Shikibo Ltd dividend yield – Shikibo Ltd Declares 50.0 Cash Dividend

March 4, 2023

Dividends Yield

Shikibo Ltd dividend yield – Shikibo Ltd ($TSE:3109) has declared a 50.0 JPY cash dividend on March 2 2023, marking the first increase in dividend in three years. The company has been providing dividend of 40.0 JPY per share until this date. These dividends have resulted in yields of 4.3%, 4.3%, and 3.91% in 2021, 2022, and 2023 respectively, resulting in an average dividend yield of 4.17%.

This is a great opportunity for investors to add this stock to their portfolio. The annual dividend yield will give investors a higher return and it also hints that the company is doing well. With the ex-dividend date being March 30 2023, it is worth considering SHIKIBO LTD for a long-term investment strategy.

Share Price

It is the company’s first quarterly dividend in thirty-five years that will be paid out in the month of August. The announcement moved the stock price of SHIKIBO LTD, with the stock opening at JP¥1068.0 and closing at JP¥1053.0, a decline of 1.4% from its prior closing price. This move generated some optimism among investors as the dividend will cushion their portfolio against any unexpected market movements. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shikibo Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 37.44k | 1.33k | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shikibo Ltd. More…

| Operations | Investing | Financing |

| 2.05k | -654 | -3.79k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shikibo Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 83.14k | 50.13k | 2.81k |

Key Ratios Snapshot

Some of the financial key ratios for Shikibo Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.5% | -19.9% | 2.8% |

| FCF Margin | ROE | ROA |

| 3.5% | 2.0% | 0.8% |

Analysis

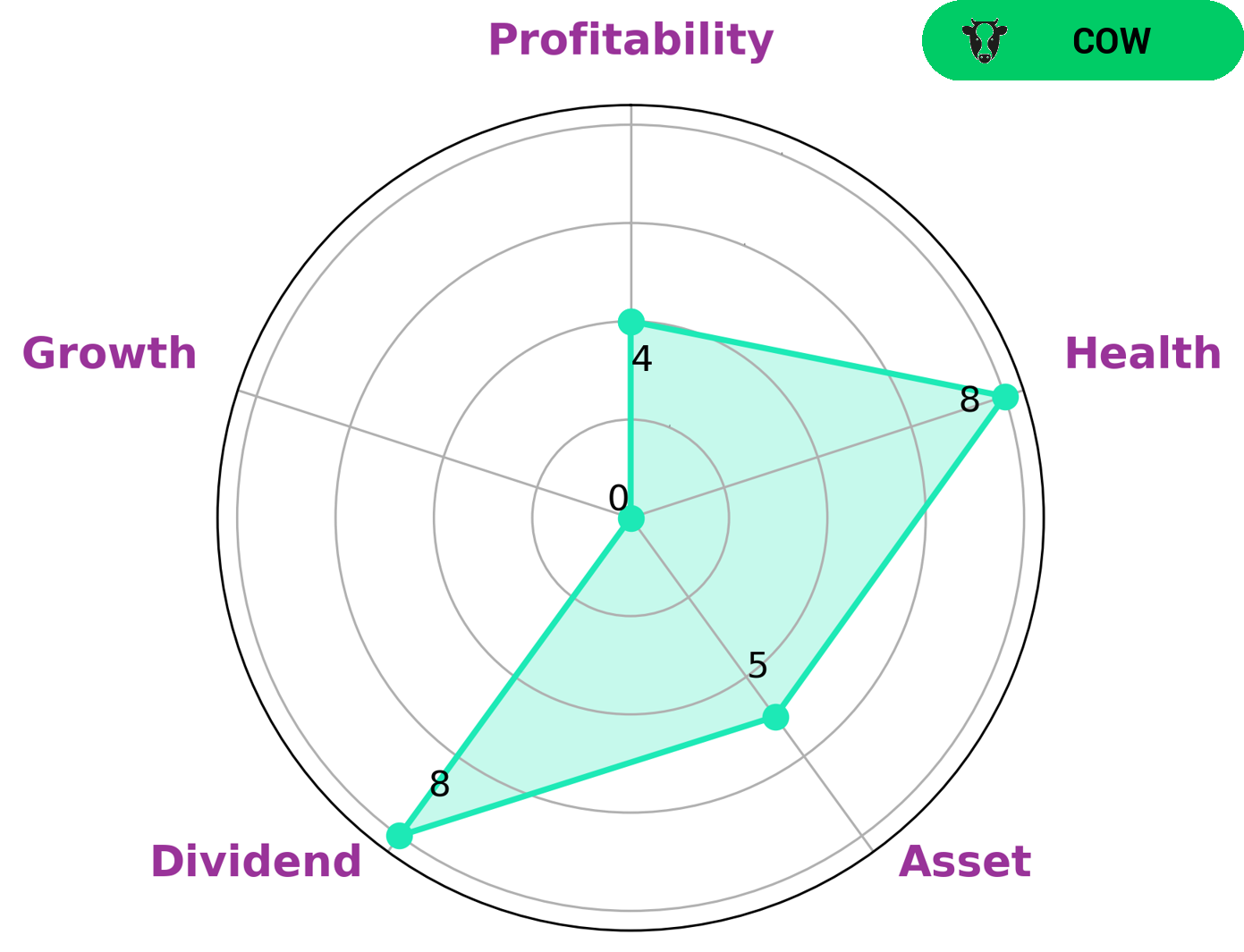

At GoodWhale, we have conducted an analysis of SHIKIBO LTD‘s finances and presented the results on our Star Chart. The results show that the company is strong in dividend, medium in asset, profitability and weak in growth. Based on this analysis, we classify SHIKIBO LTD as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are seeking safety, stability and income may be interested in such a company. With regard to safety, the company has a high health score of 8/10 considering its cashflows and debt, which indicates that it is capable to safely ride out any crisis without the risk of bankruptcy. Therefore, SHIKIBO LTD can be an attractive option for income-seeking investors who are looking for a stable, low-risk and high-reward investment. More…

Peers

The competition between Shikibo Ltd and its competitors, Hyosung Advanced Materials Co Ltd, Zhejiang Taihua New Material Co Ltd, and Yagi & Co Ltd, is fierce and intense. All companies strive to provide the highest quality materials and services to customers, making it a challenge for each to stay ahead of the other. This competition is a testament to the strength and resilience of the industry and its participants.

– Hyosung Advanced Materials Co Ltd ($KOSE:298050)

Hyosung Advanced Materials Co. Ltd is a South Korean chemical and textile products manufacturer founded in 1957. The company specializes in the production of nylon, polyester, spandex and other synthetic fibers for use in the production of textiles, carpets and industrial products. As of 2023, the company has a market cap of 1.97T and a Return on Equity (ROE) of 47.12%, showing the company is performing well financially. The high ROE indicates that the company is able to generate higher returns on its equity investments than its competitors, making it a desirable investment for many investors.

– Zhejiang Taihua New Material Co Ltd ($SHSE:603055)

Zhejiang Taihua New Material Co Ltd is a Chinese company that specializes in the production of polyester and polyamide fibers. As of 2023, the company has a market cap of 10.63B and a Return on Equity (ROE) of 7.71%. The market cap of a company is the total dollar value of all its outstanding shares, which shows how much investors are willing to pay for the stock. A high market cap is indicative of a strong and successful company. Additionally, ROE measures how efficiently a company can generate returns from its shareholders’ investments, so a high ROE indicates that the company is skillfully managing its resources to generate profits.

– Yagi & Co Ltd ($TSE:7460)

Yagi & Co Ltd is a Japanese based company that focuses on providing the best products and services to its customers. It has a market cap of 10.27B as of 2023, which shows that the company is doing well in the market and is well-positioned to sustain growth for the long-term. Additionally, Yagi & Co Ltd has a Return on Equity of 1.4%, which indicates that the company is utilizing its resources efficiently and is capable of generating returns on its investments.

Summary

Investing in SHIKIBO LTD could be a smart decision for investors seeking a regular income. The company has consistently issued a dividend of 40.0 JPY per share over the past three years and its dividend yields have remained steady. With an average dividend yield of 4.17%, this is a relatively attractive return by current market standards. Furthermore, with their track record of consistent payouts and reliable yields, SHIKIBO LTD could be poised to see continued growth in the future.

Recent Posts