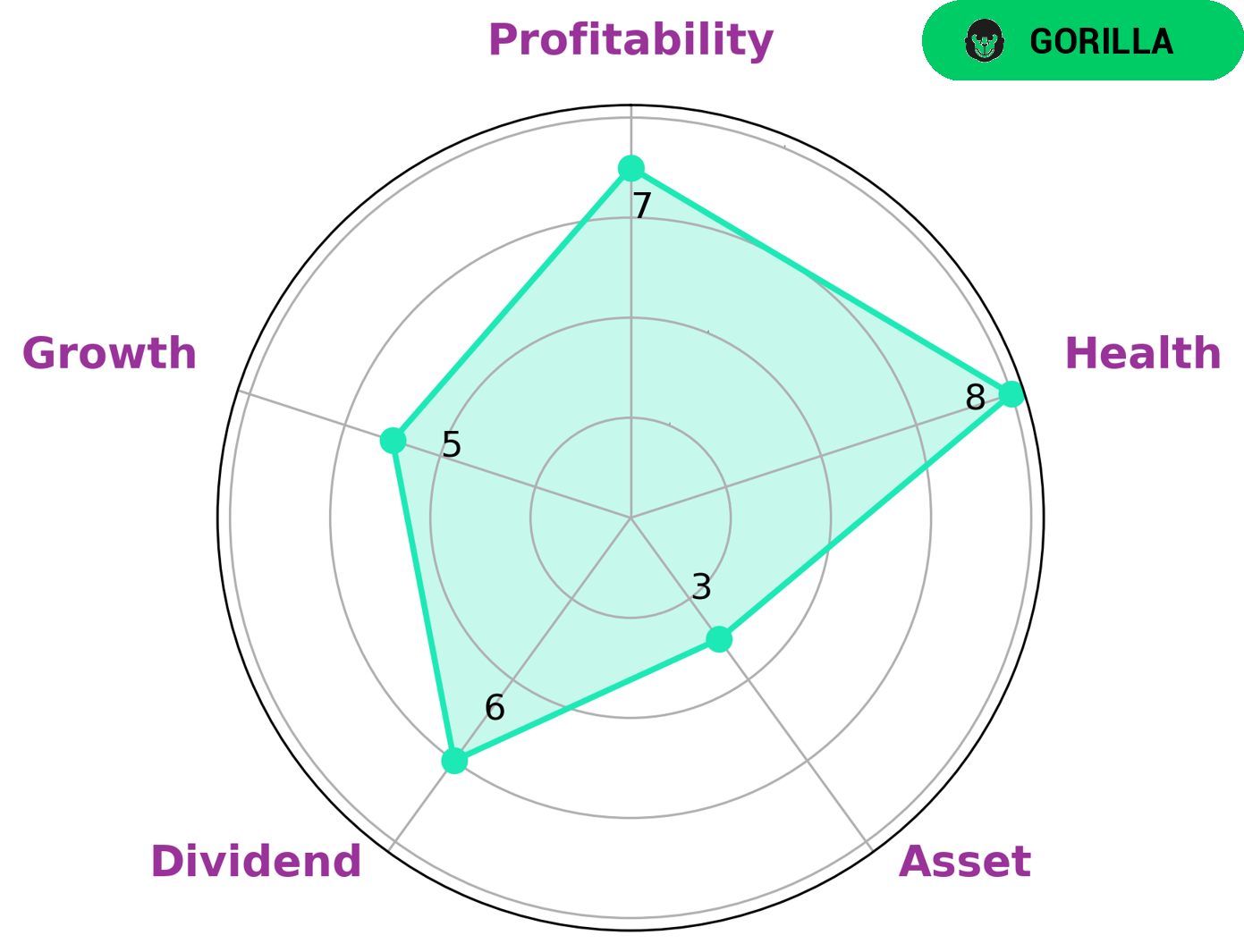

GoodWhale has done an evaluation of VENTIA SERVICES‘s financials, and the Star Chart reveals that VENTIA SERVICES has a high health score of 8/10, indicating that it is capable to sustain future operations in times of crisis. We have also classified VENTIA SERVICES as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given VENTIA SERVICES’s strength in terms of profitability, medium dividend and growth and weak asset, investors who are looking for companies that have the potential for long-term growth may be interested in VENTIA SERVICES. These investors may be attracted to VENTIA SERVICES due to its competitive advantages, plus its ability to generate consistent and high revenues or earnings. Such investors could benefit from VENTIA SERVICES’s long-term growth potential, as well as its durability through economic downturns. More…

Peers

It is one of the leading players in the industry, competing alongside other major players like AVADA Group Ltd, IAR SA Brasov, and Atlas Arteria Ltd. All of these companies are dedicated to providing quality services that meet customer needs.

– AVADA Group Ltd ($ASX:AVD)

Founded in 2009, FADADA Group Ltd is a leading provider of online legal services. Its software solutions enable legal professionals to create, sign, store, and manage legal documents online, reducing costs and improving efficiency. As of 2023, the company has a market cap of 37.37M and a Return on Equity of -11.7%. This implies that the company’s shareholders are not receiving a satisfactory amount of returns on their investments. Furthermore, their market cap is lower than other competitors in their industry, suggesting that their stock price may be undervalued.

– IAR SA Brasov ($LTS:0R9J)

Atlas Arteria Ltd is a listed global infrastructure company that invests in toll road and airport assets. As of 2023, Atlas Arteria has a market capitalization of 9.43 billion and a Return on Equity (ROE) of 4.24%. The company’s market cap reflects its strong performance, as the ROE suggests that it is generating a healthy return for its shareholders. The company’s portfolio includes investments in airports, toll roads, and other transportation assets, giving it an impressive range of infrastructure assets. With an experienced and dedicated leadership team, Atlas Arteria is well-positioned to continue delivering value to its investors.

Summary

Ventia Services is a reliable dividend stock with an attractive yield of 3.62% over the past three years. It has paid out an annual dividend of 0.09 AUD per share and is an ideal choice for investors seeking to gain long-term returns from a reliable company. With their track record of consistent dividends, investors can expect strong returns for the foreseeable future.

Recent Posts