Sprix Inc stock dividend – Sprix Inc Announces 19.0 Cash Dividend

March 23, 2023

Dividends Yield

Sprix Inc ($TSE:7030) recently announced a 19.0 Cash Dividend on March 2 2023, making it an attractive choice for dividend-seeking investors. SPRIX INC may be a good option due to its average dividend yield of 3.23% over the next three years. The company has announced that the annual dividend per share will be 38.0 JPY in 2021 and 2022, and 31.0 JPY in 2023, respectively yielding 3.15% in 2021 and 2022 and 3.39% in 2023.

The ex-dividend date is March 30, 2023. Therefore, investors who are interested in dividend stocks should consider SPRIX INC as a potential investment.

Share Price

The announcement caused the stock to open at JP¥869.0 and close at the same price, representing a marginal 0.2% increase from the prior closing price of 867.0. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sprix Inc. More…

| Total Revenues | Net Income | Net Margin |

| 29.53k | 1.25k | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sprix Inc. More…

| Operations | Investing | Financing |

| 2.2k | -1.38k | -1.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sprix Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.15k | 10.21k | 574.76 |

Key Ratios Snapshot

Some of the financial key ratios for Sprix Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 36.9% | -4.1% | 7.3% |

| FCF Margin | ROE | ROA |

| 5.0% | 13.6% | 6.7% |

Analysis

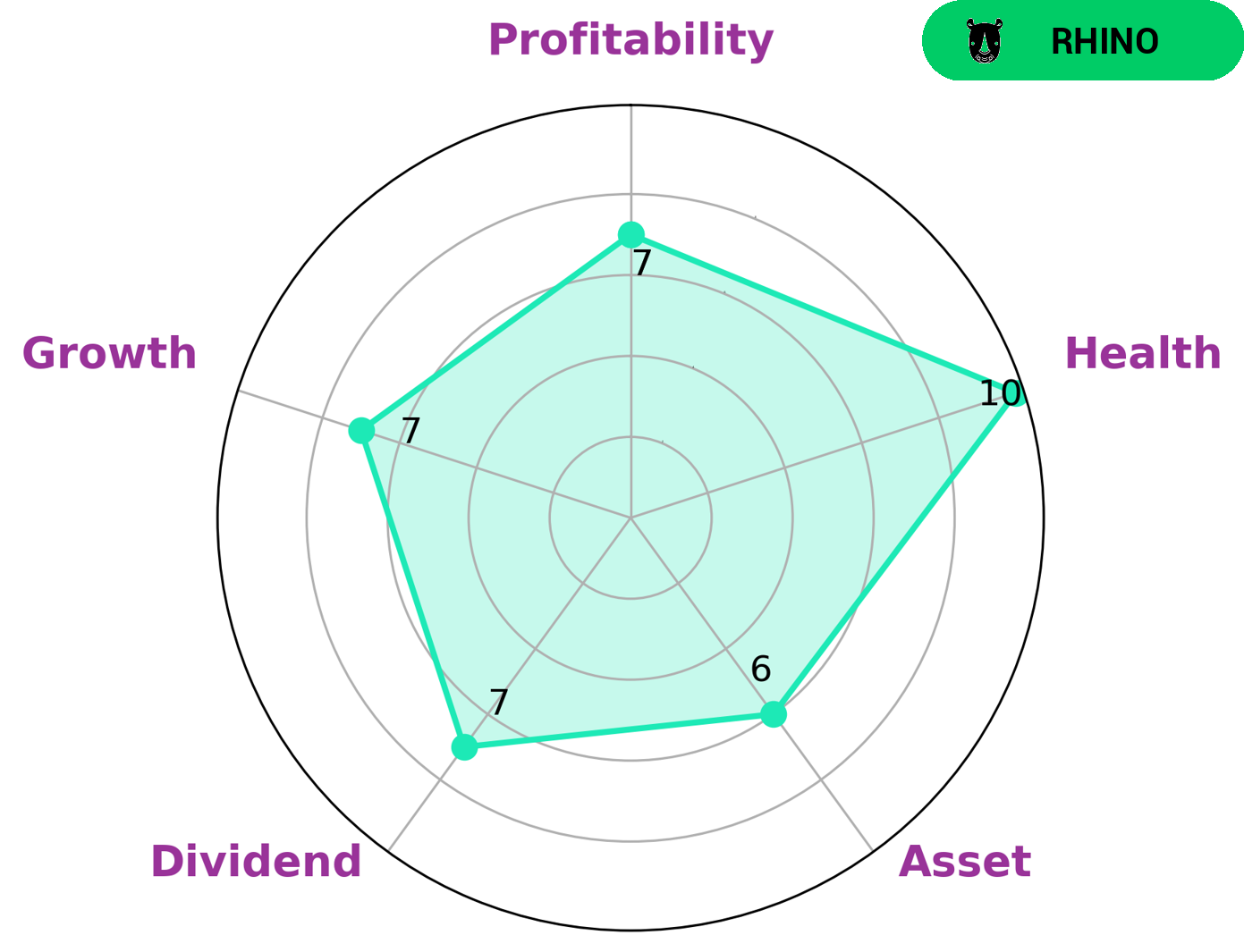

After conducting an analysis of SPRIX INC‘s wellbeing, GoodWhale has concluded that the company is categorized as a ‘rhino’, meaning that its revenue and earnings have achieved moderate growth. This type of company may be attractive to investors who are looking for a balance between dividends, growth, and profitability. Our GoodWhale Star Chart also shows that SPRIX INC has a strong score for dividend, growth, and profitability and is rated as medium for asset. Most importantly, the company has earned a high health score of 10/10 in regards to its cashflows and debt, indicating that it is capable of sustaining future operations during crises. More…

Peers

The company has been in the industry for several years and has established itself as a reliable partner for customers. With its wide range of offerings and competitive pricing, Sprix Inc is well-positioned to remain a major player in the market.

– PT Lavender Bina Cendikia Tbk ($IDX:BMBL)

B u s i n e s s B r e a k t h r o u g h I n c i s a n i n t e r n a t i o n a l e n t e r p r i s e s p e c i a l i z i n g i n t h e d e l i v e r y o f i n n o v a t i v e s o f t w a r e s o l u t i o n s t o t h e b u s i n e s s s e c t o r . W i t h a m a r k e t c a p o f 5 . 3 4 B a s o f 2 0 2 3 , B u s i n e s s B r e a k t h r o u g h I n c h a s a s t r o n g p r e s e n c e a c r o s s t h e g l o b e , o f f e r i n g a w i d e r a n g e o f s e r v i c e s t h a t a l l o w b u s i n e s s e s t o o p t i m i z e t h e i r o p e r a t i o n s . F u r t h e r m o r e , t h e i r R e t u r n o n E q u i t y ( R O E ) o f 1 6 . 5 9 % i s a m o n g t h e h i g h e s t i n t h e i n d u s t r y , w h i c h i s a t e s t a m e n t t o t h e c o m p a n y ‘ s s t r o n g f i n a n c i a l p e r f o r m a n c e . A s a r e s u l t , B u s i n e s s B r e a k t h r o u g h I n c i s w e l l p o s i t i o n e d t o c o n t i n u e l e a d i n g t h e w a y i n d e l i v e r i n g c u t t i n g – e d g e s o f t w a r e s o l u t i o n s t o b u s i n e s s e s w o r l d w i d e

– Business Breakthrough Inc ($TSE:2464)

JAIC Co Ltd is a Japanese based company that specializes in the manufacture and sale of consumer goods. The company has had a successful track record in recent years, with a market cap of 2.56B as of 2023 and a Return on Equity of 14.33%. This indicates that the company has been able to generate significant returns on its investments and is generating consistent profits. The company’s focus on consumer goods has helped JAIC Co Ltd maintain a strong presence in the Japanese market and expand its operations internationally.

Summary

Sprix Inc is an attractive investment opportunity for dividend seekers. It offers an average annual dividend yield of 3.23% over the next three years, with 38.0 JPY per share in 2021 and 2022, and 31.0 JPY per share in 2023. This amounts to a yield of 3.15% in 2021 and 2022, and 3.39% in 2023.

For long-term dividend investors, this may be a viable option for their portfolio. With its solid dividend performance, Sprix Inc could be a great low-risk stock to invest in for the foreseeable future.

Recent Posts