Stag Industrial dividend yield – STAG INDUSTRIAL Declares 0.1225 Cash Dividend

February 20, 2023

Dividends Yield

On February 2 2023, STAG INDUSTRIAL ($BER:SW6) declared a 0.1225 cash dividend. This company could be an ideal choice for investors on the hunt for stocks with a high dividend yield. Over the last few years, STAG INDUSTRIAL has consistently paid out a healthy annual dividend per share with yields of 3.77%, 3.94%, and 4.78% for 2020, 2021 and 2022 respectively. The average dividend yield of the company is 4.16%.

The ex-dividend date for the 0.1225 cash dividend is February 27 2023. Thus, investors who plan to buy before this date may receive the dividend. STAG INDUSTRIAL is a good option for those looking to maximize their returns via dividend payouts.

Price History

The increase pushed the stock open to 32.4 euros and close to 33.5 at the end of the day. The announcement of this dividend reflects the confidence of STAG Industrial’s management in the company’s ability to grow, generate profits and pay shareholders a steady and attractive dividend rate in the long term. It is speculated that this increase in dividend will encourage many investors to take a chance on STAG Industrial’s stock, which could result in a further rise in stock prices in the near future. For shareholders, this would mean a higher return on their investment and a higher overall value for their portfolio. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stag Industrial. More…

| Total Revenues | Net Income | Net Margin |

| 634.64 | 234.58 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stag Industrial. More…

| Operations | Investing | Financing |

| 379.41 | -1.01k | 603.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stag Industrial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.2k | 2.7k | 19.09 |

Key Ratios Snapshot

Some of the financial key ratios for Stag Industrial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 31.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

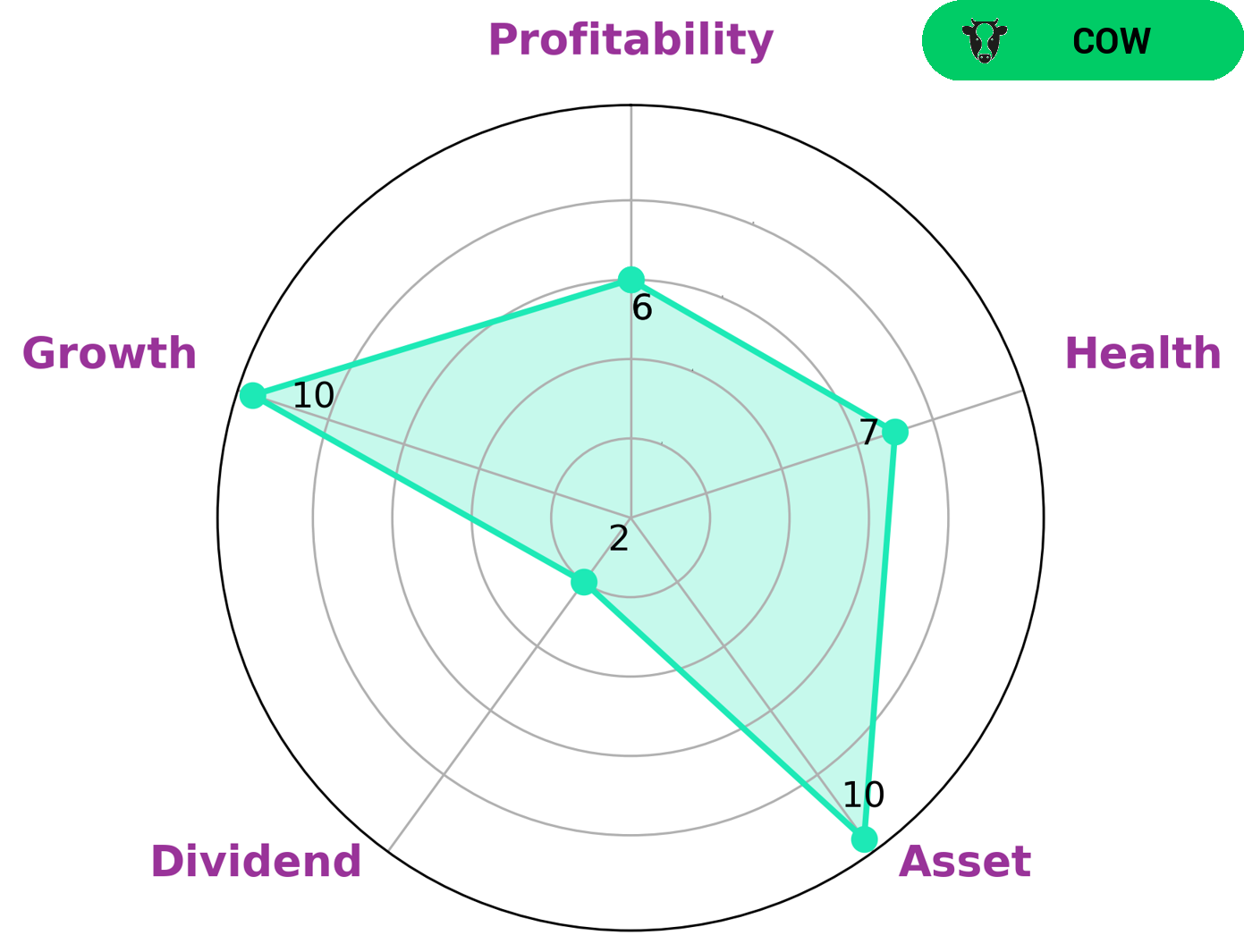

As GoodWhale’s analysis shows, STAG INDUSTRIAL is classified as a ‘cow’, which is a type of company that has the track record of paying out consistent and sustainable dividends. This makes it an attractive option for different types of investors, such as conservative investors or those looking for a base of income to offset other investments. GoodWhale’s analysis also reveals that STAG INDUSTRIAL has a high health score of 7/10 with regard to its cashflows and debt, indicating that it is capable of paying off debt and funding future operations. Furthermore, it is strong in asset, growth and medium in profitability, but weak in dividend. This makes it an attractive option for those investors who are more interested in growth potential than dividend yields. More…

Summary

STAG Industrial is a good choice for dividend-seeking investors. In the past three years, its dividend per share has been consistently stable, ranging from 1.46 USD to 1.44 USD, with average dividend yields of 3.77%, 3.94%, and 4.78%, respectively. With an average yield of 4.16%, STAG Industrial provides an attractive opportunity for investors seeking steady income from dividends. It is important for investors to analyze the company’s macroeconomic and financial performance, as well as its future prospects before investing in the stock.

Recent Posts