Steel Authority Of stock dividend – Steel Authority Of India Ltd declares 1.0 Cash Dividend!

March 19, 2023

Dividends Yield

On March 17 2023, Steel Authority Of ($BSE:500113) India Ltd declared a 1.0 Cash Dividend! If you are a dividend investor, STEEL AUTHORITY OF INDIA could be a great option to consider. In the past 3 years, the company has issued an annual dividend per share of 4.75, 8.3 and 1.0 INR respectively. Its dividend yields in 2021, 2022 and 2023 were 5.59%, 7.58% and 1.72%, averaging out to 4.96%.

The ex-dividend date for this stock is set on March 24 2023, so interested investors should ensure they have purchased the stock before this date in order to receive the dividend. This dividend offer is a promising sign of the future prospects associated with STEEL AUTHORITY OF INDIA and its current shareholders can look forward to a long term return on their investment.

Market Price

This came as good news for investors, as the stock opened at INR86.2 and closed at INR88.6, up by 3.8% from its previous closing price of 85.3. It is expected that the dividend will be credited in the bank accounts of the shareholders by the end of April 2021. The dividend will be beneficial to both existing and new investors. For new investors, the dividend payouts will provide the opportunity to gain returns on their investment, while existing investors will be able to gain extra income.

The cash dividend is an indication of the trustworthiness of the company and its commitment to reward its shareholders. With this news, Steel Authority of India once again demonstrated its commitment to providing its investors with strong returns and encouraging a supportive investment environment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Steel Authority Of. More…

| Total Revenues | Net Income | Net Margin |

| 1.03M | 112.57k | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Steel Authority Of. More…

| Operations | Investing | Financing |

| 32.81k | -39.76k | -273.98k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Steel Authority Of. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.3M | 762.96k | 130.82 |

Key Ratios Snapshot

Some of the financial key ratios for Steel Authority Of are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.4% | 80.7% | 16.4% |

| FCF Margin | ROE | ROA |

| -0.3% | 19.5% | 8.1% |

Analysis

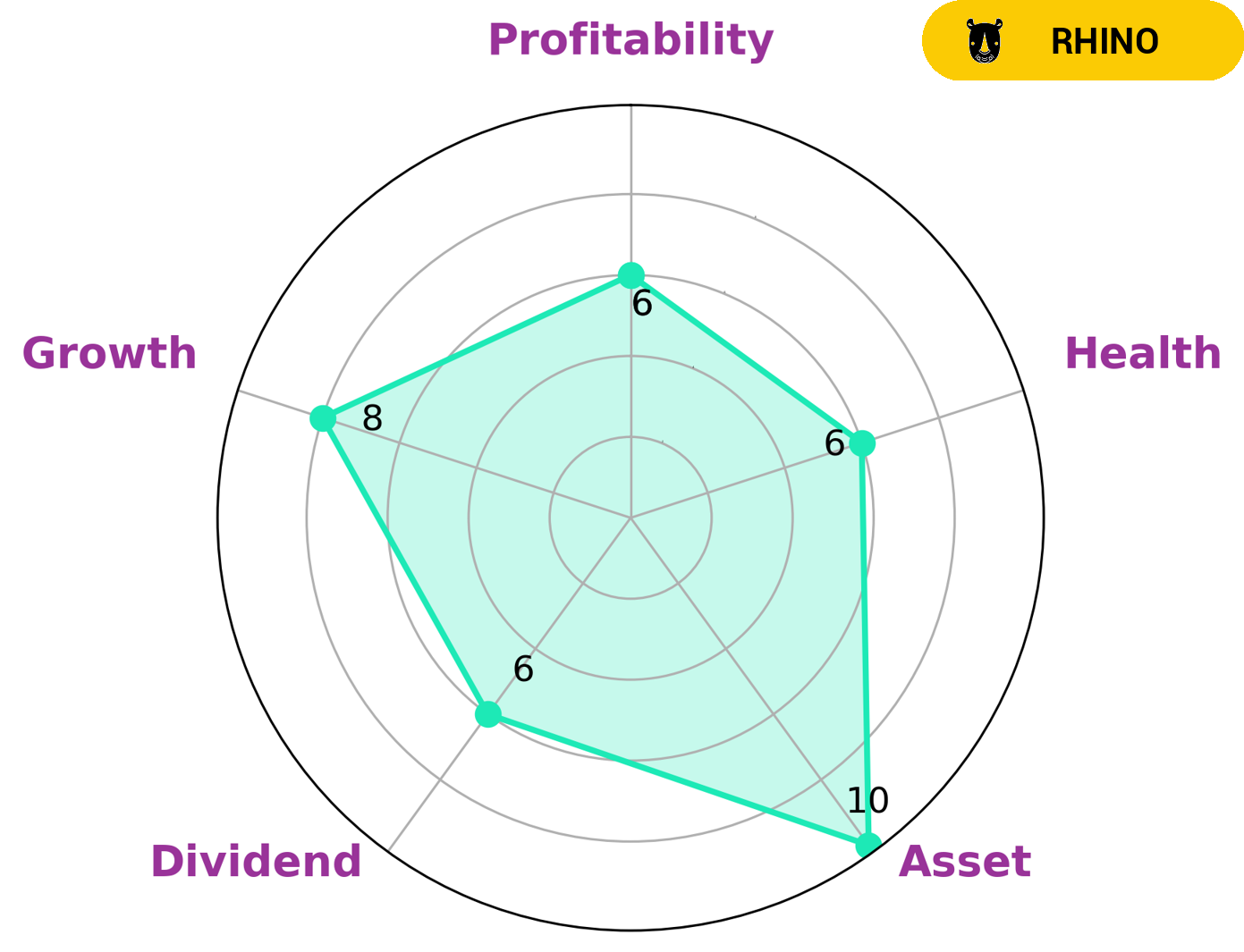

GoodWhale has conducted an analysis of STEEL AUTHORITY OF INDIA’s financials, and the results show that the company has an intermediate health score of 6/10 with regard to its cashflows and debt. This suggests that the company might be able to safely ride out any crisis without the risk of bankruptcy. Furthermore, STEEL AUTHORITY OF INDIA is strong in asset and growth, and medium in profitability and dividend. After conducting a thorough analysis, GoodWhale has classified STEEL AUTHORITY OF INDIA as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors who are looking for steady growth or capital appreciation may find this company attractive. Furthermore, investors who have a long-term focus may find the moderate dividend returns to be appealing. More…

Peers

Steel Authority of India Ltd (SAIL) is one of India’s leading steel producing companies, competing with other leading steel producing companies such as Dai Thien Loc Corp, Panchmahal Steel Ltd and Vardhman Special Steels Ltd. SAIL has a large market share in the Indian steel market and is constantly striving to be the best in the industry by improving its processes, products quality and customer services. All of its competitors also strive to stay ahead in the competition by investing in the latest technology and offering a wide range of steel products. This has created a highly competitive environment in the Indian steel market and has allowed SAIL to remain a leader in the industry.

– Dai Thien Loc Corp ($HOSE:DTL)

Panchmahal Steel Ltd is a leading steel and power company in India. It specializes in manufacturing steel products such as steel pipes, other construction materials, and also operates a thermal power plant. The company has a market cap of 2.33B as of 2023, and its Return on Equity (ROE) is 9.14%. This indicates that the company has been able to generate profits from its investments and is considered to be financially healthy. Panchmahal Steel Ltd’s success in managing its investments is a testament to its operations and management team.

– Panchmahal Steel Ltd ($BSE:513511)

Vardhman Special Steels Ltd is a leading provider of value-added steel and specialty steel products in India. The company is a part of the Vardhman Group, a renowned business conglomerate with interests in textiles, steel and trading. As of 2023, it has a market cap of 14.82 billion and a Return on Equity of 18.9%, indicating the company’s sound financial performance. Vardhman Special Steels Ltd has a wide product range that includes value-added steel, bright bars, forged products, wire rods and castings, which are highly sought after by customers for their quality and reliability. The company has established itself as a reliable partner in the industry and continues to grow in scale and stature.

Summary

Steel Authority of India (SAIL) is a promising option for dividend investors. Over the last three years, the company has issued annual dividend per share of 4.75, 8.3 and 1.0 INR and its dividend yields in 2021, 2022 and 2023 were 5.59%, 7.58% and 1.72% respectively, with an average dividend yield of 4.96%. Therefore, SAIL is a reliable dividend paying stock that presents a potential return on investment in the form of dividends. It is important to consider other factors such as the company’s financial condition and performance before investing in the stock.

Recent Posts