Vector Group dividend – Vector Group Ltd Declares 0.2 Cash Dividend

March 14, 2023

Dividends Yield

On March 7 2023, Vector Group ($NYSE:VGR) Ltd announced a 0.2 USD cash dividend. This comes as a continuation of the company’s policy of providing investors with annual dividend payouts. This dividend is particularly attractive for investors interested in dividend stocks, as VECTOR GROUP has issued an annual dividend per share of 0.8 USD for the last three years (2022-2024), with an average yield of 7.3%. The ex-dividend date is March 16th 2023, so investors must purchase the stock before that date in order to receive the dividend payout. The announcement of this dividend is likely to be welcomed by long-term investors, as it continues to provide a steady stream of income on their investments.

Additionally, this dividend may serve as an additional incentive for potential new investors to consider investing in VECTOR GROUP. With its attractive dividend yield and strong performance in the past three years, the stock may be an attractive option for many investors.

Stock Price

This news caused the stock to open at $13.2 and close at $12.8, a decrease of 2.6% from the previous closing price of $13.2. This was the first cash dividend to be declared in almost a year, likely contributing to the stock’s decrease in value. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vector Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.44k | 158.7 | 11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vector Group. More…

| Operations | Investing | Financing |

| 272.9 | -61.97 | -364.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vector Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.05k | 1.87k | -5.32 |

Key Ratios Snapshot

Some of the financial key ratios for Vector Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.9% | 13.5% | 23.0% |

| FCF Margin | ROE | ROA |

| 18.2% | -25.1% | 19.7% |

Analysis

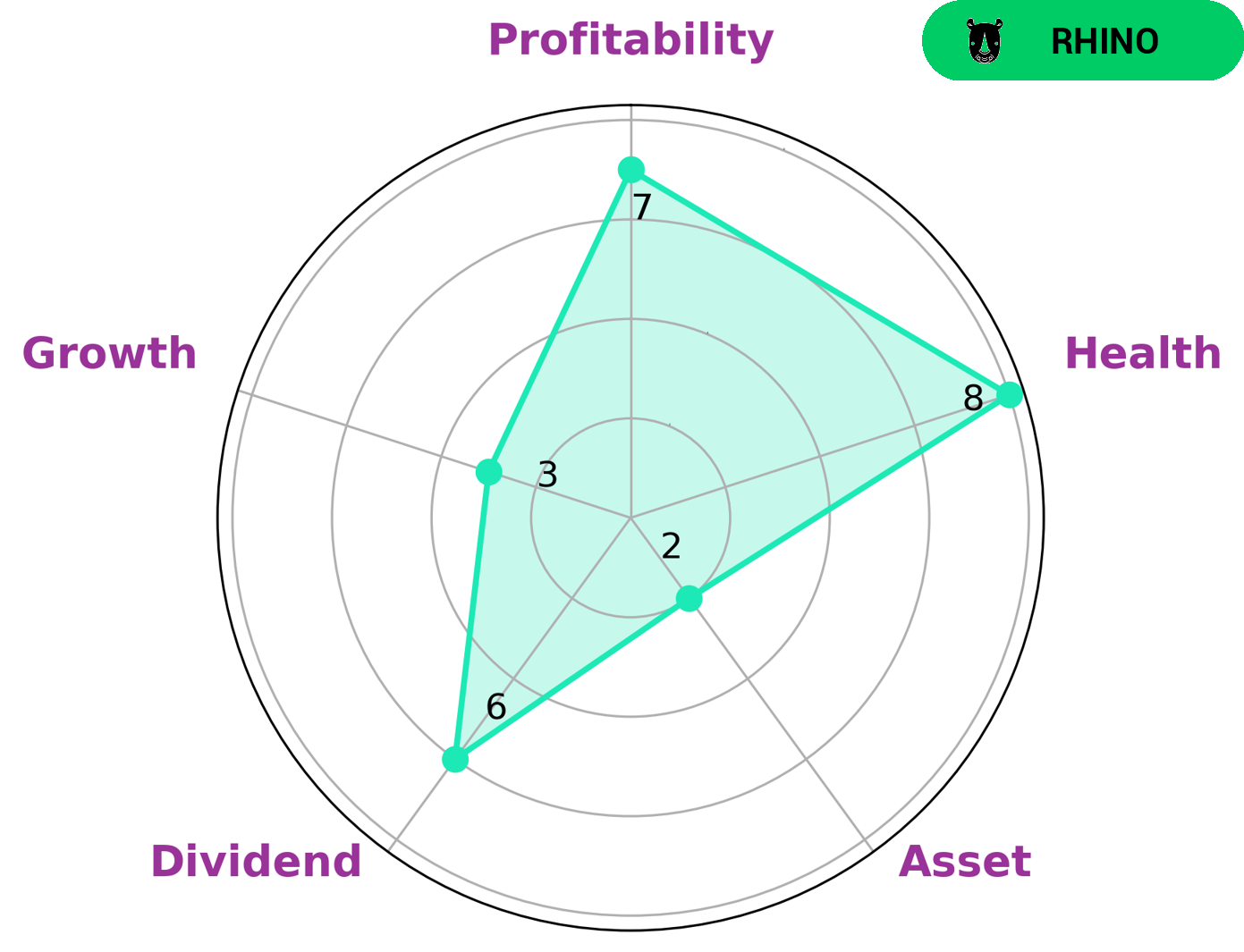

GoodWhale has conducted an analysis of VECTOR GROUP’s financials. The Star Chart shows that VECTOR GROUP is strong in terms of profitability, medium in terms of dividend, and weak in terms of asset and growth. VECTOR GROUP has a high health score of 8/10 which indicates its capability to pay off debt and fund future operations. GoodWhale has classified VECTOR GROUP as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors who are looking for a mature company with stable returns may be interested in VECTOR GROUP, as it has the potential to generate income for shareholders through dividends, interest payments, and capital appreciation. More…

Peers

The competition between Vector Group Ltd and its competitors is fierce. All of these companies are fighting for market share in the wine industry, and all of them are trying to get an edge on the others. Vector Group Ltd has a strong market position, and it is looking to maintain its position. The company has a strong brand, and it has a loyal customer base. The company is also expanding its product range, and it is investing in new technology. The company is also looking to increase its sales in China.

– Marlborough Wine Estates Group Ltd ($NZSE:MWE)

Marlborough Wine Estates Group Ltd is a wine producer and retailer based in New Zealand. The company has a market cap of 57.91 million as of 2022 and a return on equity of -0.99%. Marlborough Wine Estates Group Ltd produces and sells a variety of wine products under its own brands as well as under private label agreements. The company also owns and operates a number of retail stores in New Zealand and Australia.

– Delegat Group Ltd ($NZSE:DGL)

Delegat Group Ltd is a global wine company with vineyards and production facilities in New Zealand, Australia, and Chile. The company has a market capitalization of 1.04 billion as of 2022 and a return on equity of 12.31%. Delegat Group Ltd is engaged in the production and sale of premium wines. The company’s product portfolio includes red wine, white wine, rose wine, and sparkling wine.

– Foley Wines Ltd ($NZSE:FWL)

Foley Wines Ltd is a wine company with a market cap of 88.09M as of 2022. The company has a return on equity of 5.19%. Foley Wines Ltd produces and sells wine. The company was founded in 1993 and is headquartered in Auckland, New Zealand.

Summary

VECTOR GROUP is an attractive investment opportunity for those looking to gain a steady return. Insulated from market volatility, the company has issued a reliable annual dividend per share of 0.8 USD over the past three years (2022-2024), resulting in an average dividend yield of 7.3%. Investors may also benefit from holding shares in VECTOR GROUP due to potential capital gains as the share price rises.

In addition, potential tax benefits can be received from dividends, making VECTOR GROUP a sensible choice for those interested in dividend stocks. Analyzing the company’s financial statements and trends in stock price over time can help investors make an informed decision about the company’s future performance.

Recent Posts