SWF dividend – Stanley Black & Decker Announces 0.8 Cash Dividend

March 19, 2023

Dividends Yield

On March 1 2023, Stanley Black & Decker ($BER:SWF) (STANLEY BLACK & DECKER) announced a 0.8 cash dividend, continuing its streak of dividend payments for the past three years. With this announcement, STANLEY BLACK & DECKER hopes to make further investments in long-term growth and continue rewarding its shareholders with a steady income stream.

Stock Price

This news sent the company’s stock price up 1.2% for the day, as the stock opened at €80.4 and closed at €80.4, up from the previous closing price of 79.5. This marks an increase in shareholder value as well as a reward to existing shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SWF. More…

| Total Revenues | Net Income | Net Margin |

| 16.95k | 1.06k | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SWF. More…

| Operations | Investing | Financing |

| -1.46k | 3.57k | -1.97k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SWF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.96k | 15.25k | 63.48 |

Key Ratios Snapshot

Some of the financial key ratios for SWF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.5% | -25.0% | 2.2% |

| FCF Margin | ROE | ROA |

| -11.7% | 2.4% | 0.9% |

Analysis

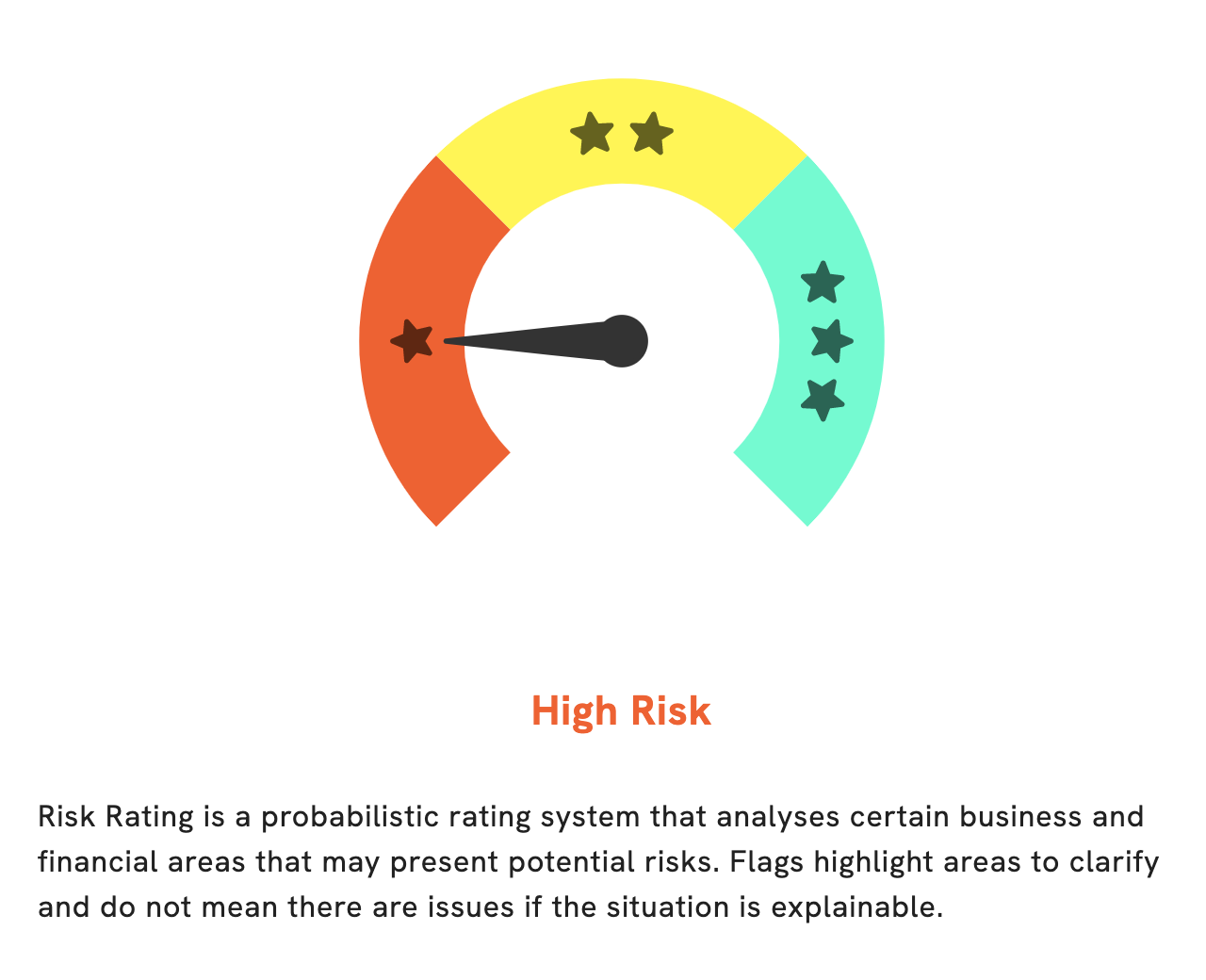

At GoodWhale, we take a deep dive into the financial and business fundamentals of companies in order to provide investors with an in-depth understanding of their investments. Let’s take a look at STANLEY BLACK & DECKER using our GoodWhale Risk Rating system. Our Risk Rating system gives you a quick understanding of how risky a company is. In the case of STANLEY BLACK & DECKER, our system has classified it as a high risk investment. This means that there are greater risks associated with investing in this company than in other companies. To take a deeper look at why this company has been classified as high risk, you can register with GoodWhale and dive into the income sheet and balance sheet. We have detected 2 risk warnings within these documents for STANLEY BLACK & DECKER, so it is worthwhile for investors to take a closer look and make an informed decision before investing. More…

Summary

Investing in STANLEY BLACK & DECKER could be rewarding for dividend investors. The company has consistently paid a 3.18 USD dividend per share in the last three years and is expected to maintain its dividend yield at 2.62% in 2022-2023. The dividend yield is higher than the market average, making it an attractive option for investors who are seeking to diversify their portfolios and maximize their returns. The company also has a strong financial position, which should provide investors with assurance that their investments are safe and secure.

Recent Posts