Sumco Corporation dividend calculator – SUMCO Corp Announces 40.0 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1 2023, SUMCO CORPORATION ($TSE:3436) announced a 40.0 JPY cash dividend. For the past three years, the company has paid out an annual dividend of 81.0 JPY per share, resulting in a dividend yield of 3.89% for the period from 2022 to 2023. The average dividend yield is also 3.89%.

This makes SUMCO CORPORATION an attractive option for investors looking to invest in dividend stocks. The ex-dividend date for this stock is June 29 2023, meaning that anyone holding the stock on or before this date will be entitled to receive the dividend.

Price History

SUMCO CORPORATION, on Thursday, announced that the company will be paying a 40.0 cash dividend to its shareholders. This news came as the stock opened at JP¥1976.0 and closed at JP¥2011.0, a 1.0% increase from the previous closing price of 1991.0. This dividend is expected to be paid out in the months ahead. The announcement was well-received by investors who have watched SUMCO CORPORATION’s stock price rise steadily over the course of the year. Despite the market volatility, SUMCO has managed to maintain its positive trend and this dividend should only serve to bolster investor confidence.

SUMCO has an impressive portfolio of investments that have a proven track record of success and this dividend should offer investors a solid return on their investment. The company also has plans to continue investing in new opportunities in the future, which could lead to even higher returns for shareholders. Investors can look forward to receiving their dividend payments while SUMCO will benefit from increased confidence in its stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sumco Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 441.08k | 70.2k | 16.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sumco Corporation. More…

| Operations | Investing | Financing |

| 179.46k | -126.35k | -23.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sumco Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 892.55k | 301.07k | 1.52k |

Key Ratios Snapshot

Some of the financial key ratios for Sumco Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.8% | 29.4% | 25.4% |

| FCF Margin | ROE | ROA |

| 12.2% | 13.3% | 7.9% |

Analysis

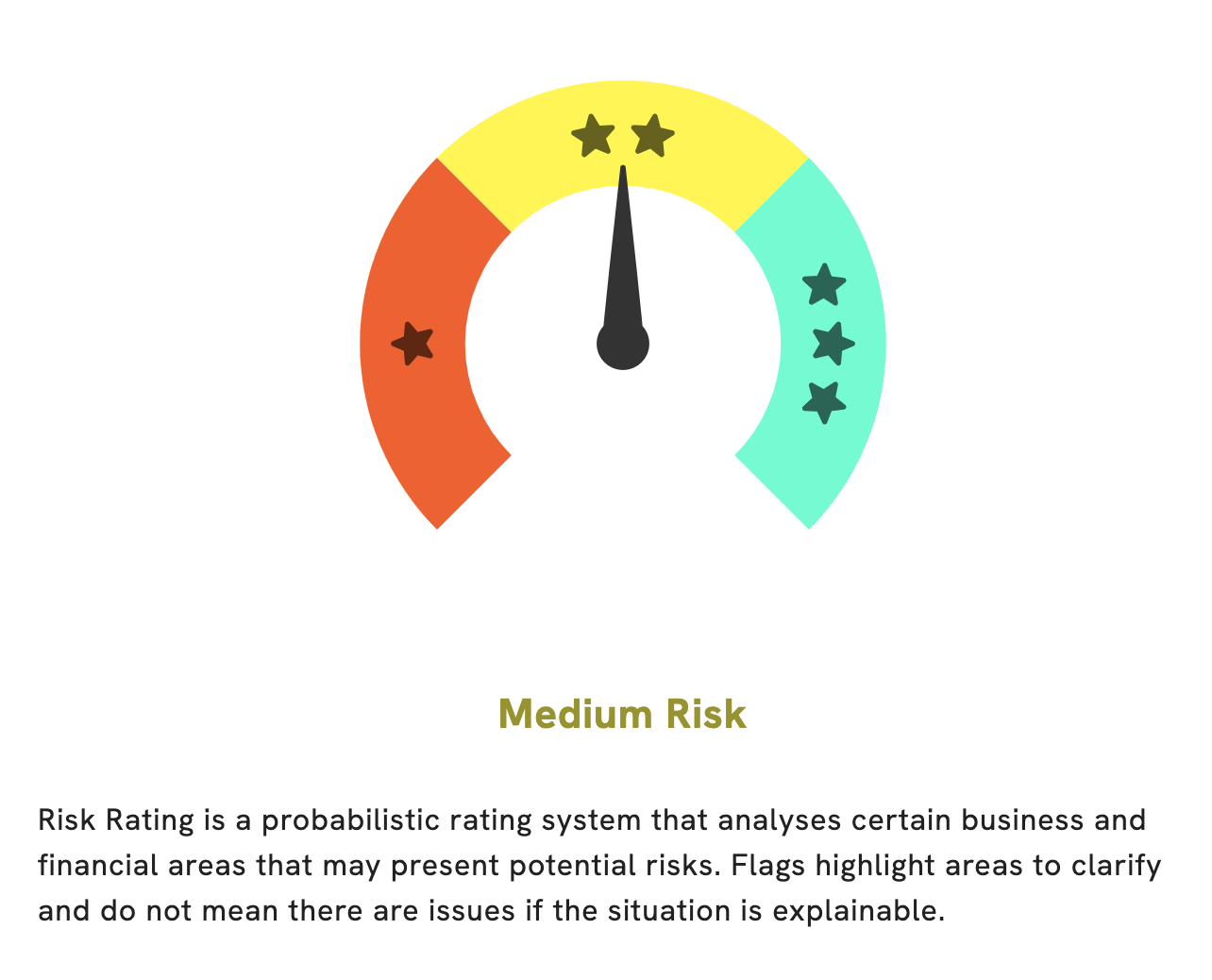

GoodWhale has conducted an analysis of SUMCO CORPORATION‘s fundamentals and determined that it is a medium risk investment. While the company has strong fundamentals in key areas like growth and profitability, there are some areas of risk that should be taken into consideration when making an investment decision. Our Risk Rating indicates that there are two risk warnings in SUMCO CORPORATION’s income sheet and balance sheet. We recommend that you become a registered user to access more detailed information about these warnings and assess the level of risk involved in investing. Ultimately, any investment decision should be based on your own research and due diligence. However, our analysis can provide valuable insight into the company’s financial health and help you make more informed decisions. More…

Peers

SUMCO Corp is in a fierce competition with 3Peak Incorporated, KEC Corp, and Advanced Wireless Semiconductor Co to stay ahead of the game in the industry. All four companies are constantly innovating their products and services to gain an edge over each other, making it a highly competitive market.

– 3Peak Incorporated ($SHSE:688536)

3Peak Incorporated is an industry leader in providing innovative, high-quality software solutions and services. With a market cap of 30.53B in 2023 and a Return on Equity of 7.23%, the company is well-positioned to further its growth and success. 3Peak Incorporated has a solid track record of creating value for its shareholders and has continually invested in new technologies to stay ahead of the competition. The company’s focus on quality and customer service has enabled them to build a loyal customer base and gain a competitive edge in the market.

– KEC Corp ($KOSE:092220)

KEC Corp is a leading engineering and construction company that specializes in the design and development of energy, infrastructure, and industrial projects. With a market cap of 304.73B as of 2023, KEC Corp is one of the top players in the industry. The company’s Return on Equity (ROE) of 5.26% shows the efficiency with which it utilizes its capital to generate profits and grow its business. KEC Corp has consistently delivered strong financial performance, making it an attractive investment for investors.

– Advanced Wireless Semiconductor Co ($TPEX:8086)

Advanced Wireless Semiconductor Co is a leading global provider of innovative semiconductor solutions for a wide range of applications. Its market cap of 13.85B as of 2023 reflects the company’s success in developing and delivering advanced semiconductor solutions, which have become increasingly important in the modern world. The company has also achieved an impressive Return on Equity (ROE) of 3.0%, showing its ability to deliver consistent returns to its shareholders. Advanced Wireless Semiconductor Co’s innovative solutions and strong financial performance have enabled it to remain an industry leader for many years.

Summary

Investing in SUMCO CORPORATION is a solid option for those looking for a consistent dividend yield. SUMCO CORPORATION has maintained an annual dividend per share of 81.0 JPY for the past three years, resulting in a dividend yield of 3.89%. This makes SUMCO CORPORATION an attractive investment option for those seeking consistency and stability in their portfolio.

With a steady dividend yield, investors can be sure that their investment is safe and secure. Furthermore, with a strong history of consistent dividends, SUMCO CORPORATION is likely to continue paying out healthy dividends in the future.

Recent Posts