Toyo Tec stock dividend – Toyo Tec Co Ltd Announces 15.0 Cash Dividend Declaration.

March 21, 2023

Dividends Yield

On March 2, 2023, Toyo Tec ($TSE:9686) Co Ltd announced a 15.0 Cash Dividend Declaration. This is a great opportunity for investors who are looking to add dividend stocks to their investment portfolio. Over the past three years, the company has issued an annual dividend per share of 30 JPY, resulting in a yield of 3.08%, 2.95%, and 3.07% in 2021, 2022, and 2023 respectively. This gives Toyo Tec an average yield of 3.03%.

The ex-dividend date for the recent dividend is March 30, 2023. Investing in TOYO TEC can provide a reliable source of income for investors and should be seriously considered for those seeking out dividend stock opportunities.

Market Price

This announcement sent the company’s stock price soaring, with the stock opening at JP¥955.0 and closing at JP¥965.0, up by 1.0% from prior closing price of 955.0. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Toyo Tec. More…

| Total Revenues | Net Income | Net Margin |

| 28.99k | 872.11 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Toyo Tec. More…

| Operations | Investing | Financing |

| 84.56 | 203.25 | -881.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Toyo Tec. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 33.35k | 12.99k | 1.99k |

Key Ratios Snapshot

Some of the financial key ratios for Toyo Tec are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.4% | -13.0% | 4.7% |

| FCF Margin | ROE | ROA |

| -3.5% | 4.2% | 2.5% |

Analysis

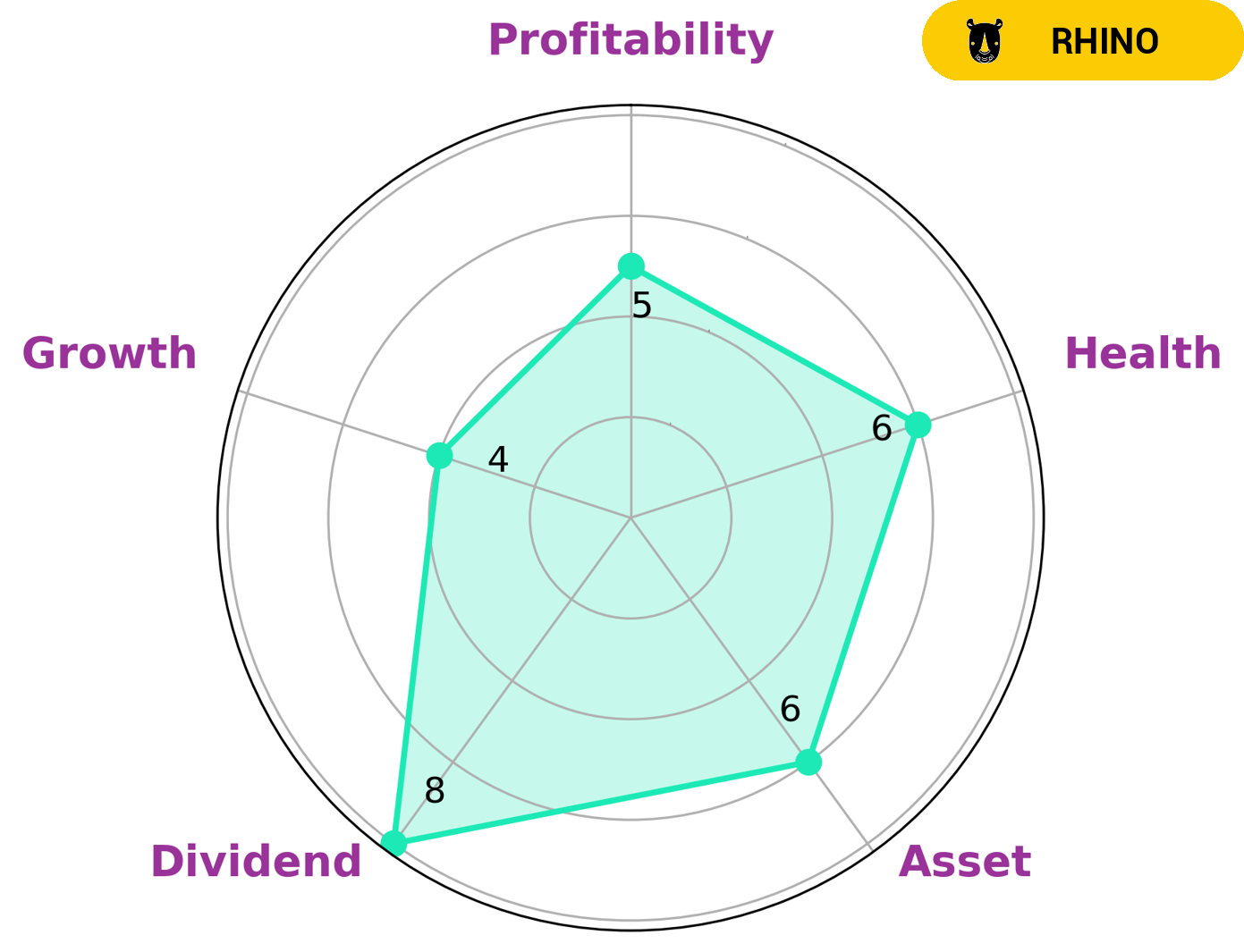

At GoodWhale, we recently analyzed the fundamentals of TOYO TEC. According to our Star Chart, TOYO TEC is strong when it comes to dividends, and medium in the categories of asset, growth, and profitability. Further, its health score of 6/10 with regard to cashflows and debt suggests that it is likely to be able to safely ride out any crisis without the risk of bankruptcy. Based on our analysis, we classify TOYO TEC as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given the company’s stable performance and reliable dividend, we believe TOYO TEC may be an attractive stock for conservative investors looking to make a steady return from their investments. Long-term investors who are looking for asset appreciation may also find TOYO TEC appealing due to its moderate growth potential. More…

Peers

The company competes with Kyoei Security Service Co Ltd, Oermester Vagyonvedelmi NyRt, and Airborne Security & Protection Services Inc. for market share in the Japanese security services industry. Toyo Tec Co Ltd is known for its comprehensive security solutions and extensive customer service.

– Kyoei Security Service Co Ltd ($TSE:7058)

Kyoei Security Service Co Ltd is a leading security service company in Japan. It specializes in providing a variety of services, including security guard services, consulting, installation of surveillance systems, and more. With a market cap of 4.23 billion as of 2023, Kyoei Security Service Co Ltd is one of the largest security service companies in the country. The company has a strong Return on Equity of 9.79%, indicating that it has created significant value for its shareholders over time. The company continues to strive to achieve even better results in the future.

– Oermester Vagyonvedelmi NyRt ($LTS:0P31)

Oermester Vagyonvedelmi NyRt is a Hungarian security and protection company with a market cap of 3.1M as of 2023. The company specializes in providing security services to businesses and other entities, such as monitoring and surveillance, access control, key management, and other related services. Its Return on Equity (ROE) of 15.67% indicates that the company is generating a good return on the capital invested in it by shareholders. The company’s market cap is a reflection of its sound financial performance and stability, making it an attractive investment opportunity for those seeking to invest in the security sector.

Summary

Investing in TOYO TEC is an attractive dividend-focused opportunity. With a three year average yield of 3.03%, the company has consistently returned high dividend payouts to its shareholders. This, combined with the company’s long-term track record of consistent payout growth, makes it an ideal option for dividend-driven portfolios. The company’s financials also appear to be healthy, with no signs of distress, making it a sound investment option that is likely to generate strong returns over time.

Recent Posts