Southern Company dividend yield – 2023: Southern Company a No-Brainer Dividend Stock for Investors!

March 14, 2023

Trending News 🌥️

Investing in The Southern Company ($NYSE:SO) is a smart move for dividend seeking investors. As of 2023, the company boasts a strong balance sheet and a consistent track record of dividend payments throughout its more than century-long history. This strong performance reflects the company’s financial strength and increases its appeal as a dividend paying stock. Since then, The Southern Company has increased its dividend payments every year, and the company currently has a dividend pay-out ratio of about 65%. The company’s long history of consistent dividend payments makes it a no-brainer for dividend-seeking investors. The Southern Company also has a portfolio of regulated utilities, which provides a steady stream of revenue and helps support its dividend payments.

In addition, the company has diversified its business in the past few years, investing in renewable energy projects and other initiatives. This diversification gives The Southern Company even more stability and makes it an even smarter investment for dividend seeking investors. With a reliable history of dividend payments and numerous other advantages, it is a no-brainer for dividend seekers looking for steady income generation.

Dividends – Southern Company dividend yield

For those keen on dividend stocks, 2023 could be the start of an exciting journey with Southern Company. The company has issued an annual dividend per share of 2.7 USD for each of the last three years and the dividend yields from 2022 to 2022 are 3.83%, presenting investors with a reliable and attractive dividend return. With an average dividend yield of 3.83%, Southern Company could be a no-brainer choice for investors who are looking for consistent dividend returns.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Southern Company. More…

| Total Revenues | Net Income | Net Margin |

| 29.28k | 3.52k | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Southern Company. More…

| Operations | Investing | Financing |

| 6.3k | -8.43k | 2.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Southern Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 134.89k | 100.36k | 28.92 |

Key Ratios Snapshot

Some of the financial key ratios for Southern Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.0% | 1.4% | 21.3% |

| FCF Margin | ROE | ROA |

| -5.5% | 12.6% | 2.9% |

Stock Price

Last Monday, SOUTHERN COMPANY opened at $63.8 and closed at $65.2, representing a 1.9% increase from its previous closing price of 63.9. This makes SOUTHERN COMPANY stock an attractive choice for investors seeking to add reliable dividend income to their portfolios. Furthermore, SOUTHERN COMPANY’s dividend yield has been consistently increasing over the past few years, providing a steady stream of income with no added risk. With its strong growth prospects and reliable dividend, SOUTHERN COMPANY is an ideal stock for dividend-seeking investors. Live Quote…

Analysis

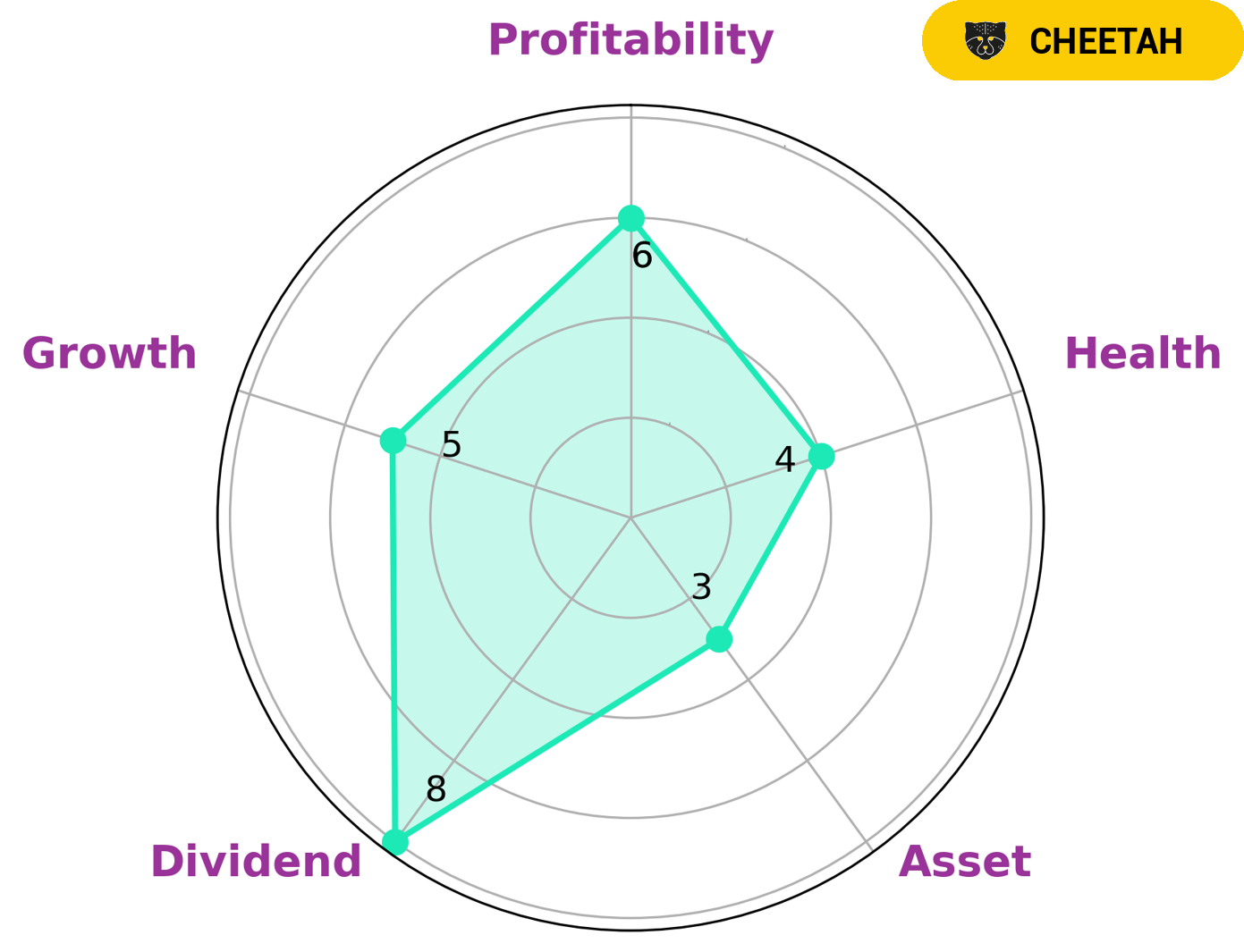

As GoodWhale, we have analyzed SOUTHERN COMPANY‘s fundamentals and have come to the conclusion that it is strong in dividend, medium in growth, profitability, and weak in asset. It has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating it is likely to pay off debt and fund future operations. Given this information, investors who are looking for high returns may be interested in such a company. Those who are looking for more stability may want to look elsewhere. SOUTHERN COMPANY may be a good option for aggressive investors who are comfortable with higher risk and are looking for potential gains. More…

Peers

In the electric utility industry, there is intense competition between Southern Co and its competitors: NextEra Energy Inc, Avangrid Inc, Entergy Corp. These companies are all vying for market share in the Southeast region of the United States.

– NextEra Energy Inc ($NYSE:NEE)

NextEra Energy Inc is a leading clean energy company with operations in 27 states and Canada. The company has a market cap of 143.98B as of 2022 and a Return on Equity of 4.45%. NextEra Energy Inc is committed to providing clean, safe and reliable energy to its customers. The company has a diversified portfolio of generation assets that includes wind, solar, nuclear and natural gas. NextEra Energy Inc is also one of the largest electric utilities in the United States.

– Avangrid Inc ($NYSE:AGR)

Avangrid Inc is a leading energy services and delivery company with operations in 26 states. It has a market cap of 15.4 billion and a return on equity of 3.84%. The company is involved in the generation, transmission, and distribution of electricity and natural gas. It also provides renewable energy solutions.

– Entergy Corp ($NYSE:ETR)

Entergy Corporation is an integrated energy company engaged primarily in electric power production and retail distribution operations. Entergy owns and operates power plants with approximately 30,000 megawatts of electric generating capacity, including nearly 10,000 megawatts of nuclear power. Entergy delivers electricity to 2.9 million utility customers in Arkansas, Louisiana, Mississippi, and Texas.

Summary

Southern Company is a well-established dividend stock that investors looking for strong, steady income should consider. It also has strong financials, with a strong balance sheet and steady growth track record.

Recent Posts