SHO dividend – Sunstone Hotel Investors Receive $0.13 Dividend Increase Per Share

December 8, 2023

☀️Trending News

Sunstone Hotel Investors ($NYSE:SHO) is a publicly-traded real estate investment trust (REIT) that invests in hotel properties primarily in the United States. It is headquartered in Aliso Viejo, California. The company recently announced a dividend of $0.13 per share, which includes a $0.07 dividend plus an extra $0.06. The dividend increase is indicative of Sunstone Hotel Investors’ strong financial performance in recent years.

This positive trend is expected to continue, with Sunstone Hotel anticipating further growth in earnings in the coming years. The dividend increase also demonstrates the company’s commitment to providing strong returns to its investors. This dividend increase is just one example of how Sunstone Hotel Investors is dedicated to providing its investors with excellent returns.

Dividends – SHO dividend

Sunstone Hotel Investors, Inc. recently announced that they will be increasing their annual dividend per share from 0.22 USD to 0.13 USD. This is a significant jump compared to the 0.1 USD dividend from the past two years. This increase in dividend payments will come with attractive yields that are projected for the years 2022 to 2023.

Specifically, the estimated dividend yields are 2.18% and 0.93%, respectively, which gives an average dividend yield of 1.56%. This increase in dividend payments provides a great opportunity for current and potential investors to take advantage of attractive yields over the next couple of years.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SHO. More…

| Total Revenues | Net Income | Net Margin |

| 1.01k | 82.63 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SHO. More…

| Operations | Investing | Financing |

| 228.43 | -91.56 | -119.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SHO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.09k | 1k | 8.79 |

Key Ratios Snapshot

Some of the financial key ratios for SHO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 13.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

Price History

Sunstone Hotel Investors reported on Thursday that they had received a dividend increase of $0.13 per share. This announcement was reflected in the stock market, as the stock opened at $9.9 and closed at $10.1, a 2.8% increase from the prior closing price of $9.8. This dividend increase is a positive sign for shareholders of Sunstone Hotel Investors, as it indicates a strong financial position and a commitment to returning profits to investors. This news is likely to be well-received by investors, who have seen their stock appreciate since the beginning of the year. Live Quote…

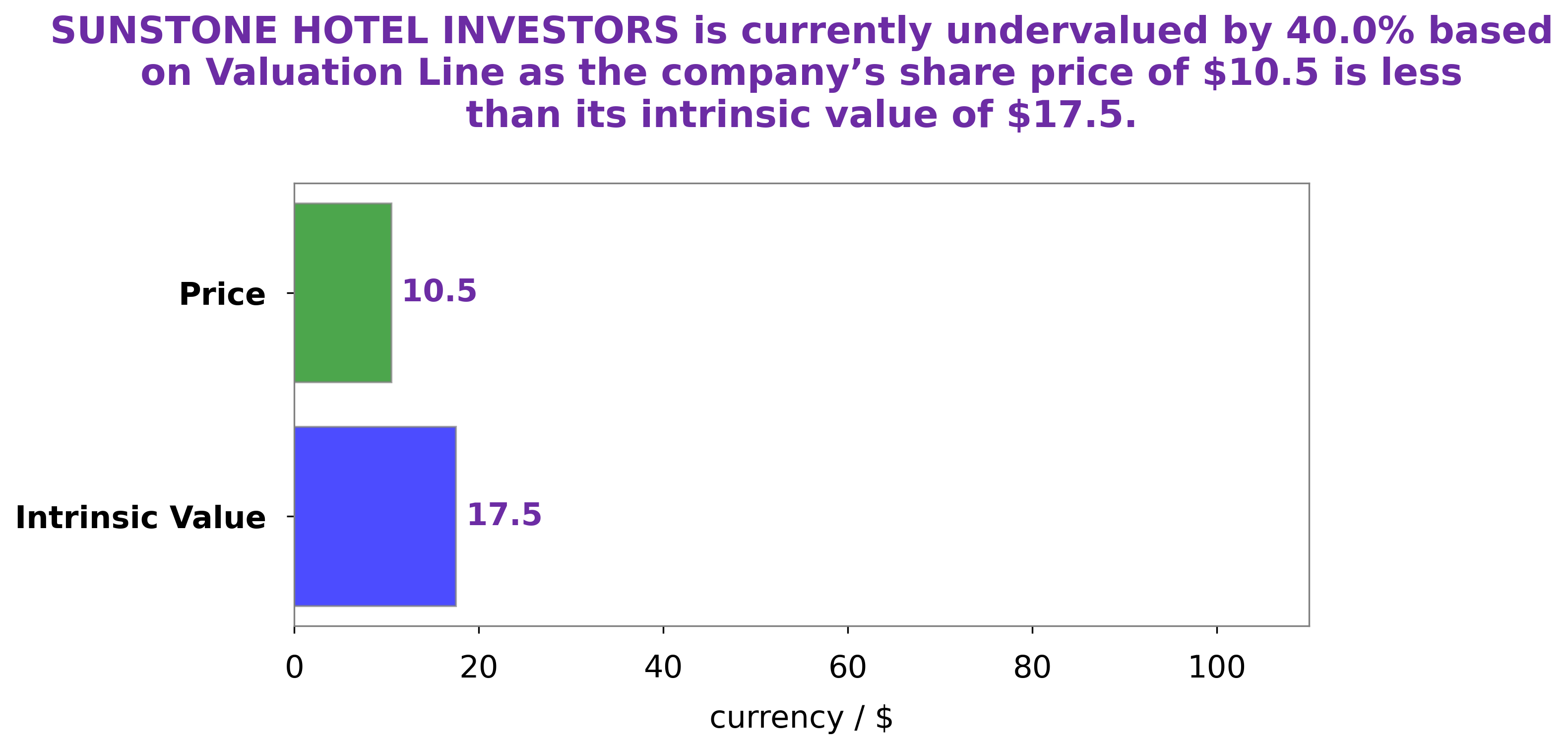

Analysis – SHO Intrinsic Stock Value

At GoodWhale, we have conducted a comprehensive analysis of SUNSTONE HOTEL INVESTORS fundamentals. After crunching the numbers, we have determined that the fair value of SUNSTONE HOTEL INVESTORS’ share is around $11.3. This has been calculated using our proprietary Valuation Line. This could be a great opportunity for investors to pick up some extra value on their investments. We believe that there is potential for the market to recognize and capitalize on this value in the near future. More…

Peers

In the hotel industry, Sunstone Hotel Investors Inc is in competition with Summit Hotel Properties Inc, Apple Hospitality REIT Inc, and Service Properties Trust. These companies are all competing for market share in the hotel industry. Its competitors are also well-known and have a strong presence in the market.

– Summit Hotel Properties Inc ($NYSE:INN)

Summit Hotel Properties, Inc. is a real estate investment trust. The Company focuses on owning premium-branded select-service and extended-stay hotels in the U.S. REITs are company’s that own, and in some cases, operate income-producing real estate.

– Apple Hospitality REIT Inc ($NYSE:APLE)

The company’s market cap is 3.66B as of 2022. The company focuses on providing hospitality real estate investment trusts (REITs) in the United States. It operates through two segments, Hotel Operations and Development. The Hotel Operations segment acquires, owns, leases, operates, and disposes of Marriott branded hotels. The Development segment is involved in developing Marriott branded hotels. As of December 31, 2020, the company owned 269 properties with 74,761 rooms.

– Service Properties Trust ($NASDAQ:SVC)

Service Properties Trust is a real estate investment trust that owns, operates, and develops hotels and resorts. The company has a market cap of $1.24 billion as of 2022. Service Properties Trust is headquartered in Boston, Massachusetts.

Summary

Sunstone Hotel Investors, Inc. recently announced a quarterly dividend of $0.07 per share and an additional $0.06 per share to its shareholders. This is a great opportunity for investors to increase their returns on Sunstone Hotel investments. This is an attractive yield for those looking to invest in the long-term.

Recent Posts