Surge Energy dividend yield calculator – Surge Energy Announces 0.04 Cash Dividend

May 31, 2023

☀️Dividends Yield

On May 26th 2023, SURGE ENERGY ($TSX:SGY) Inc. announced a 0.04 cash dividend for shareholders. If you’re searching for a dividend stock to invest in, this may be a great option for you. The company has paid out an annual dividend per share of 0.36 CAD and 0.24 CAD respectively over the past two years, making its average dividend yield for 2022-2023 stand at 3.24%, with respective yields of 3.9% and 2.57%. The ex-dividend date for this capture is May 30th 2023, so now is the perfect time to invest in SURGE ENERGY Inc. and receive your returns.

Price History

This dividend was declared on the same day the company’s stock opened at CA$7.9 and closed at the same price, representing a 1.0% increase compared to its previous closing price of CA$7.8. This comes as welcome news for shareholders of SURGE ENERGY, who will now benefit from increased returns on their invested capital. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Surge Energy. More…

| Total Revenues | Net Income | Net Margin |

| 728.04 | 268.38 | 36.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Surge Energy. More…

| Operations | Investing | Financing |

| 278.45 | -333.09 | 54.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Surge Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.54k | 680.59 | 8.76 |

Key Ratios Snapshot

Some of the financial key ratios for Surge Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.8% | 241.3% | 32.1% |

| FCF Margin | ROE | ROA |

| 14.5% | 17.2% | 9.5% |

Analysis

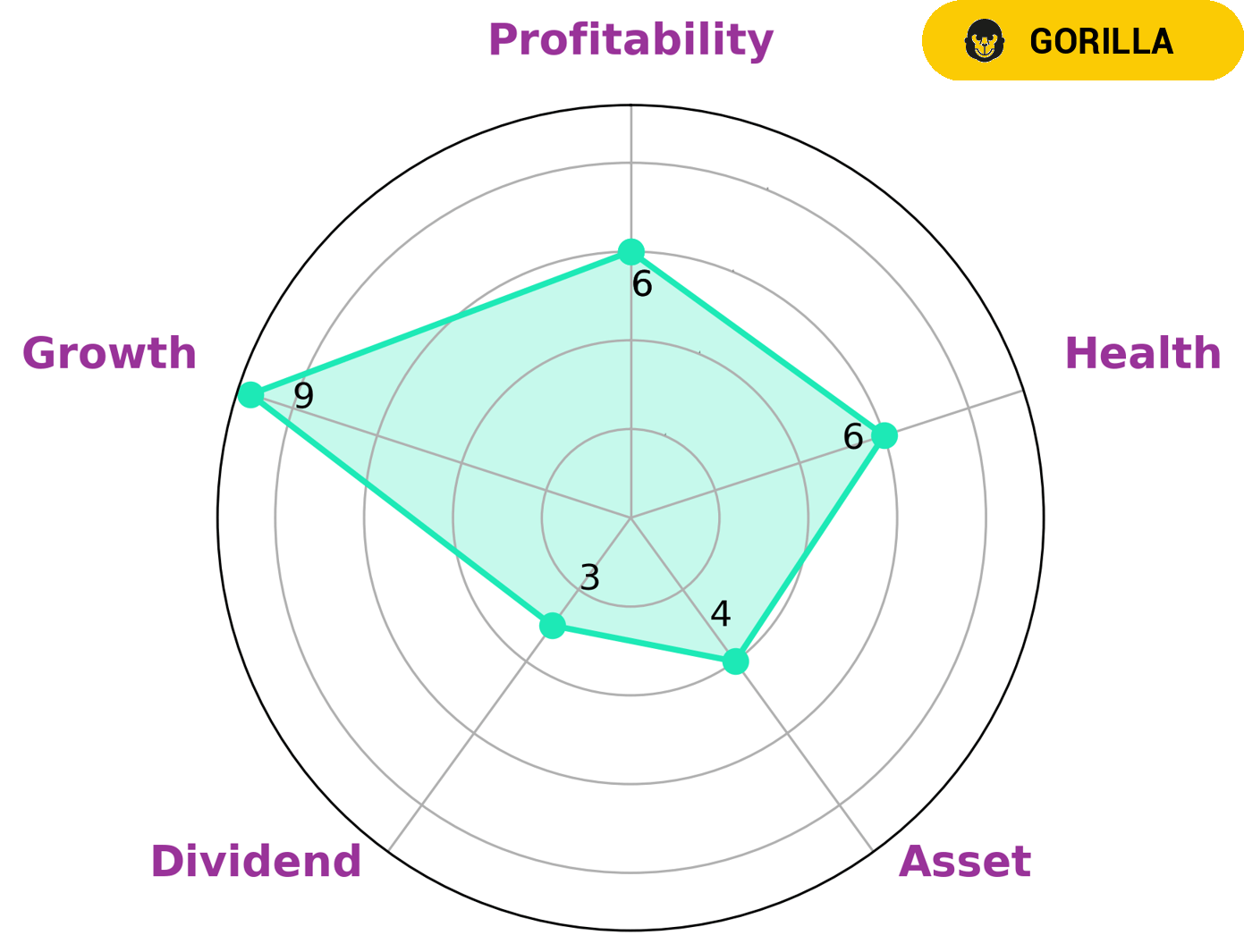

As GoodWhale, we have conducted an analysis of the fundamentals for SURGE ENERGY. According to our Star Chart, SURGE ENERGY has an intermediate health score of 6 out of 10, indicating that it has the potential to sustain its future operations in times of crisis. Additionally, we classify SURGE ENERGY as a ‘gorilla’ type of company; this means that it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. From an investor’s perspective, SURGE ENERGY may be a good option because it is strong in growth, medium in assets, profitability, and weak in dividend. Therefore, investors who are looking for a company that has good potential for growth, but does not offer dividends, may find SURGE ENERGY attractive. Moreover, those who are looking for a company with a strong competitive advantage in its sector may also find that SURGE ENERGY is a viable option. More…

Peers

Surge Energy Inc is an oil and gas company based in Calgary, Alberta. The company is involved in the exploration, development, and production of oil and natural gas in the Western Canadian Sedimentary Basin. Surge Energy’s competitors include Journey Energy Inc, Nexera Energy Inc, and Tenaz Energy Corp.

– Journey Energy Inc ($TSX:JOY)

Journey Energy Inc. is a Canadian oil and gas exploration and production company with operations in the Western Canadian Sedimentary Basin. The company has a market capitalization of $355.97 million and a return on equity of 69.52%. Journey Energy is focused on the development of its Montney natural gas and light oil resources in the Peace River area of northeastern British Columbia. The company’s strategy is to grow its production and reserves through a combination of organic growth and strategic acquisitions.

– Nexera Energy Inc ($TSXV:NGY)

Nexera Energy Inc is a Canadian oil and gas company with a market cap of 1.87M as of 2022. The company has a Return on Equity of 6.8%. Nexera Energy is involved in the exploration, development, and production of oil and gas properties in Canada.

– Tenaz Energy Corp ($OTCPK:ATUUF)

Tenaz Energy Corp is a Canadian oil and gas company with a market capitalization of $34.34 million as of March 2022. The company has a return on equity of 11.34%. Tenaz Energy Corp is engaged in the exploration, development, and production of oil and natural gas in Canada. The company’s operations are focused in the province of Alberta.

Summary

SURGE ENERGY is a good option for investors looking for dividend stocks to invest in. The company has paid dividends per share of 0.36 and 0.24 CAD in the last two years respectively, resulting in an average dividend yield of 3.24% for the next two years (2022-2023). This yield is further broken down into 3.9% for 2022 and 2.57% for 2023. Investors should consider the long-term potential of the stock when making their decision to invest.

Recent Posts