Union Tool dividend calculator – Union Tools Co Declares 42.0 Cash Dividend

June 3, 2023

🌥️Dividends Yield

On June 1 2023, UNION TOOL ($TSE:6278) Co declared a 42.0 JPY cash dividend to its shareholders. This makes it an attractive option for those in the market for dividend stocks, as its dividend yields have been consistently high over the past three years. In 2020, the company declared a dividend of 82.0 JPY, which corresponded to a yield of 2.3%. In 2021 and 2022, the dividends were 77.0 JPY and 60.0 JPY, corresponding to yields of 2.17% and 1.98%, respectively.

The average yield over the past three years has been 2.15%. An ex-dividend date has been set for June 29 2023.

Share Price

On Thursday, UNION TOOL Co. announced a 42.0 JPY cash dividend to be paid to its shareholders. This dividend was approved by the company’s board of directors and is set to be distributed on December 31, 2020. Following the announcement, UNION TOOL stock opened at JP¥3180.0 and closed at JP¥3170.0, up by 0.2% from the last closing price of 3165.0. This dividend is expected to provide shareholders with a return on their investments and reflect the company’s commitment to its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Union Tool. More…

| Total Revenues | Net Income | Net Margin |

| 30.77k | 5.1k | 17.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Union Tool. More…

| Operations | Investing | Financing |

| 6.59k | -3.16k | -1.44k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Union Tool. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 70.4k | 6.16k | 3.72k |

Key Ratios Snapshot

Some of the financial key ratios for Union Tool are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.2% | 34.6% | 22.9% |

| FCF Margin | ROE | ROA |

| 12.9% | 6.9% | 6.2% |

Analysis

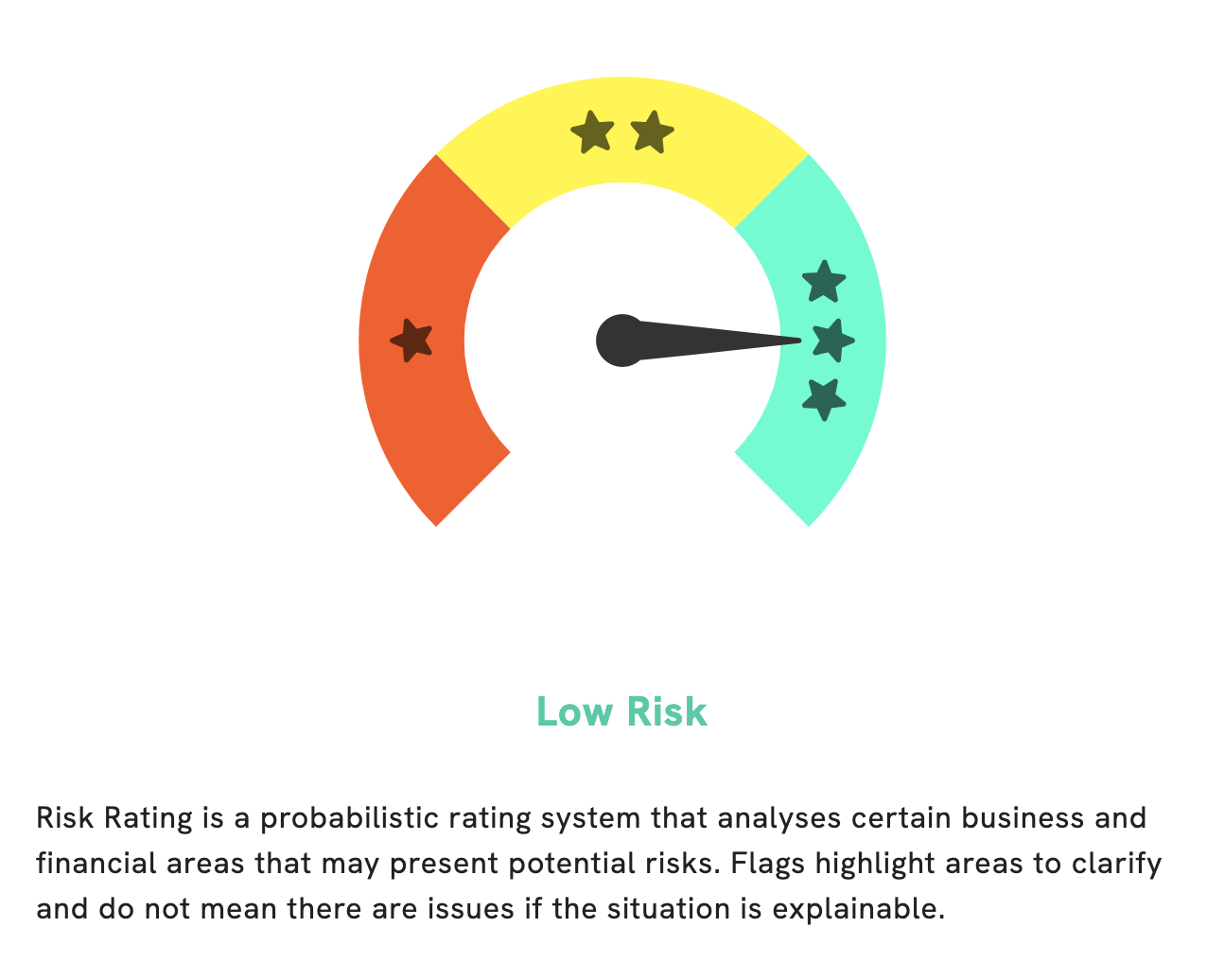

At GoodWhale, we have conducted a thorough analysis of UNION TOOL‘s financials and have determined it to be a low risk investment in terms of financial and business aspects. We have detected only one risk warning in the income sheet. However, this does not pose a major concern given the overall stability of the company. For more information on this risk, please register on GoodWhale.com to access our detailed report. More…

Peers

With a strong focus on customer service and satisfaction, Union Tools Co has established a reputation as a reliable and dependable supplier. In addition to Union Tools Co, the industry is populated by other highly competitive manufacturers such as Dmg Mori Co Ltd, Chicago Rivet & Machine Co, and Key Ware Electronics Co Ltd. Each company provides quality products and services, making the industrial and commercial markets a competitive playing field.

– Dmg Mori Co Ltd ($TSE:6141)

DMG Mori Co Ltd is a Japanese machine tool builder and cutting tool manufacturer. It is one of the world’s leading providers of advanced machine tools and cutting tools, offering high-quality products and services. The company has a market capitalization of 266.31 billion as of 2023 and a return on equity of 8.59%, indicating its financial health. DMG Mori Co Ltd has been successful in expanding its business operations by focusing on research and development of advanced technologies to remain competitive in the global market. Its comprehensive portfolio of products includes machining centers, lathes, grinders, laser processing machines, and more. The company strives to provide the best quality machinery and cutting tools to cater to the demands of its worldwide customer base.

– Chicago Rivet & Machine Co ($NYSEAM:CVR)

Chicago Rivet & Machine Co is a company that specializes in the design and manufacture of rivets, screws, and nuts for a variety of industries. The company has a market cap of 27.97M as of 2023 which indicates its current market value. The Return on Equity (ROE) of 1.44% indicates that the company is able to generate profits from its investments. Chicago Rivet & Machine Co has a strong commitment to providing quality products and services to its customers, which is reflected in its market cap and ROE.

– Key Ware Electronics Co Ltd ($TPEX:5498)

Key Ware Electronics Co Ltd is a consumer electronics company that designs, manufactures and sells a range of consumer electronic products. The company’s market cap as of 2023 is 1.98 billion. This signifies the value of the company and its potential for growth. The company’s Return on Equity (ROE) is -1.43%, which indicates that the company is not using its equity effectively and thus not generating returns that meet or exceed the cost of equity.

Summary

Investing in UNION TOOL is a good choice as it offers an attractive dividend yield. Over the past three years, its annual dividends per share were 82.0, 77.0 and 60.0 JPY, with a corresponding dividend yield of 2.3%, 2.17% and 1.98%. On average, investors can expect a yield of 2.15%. It is worth noting that UNION TOOL has a consistent dividend policy which makes it an attractive option for income investors.

Recent Posts