Scholastic Corporation stock dividend – Scholastic Corp Declares 0.2 Cash Dividend

April 6, 2023

Dividends Yield

Scholastic ($NASDAQ:SCHL) Corp declared a 0.2 cash dividend on April 1, 2023. For the past three years, the dividend per share has been issued at 0.75 USD, 0.6 USD, and 0.6 USD respectively. The dividend yields from 2021 to 2023 have been estimated at 1.77%, 1.76%, and 2.46% respectively, with an average dividend yield of 2.0%. The ex-dividend date has been set for April 27, 2023 and the dividend will be payable to shareholders of record prior to that date.

It is a signal that the company is in a strong financial position and is in a good position to reward its shareholders with more returns. This cash dividend will be a great addition to the shareholders’ portfolio, helping to give them more security and stability. This is an encouraging sign for shareholders and investors alike, as it shows that the company is doing well and is well positioned to provide returns in the future.

Stock Price

On Monday, SCHOLASTIC CORPORATION declared a 0.2 cash dividend, which was well received by investors. As a result, the company’s stock opened at $34.3 and closed at $35.0, representing a 2.3% increase from its last closing price of 34.2. This dividend announcement was a welcome sign for investors, as the company is one of the largest publishers and distributors of children’s books in the world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Scholastic Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.69k | 62.7 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Scholastic Corporation. More…

| Operations | Investing | Financing |

| 105.7 | -43.2 | -229.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Scholastic Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.03k | 815.9 | 35.77 |

Key Ratios Snapshot

Some of the financial key ratios for Scholastic Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.3% | 24.9% | 4.4% |

| FCF Margin | ROE | ROA |

| 3.5% | 3.9% | 2.3% |

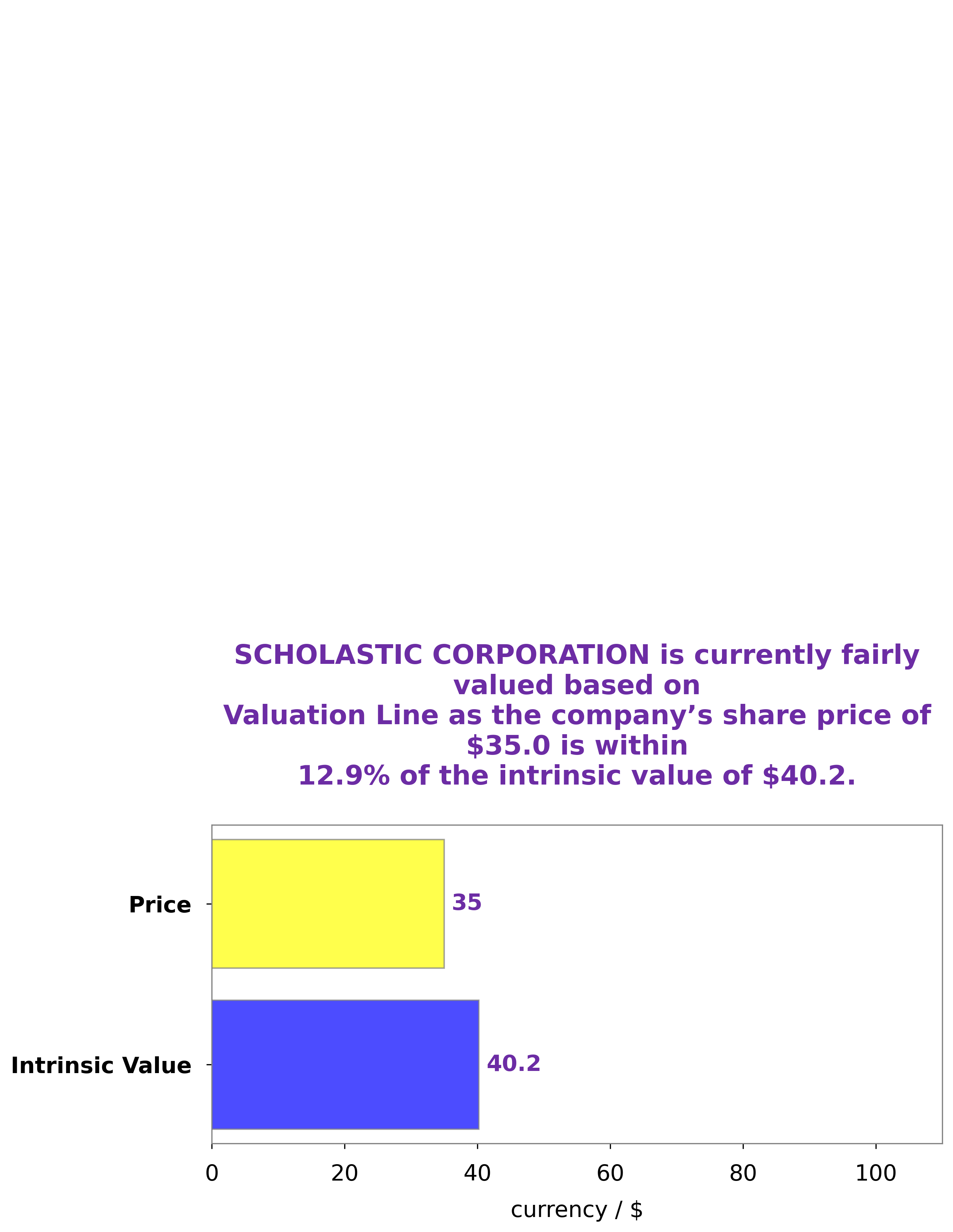

Analysis – Scholastic Corporation Intrinsic Value

At GoodWhale, we recently performed an analysis of SCHOLASTIC CORPORATION‘s wellbeing. After our thorough examination, we have determined that the fair value of SCHOLASTIC CORPORATION share is around $40.2, calculated by our proprietary Valuation Line. Currently, SCHOLASTIC CORPORATION stock is traded at $35.0, meaning it is undervalued by 13.0%. Our findings suggest that now may be a good time for investors to consider investing in the company, as the stock is discounted from its fair price. More…

Peers

The company was founded in 1920 and is headquartered in New York City. Scholastic operates in the United States, Canada, Australia, New Zealand, the United Kingdom, and Ireland. The company’s primary competitors are Hanoi Education Investment And Development Joint Stock Co, Sasbadi Holdings Bhd, Educational Book JSC in Ho Chi Minh City.

– Hanoi Education Investment And Development Joint Stock Co ($HNX:EID)

Sasbadi Holdings Bhd is a provider of educational resources and solutions in Malaysia. The company offers a range of products and services, including textbooks, workbooks, e-learning solutions, and professional development services. Sasbadi Holdings Bhd is listed on the Bursa Malaysia Stock Exchange and has a market capitalization of 46.7 million as of 2021. The company has a Return on Equity of -5.29%.

Summary

Investing in SCHOLASTIC CORPORATION can be a wise choice due to their consistent dividend payments over the last three years. The dividends per share have been 0.75 USD, 0.6 USD, and 0.6 USD for 2021, 2022, and 2023, respectively. The corresponding dividend yields for each year were 1.77%, 1.76%, and 2.46%, with a three-year average yield of 2.0%. This makes SCHOLASTIC CORPORATION an attractive option for income-seeking investors who are looking for steady returns.

Recent Posts