SLG dividend yield calculator – Is SL Green Realty’s 15% Dividend Yield Too Good To Be True?

May 16, 2023

Trending News ☀️

SL ($NYSE:SLG) Green Realty Corp is one of the largest real estate investment trusts (REITs) in the United States. The company owns, manages, and leases commercial properties, primarily in Manhattan, New York City. Its portfolio includes office, retail, apartment, and hotel properties. SL Green‘s stock is known for its high dividend yield — currently at 15%. Investors have to ask: Is SL Green’s 15% Dividend Yield a reliable investment or too good to be true? On the one hand, high dividend yields can be quite attractive for income-seeking investors. On the other hand, there is the risk that a company’s promise of a high dividend yield could be unsustainable. This may be an indication that the company is paying more than its peers to attract investors. It’s also possible that the dividend yield is higher than other office REITs due to lower stock price. While investors should be cautious of high dividend yields, SL Green’s financials suggest that its dividend may be sustainable. The company has a strong balance sheet and higher than average occupancy rates. In conclusion, while investors should approach any investment with caution, SL Green’s 15% dividend yield may be a reliable investment. The company has a strong financial position and higher than average occupancy rates that suggest a healthy future.

However, investors must do their due diligence before making any decisions.

Dividends – SLG dividend yield calculator

Over the past three years, the company has distributed an annual dividend per share of 3.57, 3.69 and 3.76 USD, respectively. This performance has made it possible to maintain a dividend yield of 7.84% in 2021, 6.49% in 2022 and 5.27% in 2023, giving it an average dividend yield of 6.53%. The company’s consistent dividend payout and attractive yield make it an interesting option for someone seeking reliable income.

The stock is also relatively low-risk since its dividend payments are fairly stable and predictable. That said, investors should always conduct their own research before making any decisions about investing in the company.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SLG. More…

| Total Revenues | Net Income | Net Margin |

| 862.35 | -142.72 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SLG. More…

| Operations | Investing | Financing |

| 276.09 | 425.81 | -654.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SLG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.34k | 7.36k | 65.84 |

Key Ratios Snapshot

Some of the financial key ratios for SLG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 19.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – SLG Intrinsic Value Calculation

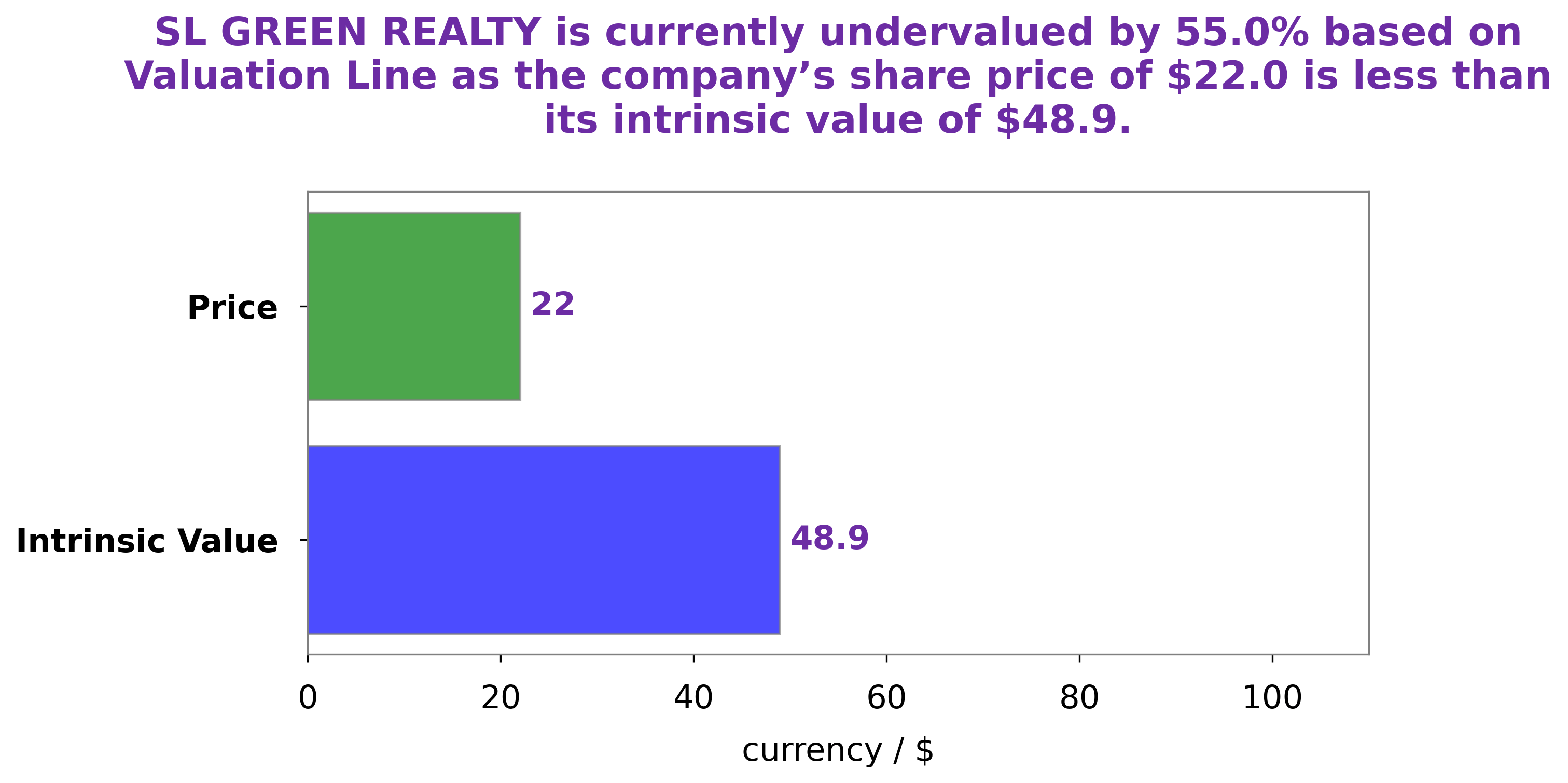

At GoodWhale, we offer users the ability to analyze the fundamentals of SL GREEN REALTY. Our proprietary Valuation Line enables us to calculate the fair value of its stocks, which is estimated to be around $48.9. Currently, SL GREEN REALTY’s stock is traded at $22.0- a full 55.0% undervalued from its fair value. This means that there may be a great opportunity for investors to take advantage of this price discrepancy and buy stock in SL GREEN REALTY. More…

Peers

The commercial real estate industry is highly competitive, with a large number of companies vying for market share. SL Green Realty Corp is one of the largest and most successful commercial real estate firms in the industry, with a long track record of success. The company’s main competitors are Picton Property Income Ltd, DDMP REIT Inc, and Cromwell Property Group. These firms are all large and well-established companies with significant resources and a strong presence in the industry.

– Picton Property Income Ltd ($LSE:PCTN)

The company’s market cap is 468.15M as of 2022. The company is a property income fund that invests in a portfolio of UK commercial properties. The company’s objective is to provide shareholders with an attractive level of income and capital growth by investing in a diversified portfolio of UK commercial properties.

– DDMP REIT Inc ($PSE:DDMPR)

Dividend and income-oriented real estate investment trust that owns and operates a diversified portfolio of real estate assets in the United States. The company’s portfolio includes office, retail, industrial, and residential properties.

– Cromwell Property Group ($ASX:CMW)

Cromwell Property Group is a real estate investment trust that owns and operates a portfolio of properties across Australia, New Zealand, and Europe. The company has a market cap of 5.46 billion as of 2022. Cromwell Property Group’s portfolio includes office, retail, industrial, and logistics properties. The company also owns and operates a number of hotels and serviced apartments.

Summary

SL Green Realty is a real estate investment trust (REIT) that invests in office and retail properties. The company has a high dividend yield of 15%, which attracts investors seeking income.

However, this should be considered cautiously due to the risks associated with REITs, as they are highly dependent on external factors. It is important to evaluate the current market conditions, the company’s financials, and its risk profile before investing in SL Green Realty. Analysts recommend focusing on the company’s financial health, dividend history, and the potential of its portfolio to generate income in order to make an informed decision.

Recent Posts