Sotoh stock dividend – Sotoh Co Ltd Announces 11.0 Cash Dividend

March 21, 2023

Dividends Yield

On March 1 2023, Sotoh ($TSE:3571) Co Ltd announced an 11.0 cash dividend for its shareholders. For those interested in dividend-yielding stocks, SOTOH could be an attractive option to consider. Over the past three years, the company has issued an annual dividend per share of 23.0, 24.0, and 26.0 JPY respectively. This means that the yields for 2021 to 2023 are estimated to be 2.82%, 3.0%, and 2.84%, with an average dividend yield of 2.89%.

Share Price

On the same day, SOTOH stock opened at JP¥801.0 and closed at JP¥809.0, indicating a 0.7% increase from the previous closing price of JP¥803.0. This news was well received by the market, with a positive reaction to the cash dividend announcement. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sotoh. More…

| Total Revenues | Net Income | Net Margin |

| 9.25k | -1.26k | -8.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sotoh. More…

| Operations | Investing | Financing |

| -808.34 | 174.04 | -338.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sotoh. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.36k | 3.3k | 869.65 |

Key Ratios Snapshot

Some of the financial key ratios for Sotoh are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.8% | -24.8% | -13.2% |

| FCF Margin | ROE | ROA |

| -16.2% | -6.9% | -5.3% |

Analysis

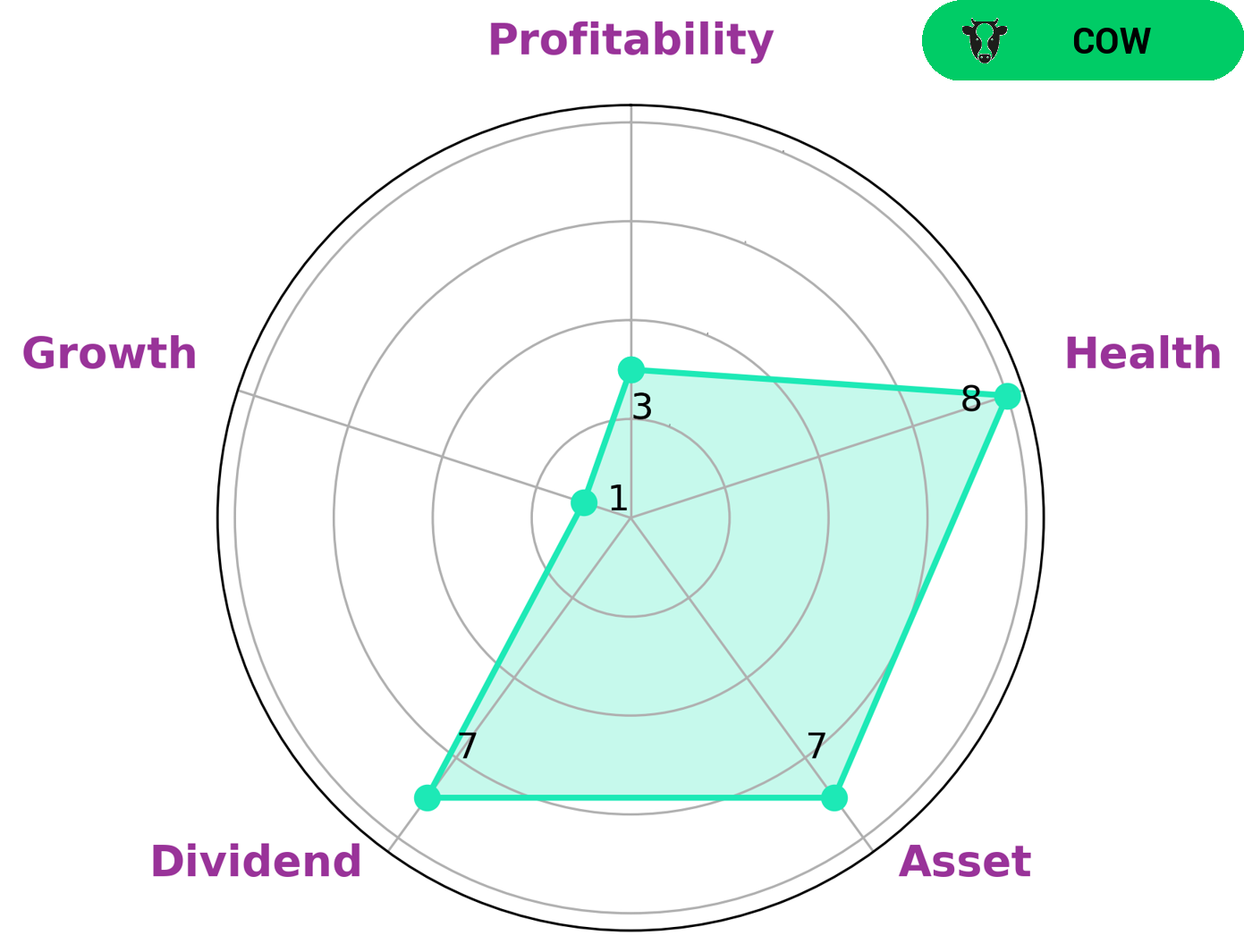

GoodWhale has completed a thorough analysis of SOTOH‘s fundamentals and has come to the conclusion that it is well-positioned for the future. According to Star Chart, SOTOH has a high health score of 8/10, indicating a strong financial position with enough cashflow and debt capacity to pay off debt and fund future operations. While SOTOH shows strength in its assets and dividends, its growth and profitability are weaker. GoodWhale classifies SOTOH as a ‘cow’, meaning that the company has a history of paying out consistent and sustainable dividends. Investors who are looking for steady, reliable dividends may find SOTOH to be an attractive option. More…

Peers

The competition between Sotoh Co Ltd and its competitors – Yadong Group Holdings Ltd, A.K. Spintex Ltd, and Dhanlaxmi Fabrics Ltd – is fierce and growing. Companies in this industry must continually innovate in order to stay ahead of the competition and remain profitable in a constantly changing market.

– Yadong Group Holdings Ltd ($SEHK:01795)

Yadong Group Holdings Ltd is a Chinese-based company that specializes in a variety of industries, ranging from financial services to engineering and technology. The company has a current market capitalization of 1.58 billion dollars as of 2023, an impressive figure considering its size. Its return on equity, or ROE, is also quite impressive at 15.58%. This high ROE indicates that Yadong Group is making efficient and productive use of its assets to generate income. Yadong Group has shown impressive growth and stability over the years, making it an attractive investment for investors.

– A.K. Spintex Ltd ($BSE:539300)

A.K. Spintex Ltd is a global company specializing in the production of synthetic and natural fibers for the textile industry. With a market cap of 402.54M as of 2023, A.K. Spintex Ltd has a solid financial position and is in a strong position to pursue growth opportunities. The company’s Return on Equity (ROE) of 22.28% indicates that it is creating value for its shareholders and is a sign of its financial health. A.K. Spintex Ltd has proven itself to be a reliable partner and has established a strong global presence in the textile industry.

– Dhanlaxmi Fabrics Ltd ($BSE:521151)

Dhanlaxmi Fabrics Ltd is a leading textile company in India, specializing in yarns and fabrics. The company has a market capitalization of 292.27M as of 2023 and a Return on Equity (ROE) of 3.55%. This indicates that the company has been able to generate a good return on its equity investments which has allowed it to grow and expand. The company’s strong market cap and ROE demonstrate that it has been able to successfully manage its operations and generate a healthy return on investments.

Summary

Investing in SOTOH can be a lucrative option for those seeking dividend-yielding stocks. SOTOH has issued an annual dividend per share of 23.0, 24.0 and 26.0 JPY over the past three years respectively, with expected yields for 2021 to 2023 estimated at 2.82%, 3.0% and 2.84% respectively, for an average dividend yield of 2.89%. SOTOH’s consistent dividend payout and attractive dividends make it an appealing option for investors seeking reliable investment income.

Recent Posts