SMPC dividend – Sahamitr Pressure Container PCL Announces 0.4 Cash Dividend

April 9, 2023

Dividends Yield

Sahamitr Pressure Container ($SET:SMPC) PCL recently announced their 0.4 cash dividend on April 1st, 2023. For the past three years, this company has issued an annual dividend per share of 1.07 THB, resulting in dividend yields of 7.62% from 2022 to 2023. This makes SAHAMITR PRESSURE CONTAINER PUBLIC a great option for investors who are looking for stocks with a steady dividend yield. The ex-dividend date for this stock is April 7th 2023, and it is important to note that the dividend will be paid out after the ex-dividend date.

If you are interested in generating a steady income from stocks, SAHAMITR PRESSURE CONTAINER PUBLIC could be a viable option for you. With its high dividend yields and long history of stable dividends, SAHAMITR PRESSURE CONTAINER PUBLIC is an excellent choice for dividend-seeking investors. It is important to do your research and learn more about the company before investing in any stock, and SAHAMITR PRESSURE CONTAINER PUBLIC is no exception.

Share Price

This announcement came after the stock opened at THB12.3 and closed at THB12.4, representing an increase of 0.8% from the previous closing price. The announcement is a positive sign for shareholders, as they will receive direct rewards in the form of cash dividends. This dividend is expected to be paid out in the coming months. Moreover, the announcement is likely to attract more investors to the company, as they can benefit from the higher returns that come with investing in SAHAMITR PRESSURE CONTAINER PUBLIC. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SMPC. More…

| Total Revenues | Net Income | Net Margin |

| 5.25k | 828.88 | 15.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SMPC. More…

| Operations | Investing | Financing |

| 878.21 | -22.18 | -825.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SMPC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.27k | 1.55k | 5.08 |

Key Ratios Snapshot

Some of the financial key ratios for SMPC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | 32.6% | 19.8% |

| FCF Margin | ROE | ROA |

| 14.1% | 24.3% | 15.2% |

Analysis

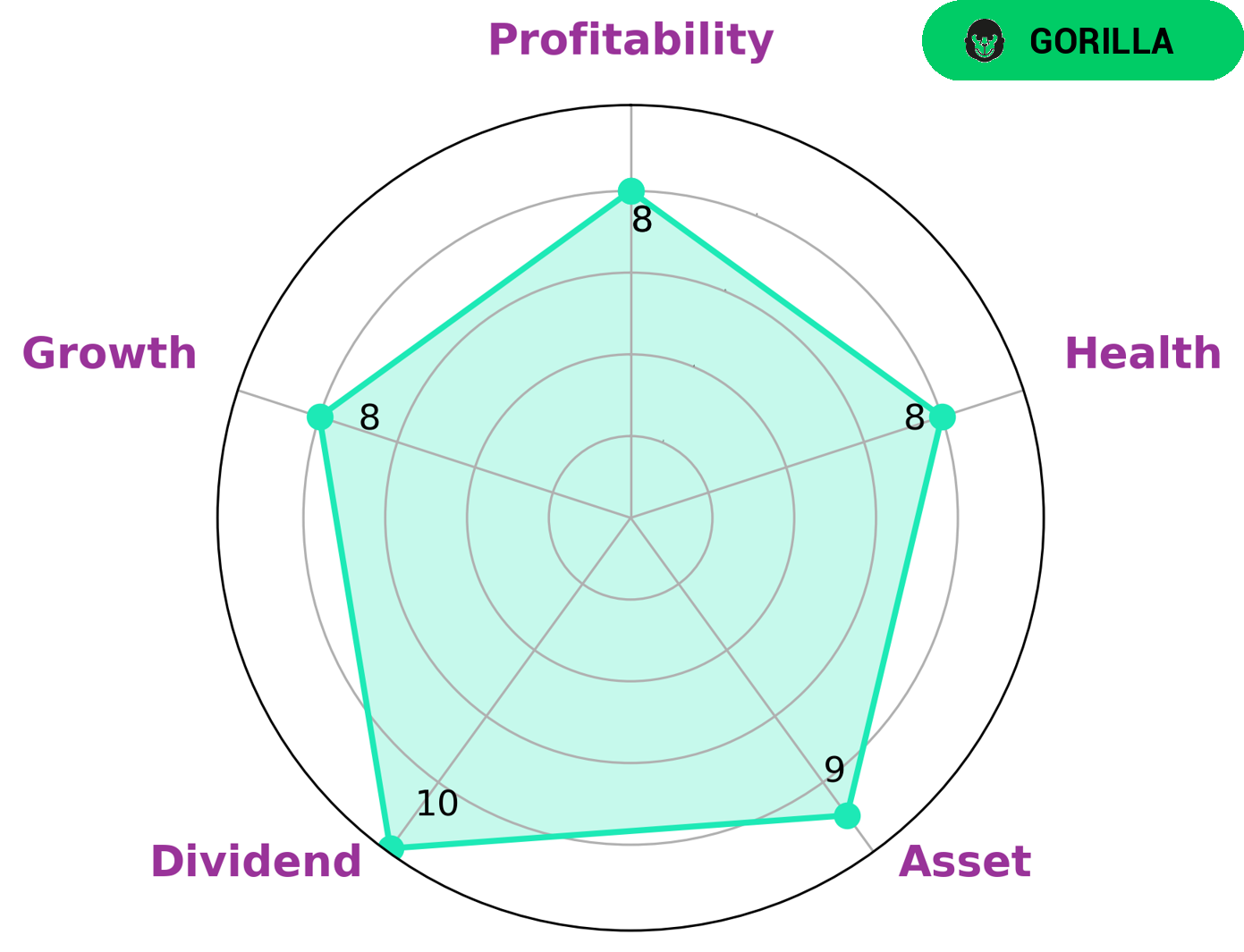

Our analysis of SAHAMITR PRESSURE CONTAINER PUBLIC’s financials has yielded a high health score of 8/10, indicating that the company is capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, based on our Star Chart classification, SAHAMITR PRESSURE CONTAINER PUBLIC is classified as ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes SAHAMITR PRESSURE CONTAINER PUBLIC an attractive prospect for many types of investors as the company demonstrates strength in asset, dividend, growth and profitability. For those who are looking for a safe investment with potential for steady returns, SAHAMITR PRESSURE CONTAINER PUBLIC is certainly worth considering. More…

Peers

The competition between Sahamitr Pressure Container PCL and its competitors, TOKYO KOKI Co Ltd, Jiangsu Liance Electromechanical Technology Co Ltd, and MFS Intercorp Ltd, is fierce. All four companies are constantly striving to develop new products and services to stay ahead in the competitive landscape. Through innovation and strategic thinking, they are all vying for the top spot in their respective markets.

– TOKYO KOKI Co Ltd ($TSE:7719)

Tokyo Koki Co Ltd is a Japanese manufacturing company specializing in power tools and machine tools. As of 2023, it has a market capitalization of 1.08B, indicating that it is a large company with a significant presence in the industry. Its Return on Equity (ROE) of -20.06% is an alarming sign as it suggests that the company has been unable to generate enough profit for its investors, which may indicate underlying issues in its operations. The company has to find ways to increase profitability and ensure that its ROE is more positive.

– Jiangsu Liance Electromechanical Technology Co Ltd ($SHSE:688113)

Jiangsu Liance Electromechanical Technology Co Ltd is an industry-leading Chinese company that specializes in advanced electromechanical engineering technology. As of 2023, the company’s market cap is 3.18B, making it a highly profitable and sought-after investment opportunity. Furthermore, its Return on Equity (ROE) of 9.03% indicates that the company is able to generate significant profits from its investments. The company’s impressive performance and success showcases their advanced technology and expertise in this field as well as their commitment to excellence in customer service and quality.

– MFS Intercorp Ltd ($BSE:513721)

MFS Intercorp Ltd is an Indian-based financial services company that provides a range of products and services to its clients, including personal banking, corporate banking, mortgages, insurance, mutual fund and advisory services. The company has a market cap of 37.8M as of 2023, indicating that it is a relatively small but successful business. The Return on Equity (ROE) of 34.31% also indicates that the company is making good returns on its investments. This reflects the company’s sound financial management practices and its ability to generate profits for its shareholders.

Summary

SAHAMITR PRESSURE CONTAINER PUBLIC is an attractive stock for investors looking for consistent dividends. For the past three years, the company has issued a dividend per share of 1.07 THB, resulting in a 7.62% dividend yield during that period. While investing in SAHAMITR PRESSURE CONTAINER PUBLIC is a high-risk endeavor, investors can benefit from its consistent dividend yield, as well as potential capital appreciation. Investors should consider their risk tolerance, financial goals, and research the company before making a decision to invest.

Recent Posts