Takemoto Yohki stock dividend – Takemoto Yohki Co Ltd Declares 18.0 Cash Dividend

June 11, 2023

🌥️Dividends Yield

On June 1 2023, TAKEMOTO YOHKI ($TSE:4248) Co Ltd Declares 18.0 Cash Dividend. TAKEMOTO YOHKI has been paying dividends to shareholders for the last 3 years, amounting to 35.5, 35.5 and 32.0 JPY per share. This has led to dividend yields of 4.73%, 4.73% and 3.5% in 2021 to 2023 respectively, with an average dividend yield of 4.32%. The ex-dividend date for this dividend is set for June 29 2023, which means that investors who purchase shares before this date will be eligible for the dividend payment.

Therefore, if you are looking for dividend stocks, TAKEMOTO YOHKI should be added to your list of considerations. With a strong history of consistent dividend payments, it is a good choice for income investors.

Market Price

The company’s stock opened on the same day at JP¥800.0 and closed at JP¥799.0, which was a slight increase of 0.1% from the previous closing price of 798.0. This dividend announcement marks TAKEMOTO YOHKI‘s commitment to rewarding its shareholders with generous dividends. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Takemoto Yohki. More…

| Total Revenues | Net Income | Net Margin |

| 14.78k | 251.43 | 1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Takemoto Yohki. More…

| Operations | Investing | Financing |

| 1.26k | -803.5 | -732.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Takemoto Yohki. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.12k | 7.25k | 903.74 |

Key Ratios Snapshot

Some of the financial key ratios for Takemoto Yohki are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.3% | -22.6% | 5.0% |

| FCF Margin | ROE | ROA |

| 3.0% | 4.2% | 2.5% |

Analysis

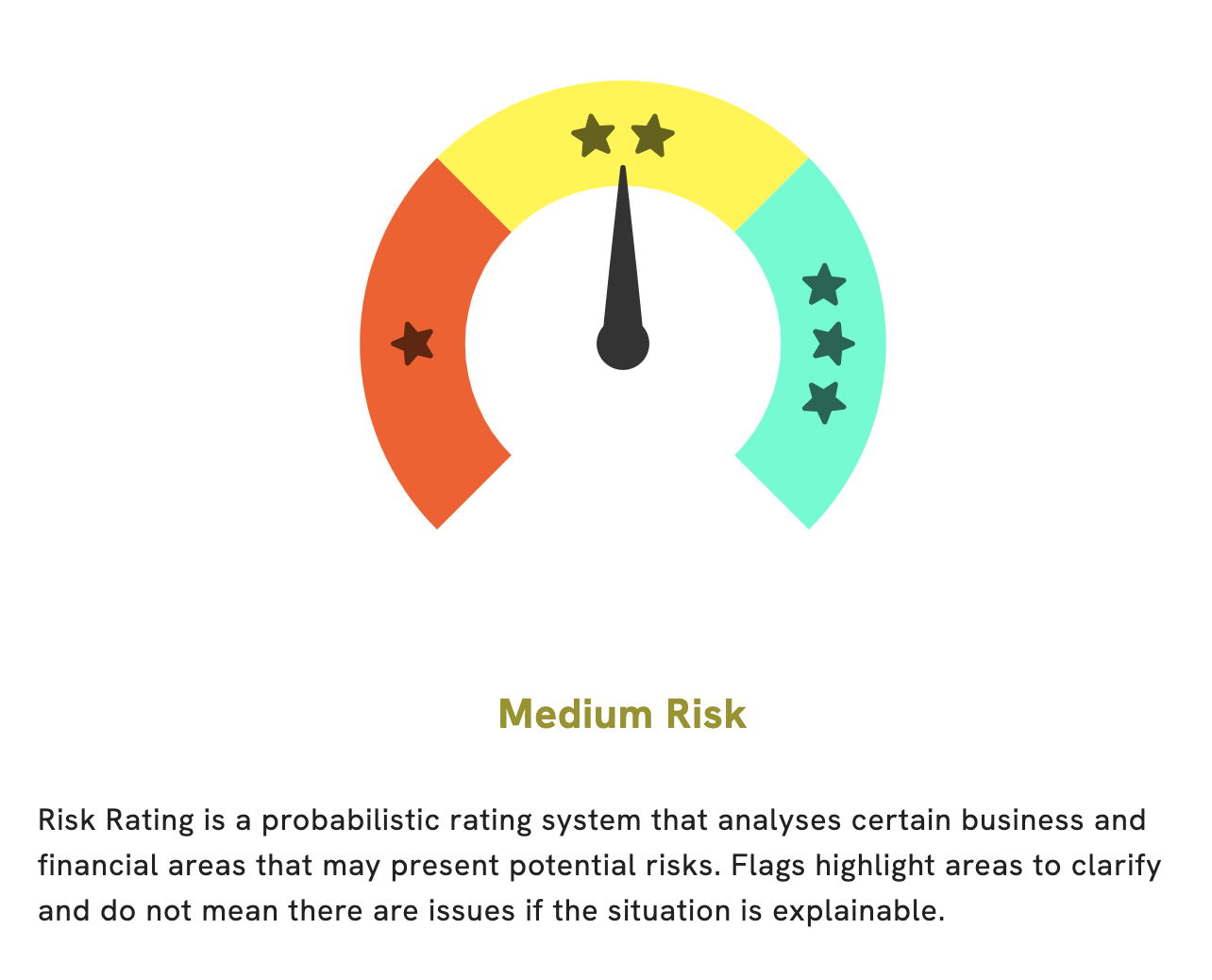

At GoodWhale, we pride ourselves on providing investors with comprehensive analyses of financials for businesses worldwide. Recently, our analysts conducted a risk assessment of TAKEMOTO YOHKI and the results indicate that it is a medium risk investment in terms of financial and business aspects. Upon further investigation, GoodWhale detected two risk warnings on the income sheet and balance sheet of TAKEMOTO YOHKI. We encourage investors to register with us to learn more about these warnings and gain further insights into the company. More…

Peers

Takemoto Yohki Co Ltd has been a formidable competitor in the industry, facing off against Starflex PCL, Innovative Tech Pack Ltd, and Richards Packaging Income Fund. All these companies are well-known for their innovative and reliable packaging solutions.

– Starflex PCL ($SET:SFLEX)

Starflex PCL is a Thai polymer manufacturer that specializes in the production of polycarbonate resins, polypropylene resins and a variety of other plastic compounds. As of 2023, the company has a market cap of 2.8 billion USD and a Return on Equity of 6.59%. The market cap represents the total value of Starflex PCL’s outstanding shares, while its Return on Equity indicates the company’s ability to generate profits from its shareholders’ investment. In general, higher ROE is better and Starflex PCL is performing well in this regard.

– Innovative Tech Pack Ltd ($BSE:523840)

Innovative Tech Pack Ltd is a leading provider of packaging solutions to the food, beverage, and pharmaceutical industries. The company has a market capitalization of 401.67 million as of 2023, representing the total value of all its outstanding shares. With a return on equity of 9.03%, the company is able to produce a higher return on its investments compared to other companies in the industry. Innovative Tech Pack offers a wide range of products, including custom packaging, bulk packaging, and innovative packaging solutions. The company is focused on providing quality products that meet the needs of their customers while maintaining a sustainable business.

– Richards Packaging Income Fund ($TSX:RPI.UN)

Richards Packaging Income Fund is a leading Canadian packaging distributor and manufacturer of industrial packaging products. With a market cap of 381.34M and a Return on Equity of 22.95%, the company is well-positioned to continue providing a wide range of diversified packaging solutions to its customers. Richards Packaging Income Fund is committed to its customers’ success, offering an ever-growing variety of innovative and cost-effective packaging solutions. Its commitment to customer service and satisfaction has enabled Richards Packaging Income Fund to become one of the most respected names in the industry.

Summary

TAKEMOTO YOHKI has consistently declared high dividends per share over the past three years, providing investors with an average dividend yield of 4.32%. In 2021, the dividend yield was 4.73%, followed by 4.73% in 2022 and 3.5% in 2023. Dividends are an ideal way for investors to gain a steady return from their investments in TAKEMOTO YOHKI and are beneficial for any long-term investor looking to generate income from their investments. TAKEMOTO YOHKI’s dividend history is a strong indication of the company’s financial strength and provides investors with confidence for their investments.

Recent Posts