SNNP-F dividend yield calculator – Srinanaporn Marketing PCL Announces 0.23 Cash Dividend

June 1, 2023

🌥️Dividends Yield

On May 26, 2023, Srinanaporn ($SET:SNNP-F) Marketing PCL announced a cash dividend of 0.23 THB per share for the year 2023. This marks a decrease from the annual dividend rate of 0.32 THB per share that the company offered for the past two years, resulting in a dividend yield of 2.24%. For investors looking for a reliable dividend paying stock, Srinanaporn Marketing PCL is an attractive option. The ex-dividend date for this dividend is May 2, 2023. For those unfamiliar with Srinanaporn Marketing PCL, it is a Thai public limited company that provides marketing services and solutions to both local and international clients.

Srinanaporn Marketing PCL offers a variety of services to its customers, such as market research and analysis, digital marketing, media advertising, and product development. It also provides strategic guidance and support to its clients in order to help them achieve their business goals. By investing in Srinanaporn Marketing PCL, investors have the opportunity to earn steady dividends as well as benefit from the company’s expertise in marketing and solutions.

Share Price

The stock opened for trading on the same day at THB14.3 and closed at the same price. This dividend is expected to reward long-term shareholders for their continued support and loyalty. It is also likely to attract new investors who are looking for returns on their investments.

The dividend will also help to shore up investor confidence in the company’s stock. This announcement is also likely to have a positive impact on the stock price in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SNNP-F. More…

| Total Revenues | Net Income | Net Margin |

| 5.84k | 564.36 | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SNNP-F. More…

| Operations | Investing | Financing |

| 440.89 | -371.51 | -67.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SNNP-F. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.08k | 1.63k | 3.33 |

Key Ratios Snapshot

Some of the financial key ratios for SNNP-F are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.7% | 58.8% | 12.1% |

| FCF Margin | ROE | ROA |

| 1.2% | 14.2% | 8.7% |

Analysis

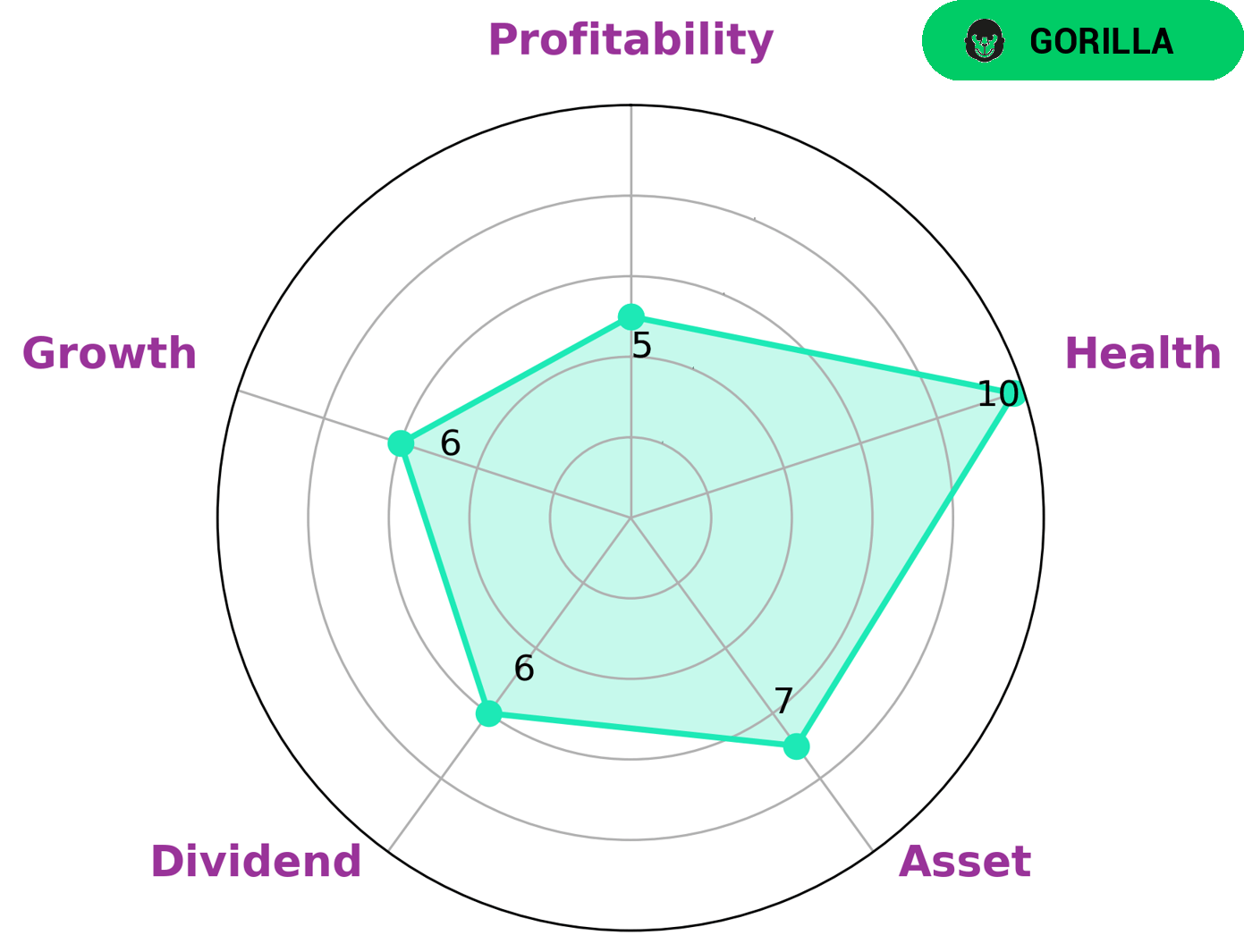

GoodWhale has conducted an analysis of SRINANAPORN MARKETING PCL’s wellbeing, and the results are impressive. Our Star Chart shows that SRINANAPORN MARKETING PCL has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable of riding out any crisis without the risk of bankruptcy. Based on these results, we have classified SRINANAPORN MARKETING PCL as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. This makes SRINANAPORN MARKETING PCL an attractive prospect for investors, particularly those looking for long-term financial gains. SRINANAPORN MARKETING PCL is strong in asset, and medium in dividend, growth, and profitability. With such stability and potential for growth, investors seeking a reliable investment option can be confident in SRINANAPORN MARKETING PCL as a solid choice. More…

Summary

SRINANAPORN MARKETING PCL has offered an annual dividend per share of 0.32 THB for the past two years, resulting in a yield of 2.24%. This makes it a great choice for investors looking for a steady dividend payment. The company’s dividend payout ratio is also quite reasonable, indicating that it has the capacity to sustain its dividends in the future.

In addition, SRINANAPORN MARKETING PCL has a strong balance sheet and has shown consistent profitability over the years. Therefore, it is a good option to consider when evaluating potential investments.

Recent Posts