Tele2 Ab dividend calculator – Tele2 AB Declares 3.4 Cash Dividend

May 27, 2023

Dividends Yield

Tele2 AB announced on May 25 2023, that it will be paying a 3.4 cash dividend to its shareholders. This is the fourth dividend paid by TELE2 AB ($LTS:0QE5) in the past 3 years, following dividends of 6.75, 6.75, and 6.0 SEK per share. The dividend yield from 2021 to 2023 are 9.09%, 9.09%, and 7.71% respectively, with an average dividend yield of 8.63%. For investors looking for a stock with a steady dividend, TELE2 AB could be worth considering, with the ex-dividend date falling on May 16 2023.

This stock may be a good choice for those who are looking for consistent income from their investments. Overall, this dividend payment is a sign of good financial health and stability for TELE2 AB and its shareholders.

Share Price

Investors reacted positively to the news as the dividend will provide an additional income stream for them. The dividend is expected to be paid out in early 2021. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tele2 Ab. More…

| Total Revenues | Net Income | Net Margin |

| 28.37k | 3.95k | 12.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tele2 Ab. More…

| Operations | Investing | Financing |

| 8.63k | -3.87k | -13.87k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tele2 Ab. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.19k | 41.54k | 35.68 |

Key Ratios Snapshot

Some of the financial key ratios for Tele2 Ab are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.9% | 4.5% | 17.6% |

| FCF Margin | ROE | ROA |

| 17.2% | 12.9% | 4.7% |

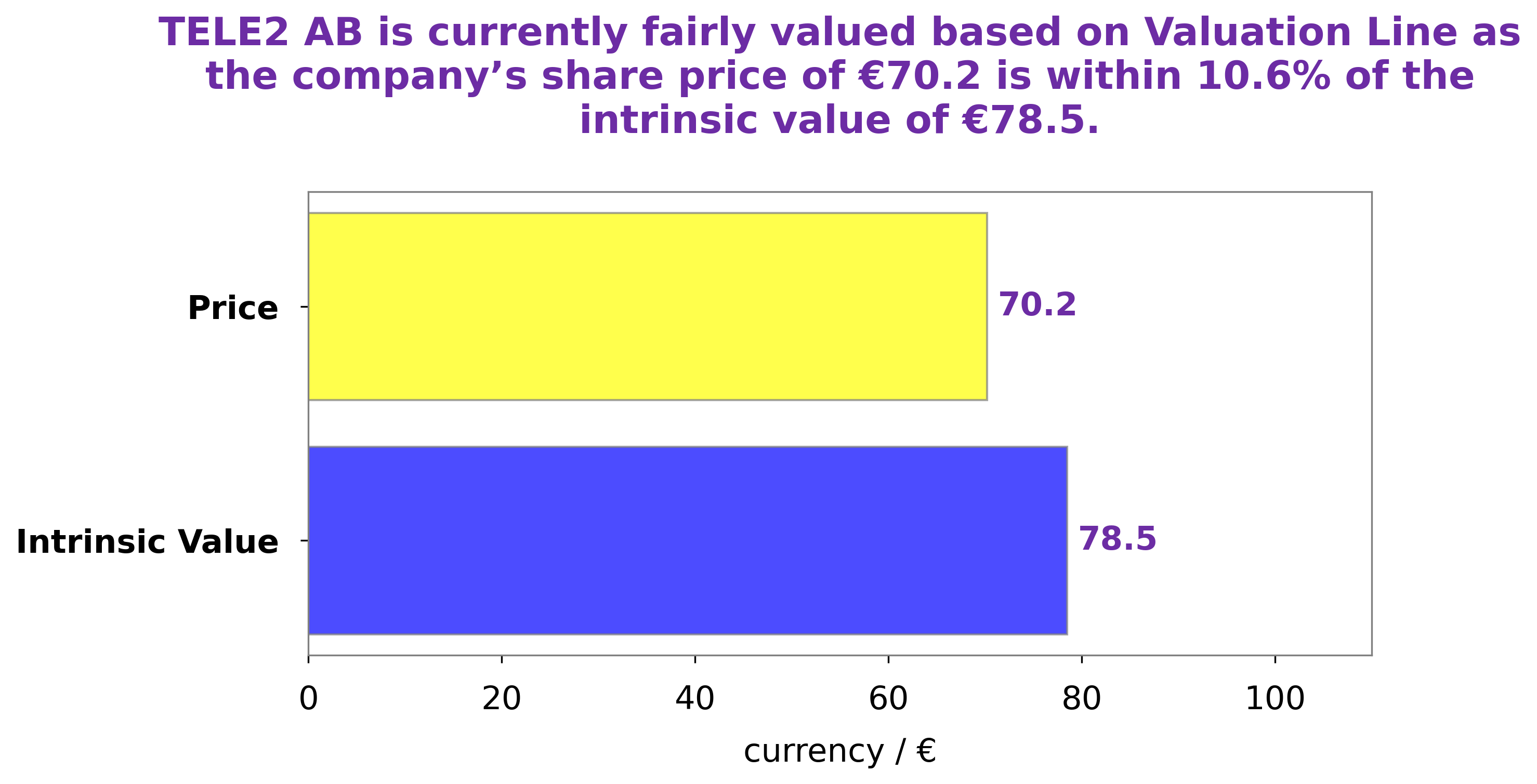

Analysis – Tele2 Ab Stock Fair Value

At GoodWhale, we have conducted an in-depth analysis of TELE2 AB‘s finances. Through our proprietary Valuation Line, we have estimated the intrinsic value of a TELE2 AB share to be €78.5. Currently, TELE2 AB stock is trading at €70.2, which is a fair price, albeit 10.6% undervalued. Our analysis allows us to recommend TELE2 AB as an attractive investment opportunity for those seeking exposure to the telecommunications sector. More…

Summary

Investing in TELE2 AB is a sound choice for those seeking reliable income. The company has paid out an annual dividend per share of 6.75-6.0 SEK over the past 3 years, which translates into a consistent dividend yield of around 8.63%. TELE2 AB is one of the top dividend stocks to consider for investors looking for consistent returns without taking on too much risk. With a solid dividend history and reliable dividend yield, TELE2 AB proves to be a reliable stock to invest in.

Recent Posts