Spring Real Estate dividend yield – Spring Real Estate Investment Trust Announces 0.1 Cash Dividend

April 4, 2023

Dividends Yield

Spring Real Estate ($SEHK:01426) Investment Trust (SPRING REAL ESTATE INVESTMENT TRUST) has announced that on April 1 2023, it will distribute a cash dividend of 0.1 CNY per share. This dividend is a follow up to the trust’s past three year performance, where it has distributed an annual dividend per share of 0.18 CNY, 0.18 CNY and 0.17 CNY respectively. The dividend yields for 2020, 2021 and 2022 have been 7.91%, 7.57%, and 7.88% respectively, with an average yield of 7.79%. The trust’s commitment to consistently distributing an annual dividend per share, coupled with its average yield of 7.79% make it an attractive option for investors seeking to capitalize on the potential of real estate investment trusts.

Share Price

SPRING stock opened at HK$2.4 and closed at the same price. The dividend will be paid out on June 4th and represents the first of a series of cash dividends planned this year by SPRING. This dividend payout will be of great value to investors who are looking for stable returns in real estate investments. SPRING’s dividend program will support the company’s mission of providing investors with reliable and steady returns over the long-term.

The company believes that this commitment to dividends will strengthen their appeal to investors and ultimately benefit shareholders. The announcement of the dividend comes at a time when SPRING is engaging in strategic initiatives to further its position as one of the most successful real estate investment trusts in Asia. With its strong portfolio of properties and long-term vision, SPRING is poised to continue its success and provide solid returns to its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spring Real Estate. More…

| Total Revenues | Net Income | Net Margin |

| 538.83 | 391.38 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spring Real Estate. More…

| Operations | Investing | Financing |

| 351.59 | -13.54 | -348.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spring Real Estate. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.03k | 3.35k | 4.52 |

Key Ratios Snapshot

Some of the financial key ratios for Spring Real Estate are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 62.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

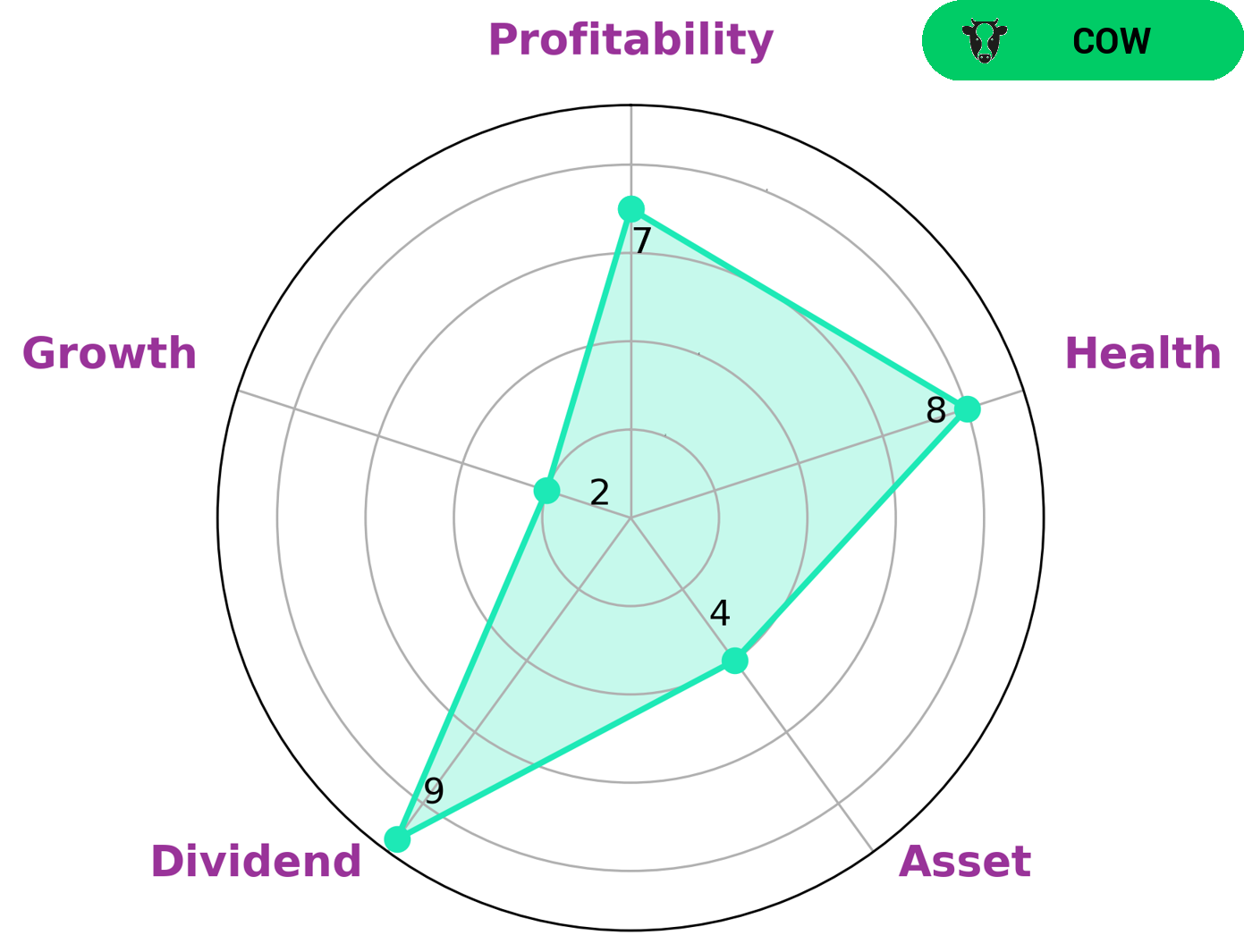

GoodWhale’s analysis of SPRING REAL ESTATE INVESTMENT TRUST’s wellbeing shows that the company has a high health score of 8/10. This is due to its strong cashflows and debt capacity, indicating that it should be able to sustain itself in times of crisis. This makes SPRING REAL ESTATE INVESTMENT TRUST an attractive option for investors looking for a reliable source of income. Furthermore, an analysis of its financial health shows that the company is strong in dividend and profitability, medium in asset and weak in growth. Therefore, investors who are looking for a company that offers a steady and reliable return may find SPRING REAL ESTATE INVESTMENT TRUST to be a good fit for their investment portfolio. More…

Peers

Spring Real Estate Investment Trust (REIT) is an American publicly traded real estate company primarily focused on investing in the acquisition and ownership of retail and office properties. Spring REIT is one of many companies in the real estate investment trust industry, competing alongside Generation Income Properties Inc., Spirit Realty Capital Inc., and UNITE Group PLC.

– Generation Income Properties Inc ($NASDAQ:GIPR)

Generation Income Properties Inc is a real estate investment trust (REIT) that focuses on acquiring, owning, and operating a portfolio of net leased industrial and office properties. As of 2023, the company had a market capitalization of 12.2 million dollars. This market cap reflects the total value of the company’s shares, which are publicly traded on the NASDAQ stock exchange. Generation Income Properties Inc’s objective is to provide shareholders with stable, diversified income from its portfolio of net leased properties. The company seeks to acquire properties with long-term leases in place and to maintain occupancy through tenant retention and leasing activities.

– Spirit Realty Capital Inc ($NYSE:SRC)

Spirit Realty Capital Inc is a real estate investment trust (REIT) with a market cap of 5.99B as of 2023. Founded in 2003, the company invests in single-tenant properties primarily located in the United States. It currently owns over 3,000 properties across 46 states and Canada with a total annual rentable square footage of approximately 57 million. The company focuses on leasing these properties to tenants with strong credit ratings, and its portfolio includes a mix of retail, industrial, office and specialty assets. Spirit Realty Capital Inc also provides financial services to other REITs, including mortgage loan origination, securitization and servicing.

– UNITE Group PLC ($LSE:UTG)

Unite Group PLC is a leading provider of student accommodation in the United Kingdom. Founded in 1991, the company has grown to become the largest provider of purpose-built student accommodation in the UK, with a portfolio of over 51,000 beds across more than 175 properties. As of 2023, Unite Group PLC has a market capitalization of 4.05 billion pounds. The company’s stock is listed on the London Stock Exchange and is part of the FTSE 250 Index. The company operates through its subsidiaries, Unite Students and Unite Property Management, and provides student accommodation services including residential property management and development, student lettings and marketing, and asset management.

Summary

SPRING REAL ESTATE INVESTMENT TRUST is a Hong Kong-based real estate investment trust that has been providing dividend payments for the past three years. In 2020-2022, the company has distributed an annual dividend per share of 0.18 CNY, 0.18 CNY, and 0.17 CNY respectively, resulting in yields of 7.91%, 7.57%, and 7.88% respectively. The average yield of these three years is 7.79%.

This indicates that the trust offers good returns to its investors, making it a good investment option. Investors should consider the trust’s dividend history and other characteristics before investing, including the company’s financials, its management team, and the overall market conditions.

Recent Posts