Star Micronics dividend calculator – Star Micronics Co Ltd Declares Cash Dividend of 30.0

June 3, 2023

🌥️Dividends Yield

On June 1 2023, Star Micronics ($TSE:7718) Co Ltd Declares Cash Dividend of 30.0. If you are looking for dividend stocks, STAR MICRONICS could be the answer. For the last three years, the company has issued an annual dividend per share of 60.0, 60.0, and 58.0 JPY respectively, with dividend yields from 2021 to 2023 being 4.07%, 4.07%, and 3.57% respectively. This gives an average dividend yield of 3.9%.

The ex-dividend date is June 29 2023, meaning that shareholders as of that date are eligible to receive the cash dividend. Investors can benefit from the steady cash flow generated from dividend payments and increase the value of their portfolio. With an average dividend yield of 3.9%, investors could find Star Micronics to be a good option for a portfolio diversification strategy.

Price History

The stock opened at JP¥1800.0 and closed at JP¥1804.0, down by 0.3% from the previous closing price of 1810.0. Investors can expect to receive their dividends soon, as long as they are registered stockholders of STAR MICRONICS Co Ltd by the end of March 2021. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Star Micronics. More…

| Total Revenues | Net Income | Net Margin |

| 90.95k | 11.65k | 12.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Star Micronics. More…

| Operations | Investing | Financing |

| 7.52k | -2.63k | -4.62k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Star Micronics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 97.39k | 22.05k | 2k |

Key Ratios Snapshot

Some of the financial key ratios for Star Micronics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.8% | 46.2% | 17.8% |

| FCF Margin | ROE | ROA |

| 5.9% | 13.6% | 10.4% |

Analysis

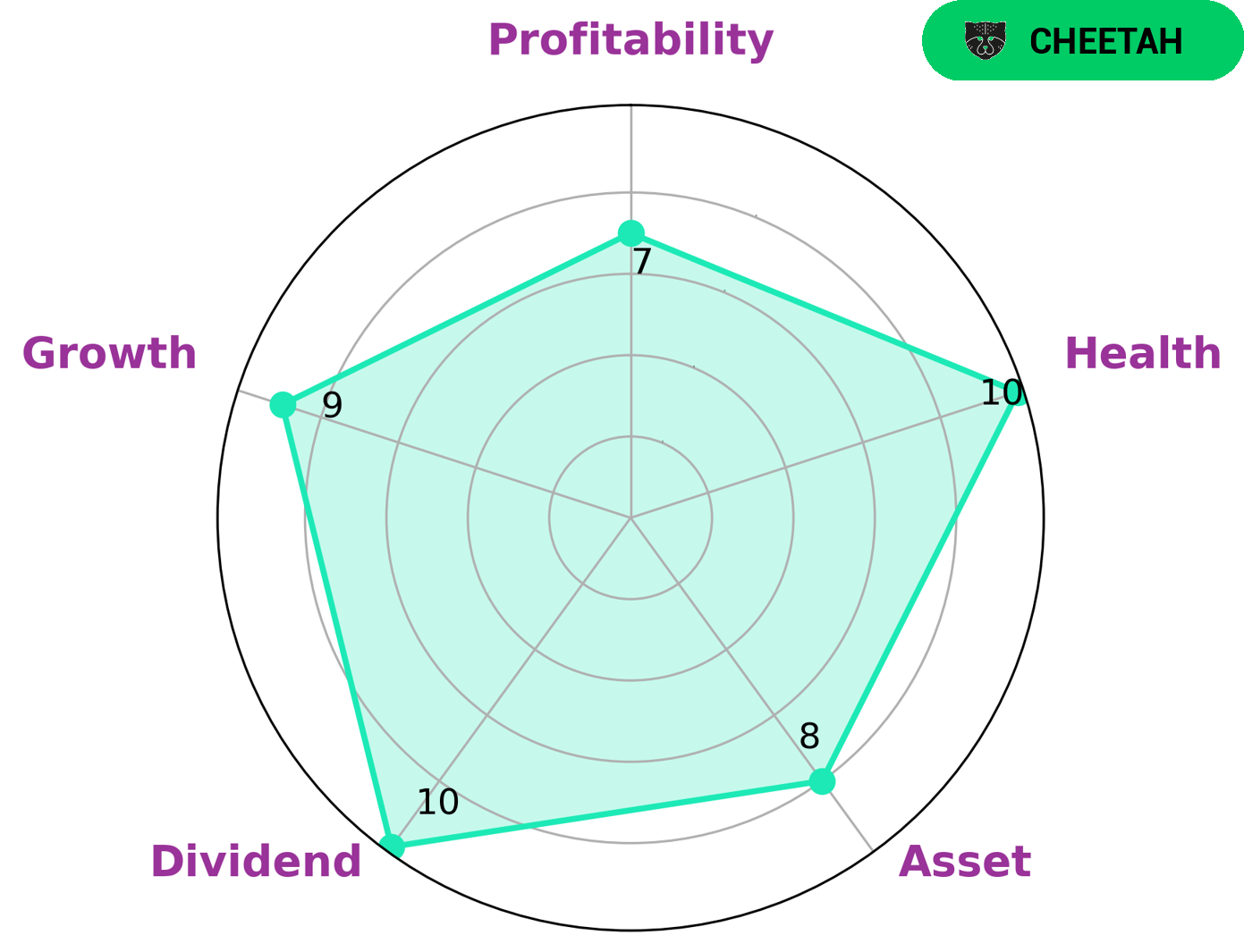

GoodWhale has conducted a comprehensive analysis of STAR MICRONICS’s financials. According to the Star Chart, STAR MICRONICS has performed very well in terms of its assets, dividend, growth, and profitability. The company boasts a health score of 10/10 with regard to cashflows and debt, indicating that the company is capable of paying off debt and funding future operations. Based on this analysis, we have concluded that STAR MICRONICS is classified as ‘cheetah’, a type of company that achieved high revenues or earnings growth but is considered less stable due to lower profitability. Investors interested in these types of companies may find STAR MICRONICS to be an attractive investment opportunity. STAR MICRONICS’s strong financial performance and stable cash flow make it a viable candidate for investors looking for a long-term investment. Additionally, its high revenue or earnings growth make it an attractive option for those looking for a more aggressive return. Ultimately, STAR MICRONICS may be a viable option for both conservative and more high-risk investors. More…

Peers

The competition among Star Micronics Co Ltd and its competitors, Schumag AG, Pegasus Sewing Machine Mfg Co Ltd, and Pritika Auto Industries Ltd, is intense. All four companies are striving to be the best in their respective industries by providing innovative products, competitive prices, and excellent customer service. This competition has become a key factor in the success of each company and has pushed them to become even better.

– Schumag AG ($LTS:0NIY)

Schumag AG is a global manufacturer of advanced cutting, welding and processing technologies. With a market cap of 7.89M as of 2023, the company has seen steady growth since its inception in the early 20th century. In addition to its impressive market cap, Schumag AG boasts an excellent Return on Equity (ROE) of 1981.48%. This number further demonstrates the company’s commitment to financial stability and efficient operations. Their wide array of products and services reflect their dedication to providing customers with the highest quality of solutions for their cutting, welding and processing needs.

– Pegasus Sewing Machine Mfg Co Ltd ($TSE:6262)

Pegasus Sewing Machine Mfg Co Ltd is a leading manufacturer of sewing machines and related products in the world. It has a market cap of 15.26 billion as of 2023, reflecting a growth of 120% over the previous year. The company’s Return on Equity (ROE) stands at 7.12% for this period, which is an impressive sign of profitability and financial health. Pegasus Sewing Machine Mfg Co Ltd aims to provide quality products to its customers worldwide, making use of state-of-the-art technologies and advanced production processes. It strives to continuously develop innovative products to cater to the ever-changing tastes of the customers and stay ahead of the competition.

– Pritika Auto Industries Ltd ($BSE:539359)

Pritika Auto Industries Ltd is an Indian auto parts manufacturer. It produces a range of automotive components for a variety of vehicles, including commercial vehicles, passenger cars, and two-wheelers. The company has a market capitalization of 1.38 billion as of 2023, indicating its strong financial health and a share price that has appreciated steadily over the last few years. This is further supported by its impressive Return on Equity (ROE) of 11.71%, which is a measure of how much profit is earned for every dollar invested into the business. With strong financials and a solid business model, Pritika Auto Industries Ltd appears to be in an excellent position to continue providing high-quality automotive parts and services in the future.

Summary

Investing in STAR MICRONICS can be a viable option for those seeking a reliable dividend yield. The company has issued an annual dividend per share of 60.0 JPY for the last three years, with dividend yields from 2021 to 2023 at 4.07%, 4.07%, and 3.57%, respectively. The average dividend yield is 3.9%. This makes STAR MICRONICS an attractive investment as it offers decent returns with relatively low risk.

Recent Posts