Tsukishima Kikai dividend yield – TSUKISHIMA KIKAI Announces 5.0 Special Dividend!

March 27, 2023

Dividends Yield

On March 23, 2023, TSUKISHIMA KIKAI ($TSE:6332) announced its 5.0 Special Dividend. This announcement follows after the company has issued annual dividend per share of JPY 33.0, 30.0 and 24.0 for the last 3 years, which indicates an average dividend yield of 2.49%. The upcoming ex-dividend date is scheduled for March 30, 2023 with a dividend yield of 1.94%. For investors looking to invest in dividend stocks, TSUKISHIMA KIKAI makes for a viable option.

The company’s recent dividend announcement is an indication that it is committed to providing returns to its shareholders. It also has a long track record of providing consistent dividends for multiple years in a row. For those looking for a reliable dividend stock, this could be a great choice.

Market Price

The announcement sent the stock soaring, with the stock opening at JP¥1037.0 and closing at JP¥1058.0, representing a 1.3% increase from the previous close of 1044.0. Investors welcomed the news and responded positively to the announcement, driving up the stock price. The company’s strategy of focusing on high-quality products and innovation has allowed it to remain competitive in the market and has resulted in strong financial performance in recent years.

Overall, TSUKISHIMA KIKAI‘s 5.0 special dividend announcement has been well-received by investors and has led to an increase in stock price. This dividend is a great way for investors to benefit from the company’s success and will likely help further improve its reputation in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tsukishima Kikai. More…

| Total Revenues | Net Income | Net Margin |

| 99.37k | 8.24k | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tsukishima Kikai. More…

| Operations | Investing | Financing |

| 7.49k | -5.37k | -628 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tsukishima Kikai. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 140.52k | 58.63k | 1.82k |

Key Ratios Snapshot

Some of the financial key ratios for Tsukishima Kikai are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.1% | -9.3% | 11.7% |

| FCF Margin | ROE | ROA |

| -7.1% | 9.1% | 5.2% |

Analysis

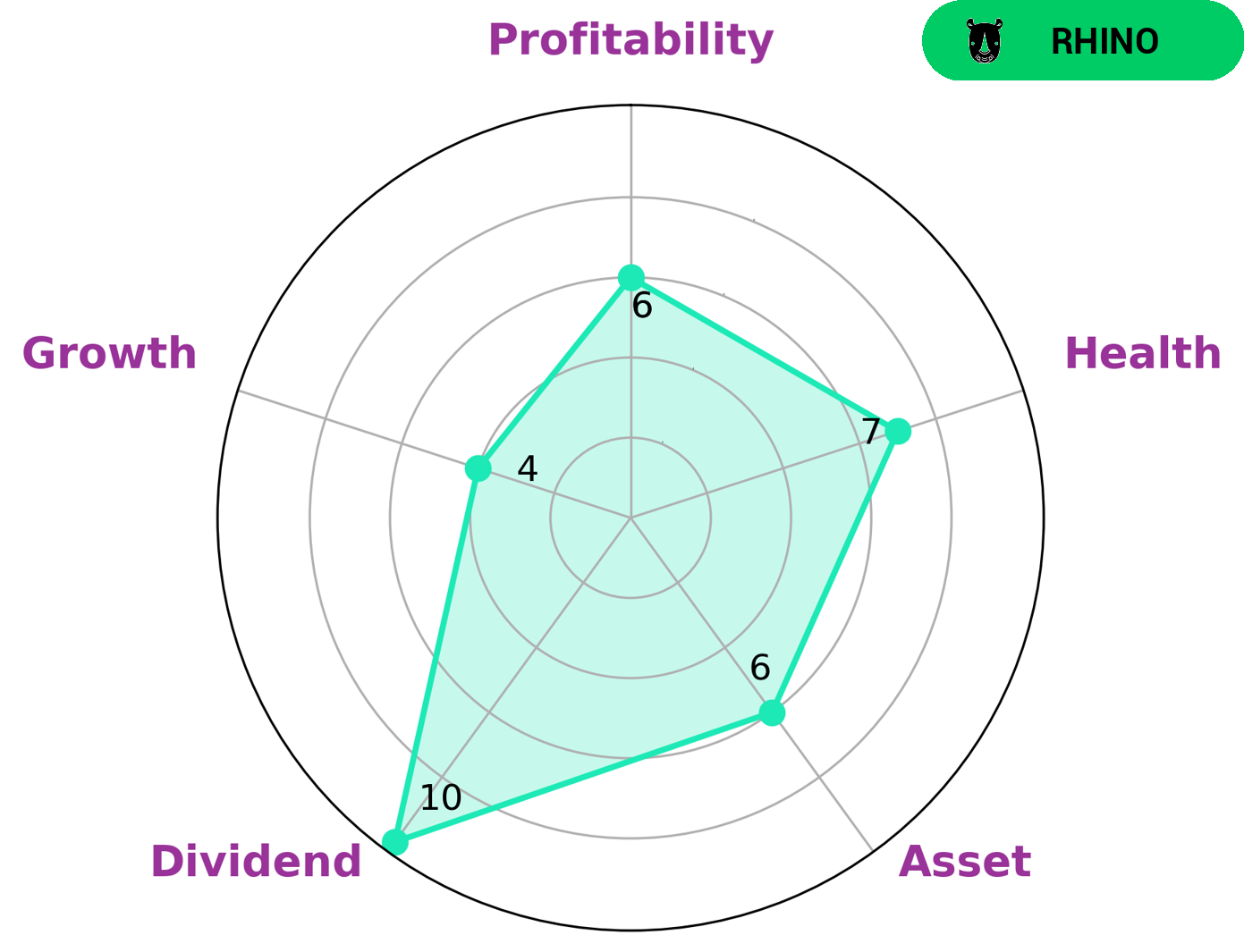

At GoodWhale, we conducted an analysis of TSUKISHIMA KIKAI‘s financials, and found that it is strong in dividend, and medium in asset, growth, and profitability. According to our Star Chart, TSUKISHIMA KIKAI has a high health score of 7/10 with regard to its cashflows and debt, indicating that it is capable of sustaining future operations in times of crisis. We classify TSUKISHIMA KIKAI as a ‘rhino’ type of company, which has achieved moderate revenue or earnings growth. Given the company’s moderate growth and strong dividend, we believe that income investors may be particularly interested in TSUKISHIMA KIKAI. However, the company’s medium scores in asset and growth could also attract those investors looking for stocks with potential for capital appreciation. More…

Peers

The competition between Tsukishima Kikai Co Ltd and its competitors is fierce, with Penyao Environmental Protection Co Ltd, Brite-Tech Bhd, and CEC Environmental Protection Co Ltd all vying for the top spot in the industry. Each company is working hard to provide the best services and products for their customers, striving for success in a competitive marketplace.

– Penyao Environmental Protection Co Ltd ($SZSE:300664)

Penyao Environmental Protection Co Ltd is a Chinese company that specializes in environmental protection services. As of 2023, the company has achieved a market cap of 4.22 billion, indicating the company’s strong financial performance and investor confidence. Additionally, the company has a Return on Equity (ROE) of 7.6%, which is a measure of the amount of net income that is generated from equity invested by shareholders. This is a strong indication of the company’s ability to generate profits from the money invested by its shareholders. Penyao Environmental Protection Co Ltd is well-positioned to continue to provide quality environmental protection services and remain highly profitable in the future.

– Brite-Tech Bhd ($KLSE:0011)

Brite-Tech Bhd is a Malaysian based technology company that offers a variety of services and products related to information technology. As of 2023, the company has a market capitalization of 78.12M, which indicates its financial strength and stability. Additionally, the company’s return on equity of 9.52% further highlights its overall profitability and is indicative of its strong financial position. The company strives to be a leader in the IT sector by providing innovative solutions for its customers and leveraging technology to create value for its stakeholders.

– CEC Environmental Protection Co Ltd ($SZSE:300172)

CEC Environmental Protection Co Ltd is a Chinese environmental protection company that specializes in air pollution control. The company has a market capitalization of 3.25 billion as of 2023, indicating that the company is highly valued by the market. Additionally, the company’s Return on Equity of 5.11% indicates that the company is effectively utilizing its resources to generate profits. CEC Environmental Protection Co Ltd provides environmental protection services, including air pollution control, water pollution control and environmental engineering services, to various industries.

Summary

TSUISHIMA KIKAI is a great investment opportunity for income investors due to its strong dividend yield. It has a three-year average dividend yield of 2.49% and an upcoming ex-dividend date on March 30 2023 with a dividend yield of 1.94%. Its consistent dividend payouts make it an attractive option for those seeking regular income from their investments. Furthermore, it has a relatively low risk profile making it an ideal choice for conservative investors.

However, potential investors should research the company and its financials thoroughly before investing to ensure they are comfortable with their decision.

Recent Posts