Tear Corporation dividend yield – TEAR Corporation Declares 10.0 Cash Dividend

March 26, 2023

Dividends Yield

TEAR CORPORATION ($TSE:2485), a leading provider of products and services, has announced that it will declare a 10.0 Cash Dividend on March 1 2023. This dividend is the fourth in a series of dividends the company has issued over the last three years, with an annual dividend per share of 20.0 JPY. This means that the dividend yield is 4.08% for 2021, 4.08% for 2022, and 4.78% for 2023, with an average dividend yield of 4.31%. For investors who are looking for stocks with high dividends, TEAR CORPORATION is a solid option to consider. The ex-dividend date is March 30, 2023, which means that stocks must be held prior to that date to be eligible for the dividend.

The company’s long-term dividend growth record and its current dividend yield make it an attractive investment for income investors. In addition to its attractive dividend yield, TEAR CORPORATION also has a strong history of steady growth over the last three years. For these reasons, it is definitely worth considering when looking for stocks with high dividends.

Price History

The announcement came as a pleasant surprise to market watchers, as the stock opened at JP¥434.0 and closed at JP¥439.0, representing a 1.6% increase from the previous closing price of JP¥432.0. This news further strengthened investor confidence in TEAR CORPORATION and its ability to provide lucrative returns on investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tear Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 13.57k | 585 | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tear Corporation. More…

| Operations | Investing | Financing |

| 1.35k | -906 | -237 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tear Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.32k | 6.78k | 336.4 |

Key Ratios Snapshot

Some of the financial key ratios for Tear Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.7% | -0.3% | 7.0% |

| FCF Margin | ROE | ROA |

| 3.3% | 7.9% | 4.1% |

Analysis

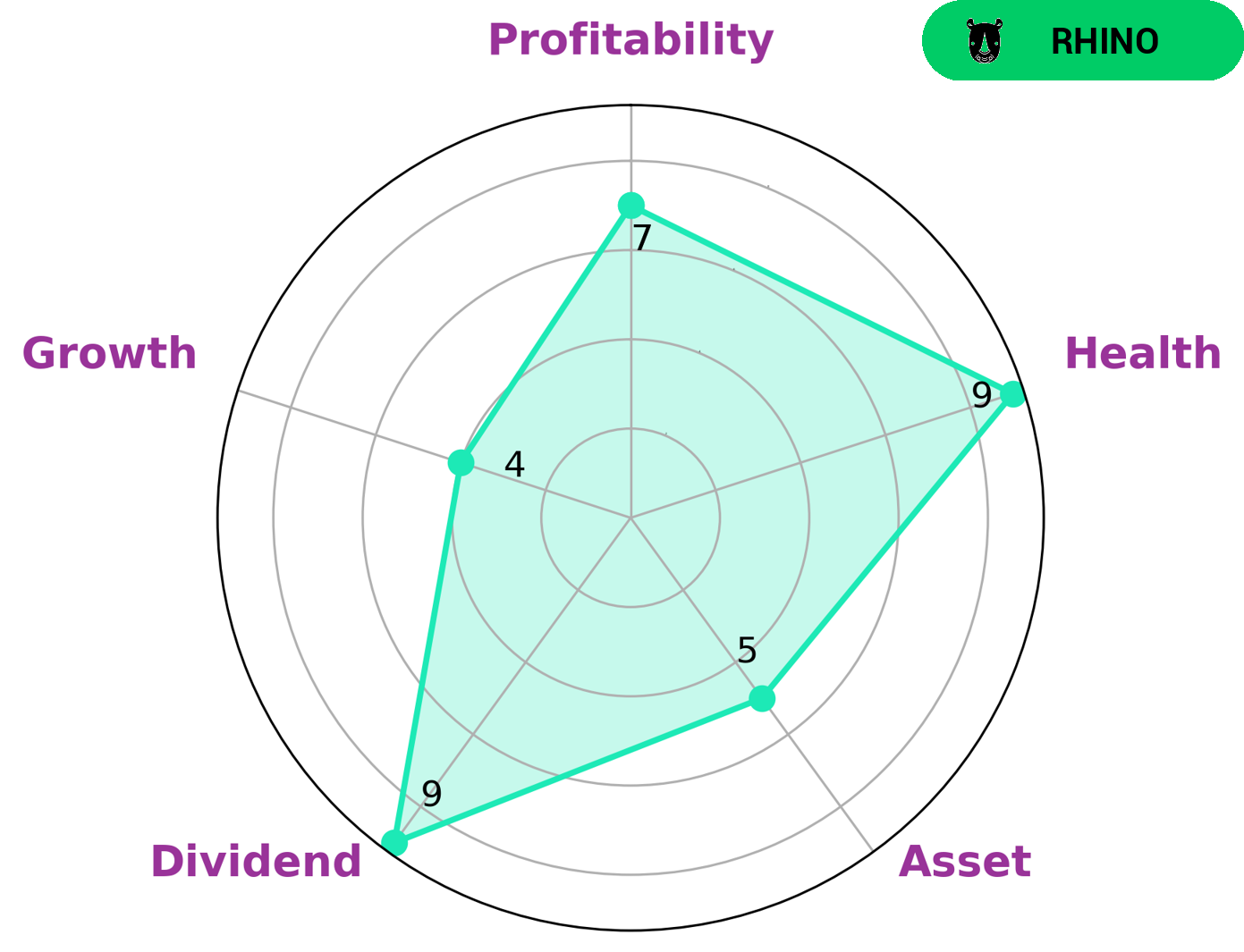

GoodWhale has performed an analysis on TEAR CORPORATION‘s financials, and based on the Star Chart, TEAR CORPORATION is strong in dividend and profitability, and medium in assets and growth. Specifically, TEAR CORPORATION has a high health score of 9/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. As such, we classify TEAR CORPORATION as a ‘rhino’, a type of company we conclude that has achieved moderate revenue or earnings growth. Given its strength in dividend, profitability and high health score, TEAR CORPORATION may be of interest to investors such as growth-oriented funds, value-based funds, or risk-averse investors seeking high dividend yields. Long-term investors may also find TEAR CORPORATION attractive due to its strong financials and ability to pay off its debt. More…

Peers

TEAR Corp is an established organization in the global market, and has been increasingly facing intense competition from Kyowa Corp Co Ltd, Kizuna Holdings Corp, and Decollte Holdings Corp. As these companies have gained significant market share, TEAR Corp has been hard-pressed to keep up and maintain its competitive edge in the industry.

– Kyowa Corp Co Ltd ($TSE:6570)

Kyowa Corp Co Ltd is a leading global company based in Japan that specializes in industrial products and services. The company has a market capitalization of 3.72B as of 2023, making it one of the largest companies in the world. Kyowa Corp Co Ltd also has a strong Return on Equity (ROE) of 13.28%, indicating that the company is well-run and profitable. The company’s success can be attributed to its focus on developing innovative technology and providing quality customer service. With its strong market cap and ROE, Kyowa Corp Co Ltd is in a great position to continue growing and expanding its business.

– Kizuna Holdings Corp ($TSE:7086)

Kizuna Holdings Corp is a Japanese based conglomerate that has operations across the technology, media, and financial services industries. With a market capitalization of 7.93 billion as of 2023, the company is one of the largest publicly traded companies in the country. The company’s return on equity (ROE) is 14.29%, indicating a healthy level of profitability on the investments of its shareholders. Kizuna also employs over 23,000 people and has operations in Japan, North America, Europe, and Asia. The company’s success is largely attributed to its diversified portfolio and its commitment to providing quality products and services.

– Decollte Holdings Corp ($TSE:7372)

Decollte Holdings Corp is a world-renowned fashion and lifestyle brand that has been in operation since the early 1980s and caters to diverse consumers, including luxury, streetwear, and everyday apparel. As of 2023, Decollte Holdings Corp has a market capitalization of 6.13 billion US dollars, reflecting the company’s strong performance in the industry. The company’s impressive Return on Equity of 20.43% indicates its superior financial management and the impressive returns it generates for its shareholders. By leveraging its diverse customer base and innovative designs, Decollte Holdings Corp has become one of the most prominent and successful fashion companies in the world.

Summary

TEAR CORPORATION is a good option for investors interested in high dividend yields. Over the last three years, it has issued an annual dividend of 20.0 JPY per share, with a dividend yield of 4.08%, 4.08%, and 4.78% for 2021-2023 respectively. The average dividend yield for the same period is 4.31%. It is worth noting that dividend yields may vary depending on market conditions and the company’s financial performance.

Recent Posts