T.kawabe dividend – T. Kawabe & Co Ltd Announces 10.0 Cash Dividend.

March 13, 2023

Dividends Yield

On March 2 2023, T. Kawabe & Co Ltd announced a 10.0 cash dividend. This annual dividend per share of 0.0 JPY will be applicable from 2023 to 2023 and has an average dividend yield of 2.0%. The ex-dividend date for this dividend is March 30 2023. This is a great way for T.KAWABE ($TSE:8123) shareholders to benefit from their investments and realize a return on their capital.

It is a sign of the company’s commitment to rewarding its shareholders and demonstrates its financial strength. It is also a sign of the company’s confidence in its ability to sustain this dividend over the long term.

Price History

On Thursday, T.KAWABE & Co Ltd announced that it will be distributing a 10.0 JPY cash dividend to its shareholders. This announcement caused their stock to open at JP¥975.0 and close at JP¥970.0, down 1.1% from the previous closing price of 981.0. Shareholders are encouraged to take advantage of this opportunity to receive a return on their investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for T.kawabe. More…

| Total Revenues | Net Income | Net Margin |

| 12.11k | -167.28 | -1.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for T.kawabe. More…

| Operations | Investing | Financing |

| 667.12 | -49.25 | 623.28 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for T.kawabe. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.04k | 5.82k | 3.32k |

Key Ratios Snapshot

Some of the financial key ratios for T.kawabe are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.2% | -31.2% | 0.5% |

| FCF Margin | ROE | ROA |

| 4.7% | 0.6% | 0.3% |

Analysis

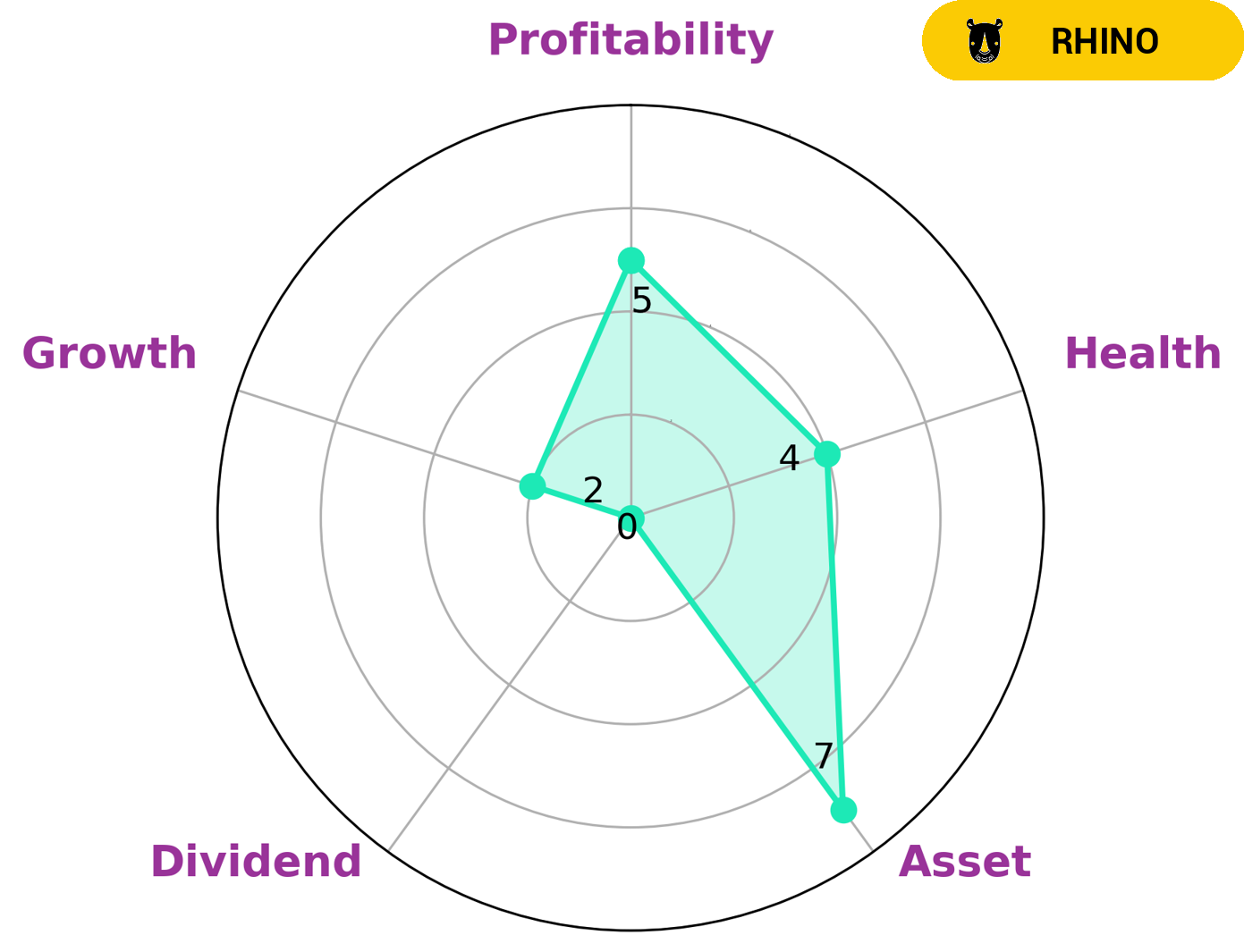

We conducted an analysis of T.KAWABE‘s fundamentals and found it to be classified as a ‘rhino’ on our Star Chart. This type of company has achieved moderate revenue or earnings growth and may be of interest to investors looking for steady returns. T.KAWABE is strong in assets, medium in profitability, and weak in dividend growth. Its intermediate health score of 4/10 with regard to cashflows and debt suggests that it may be able to safely ride out any crisis without the risk of bankruptcy. The company’s fundamentals suggest that investors looking for steady returns may find T.KAWABE attractive. More…

Peers

T. Kawabe & Co Ltd is one of the leading companies in the textile industry, competing with established companies such as Caleffi SpA, Marumitsu Co Ltd, and Kitanihon Spinning Co Ltd. All of these companies have a long history in the industry, providing innovative products and services in the garment, industrial and technical textile markets. With its focus on quality, innovation and service, T. Kawabe & Co Ltd stands out from its competitors.

– Caleffi SpA ($LTS:0N7W)

Caleffi SpA is an Italian manufacturer of valves, radiator valves, hydraulic separators, and other products for heating, air conditioning, and plumbing systems. With its headquarters based in Brescia, Italy, the company has grown to become one of the most established names in the European market for HVAC and plumbing supplies. Its total market capitalization as of 2023 is 17.96M, reflective of its outstanding financial performance in recent years. Specifically, its return on equity (ROE) stands at 12.41%, which is well above the industry average. This impressive level of financial performance reflects Caleffi SpA’s ability to effectively manage its operations and leverage its competitive advantages.

– Marumitsu Co Ltd ($TSE:8256)

Marumitsu Co Ltd is a Tokyo-based company that specializes in the design, production, and sale of electronic components. The company has been in business since 2003 and has a market capitalization of 2.07 billion as of 2023. Despite its impressive size, the company has a negative Return on Equity (ROE) of -118.64%, indicating that it has struggled to generate profits from its equity investments. This could be due to a variety of reasons, including ineffective management, poor financial decisions, or even a lack of competitive advantage. As a result, investors should exercise caution when considering investing in Marumitsu Co Ltd.

– Kitanihon Spinning Co Ltd ($TSE:3409)

Kitanihon Spinning Co Ltd is a major Japanese company specializing in the manufacture of industrial yarns and fabrics. The company has a market cap of 1.72B as of 2023 and a Return on Equity (ROE) of -9.79%. The market cap is an indication of the value of the company’s outstanding shares, while the ROE is a measure of how effectively the company’s management is using its equity to generate profits.As such, Kitanihon Spinning Co Ltd has experienced a significant decrease in profitability in the past year, indicating that the company’s management may need to take steps to improve efficiency.

Summary

T.KAWABE is an attractive investment option due to its relatively high dividend yield of 2.0%. Over the past year, the company has kept up its payment of a 0.0 JPY annual dividend per share, which provides a steady return on investment. The stock is also trading at a reasonable price, making it a potential bargain for those looking to build a portfolio of dividend-paying stocks.

In addition, the company’s long-term outlook looks positive, with potential for further dividend growth in the future. With its attractive dividend yield and potential for future capital appreciation, T.KAWABE is a sensible choice for investors seeking to build a reliable and profitable portfolio.

Recent Posts