Schneider National dividend calculator – Schneider National, to Pay Out $0.09 Dividend on October 10th

July 22, 2023

🌧️Trending News

Schneider National ($NYSE:SNDR), Inc. is a leading transportation and logistics services provider in North America, offering a wide range of truckload and logistics solutions such as intermodal, dedicated trucking services, and supply chain services. The company is publicly traded on the New York Stock Exchange (NYSE) under the ticker symbol SNDR. The company has managed to remain profitable through these challenging times and this dividend payout is a testament to their financial strength and resilience. For investors looking for steady income with limited risk, the stock is an attractive option given its consistent dividend payments and strong financials.

Dividends – Schneider National dividend calculator

This marks the third consecutive year the company has issued an annual dividend per share; in 2021, the dividend was 0.33 USD per share, 0.32 USD per share in 2022 and 0.28 USD per share in 2023. The dividend yield for Schneider National, Inc. over the past three years has been 1.37%, 1.36% and 1.23%. This results in an average dividend yield of 1.32%. Investors looking for an attractive dividend yield may want to consider investing in Schneider National, Inc.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Schneider National. More…

| Total Revenues | Net Income | Net Margin |

| 6.41k | 463.7 | 7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Schneider National. More…

| Operations | Investing | Financing |

| 903.9 | -720.9 | -65.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Schneider National. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.47k | 1.55k | 15.94 |

Key Ratios Snapshot

Some of the financial key ratios for Schneider National are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.1% | 23.4% | 9.7% |

| FCF Margin | ROE | ROA |

| 2.9% | 13.7% | 8.7% |

Market Price

Schneider National, Inc., a premier provider of transportation, logistics, and supply chain management services, recently announced that the company will pay out a dividend of $0.09 per share on October 10th. On the same day of the announcement, SCHNEIDER NATIONAL’s stock opened at $29.8 and closed at $29.7, staying relatively unchanged on the news. This suggests that investors are taking a long-term view on the stock and are more focused on the company’s underlying fundamentals rather than being swayed by short-term news. Live Quote…

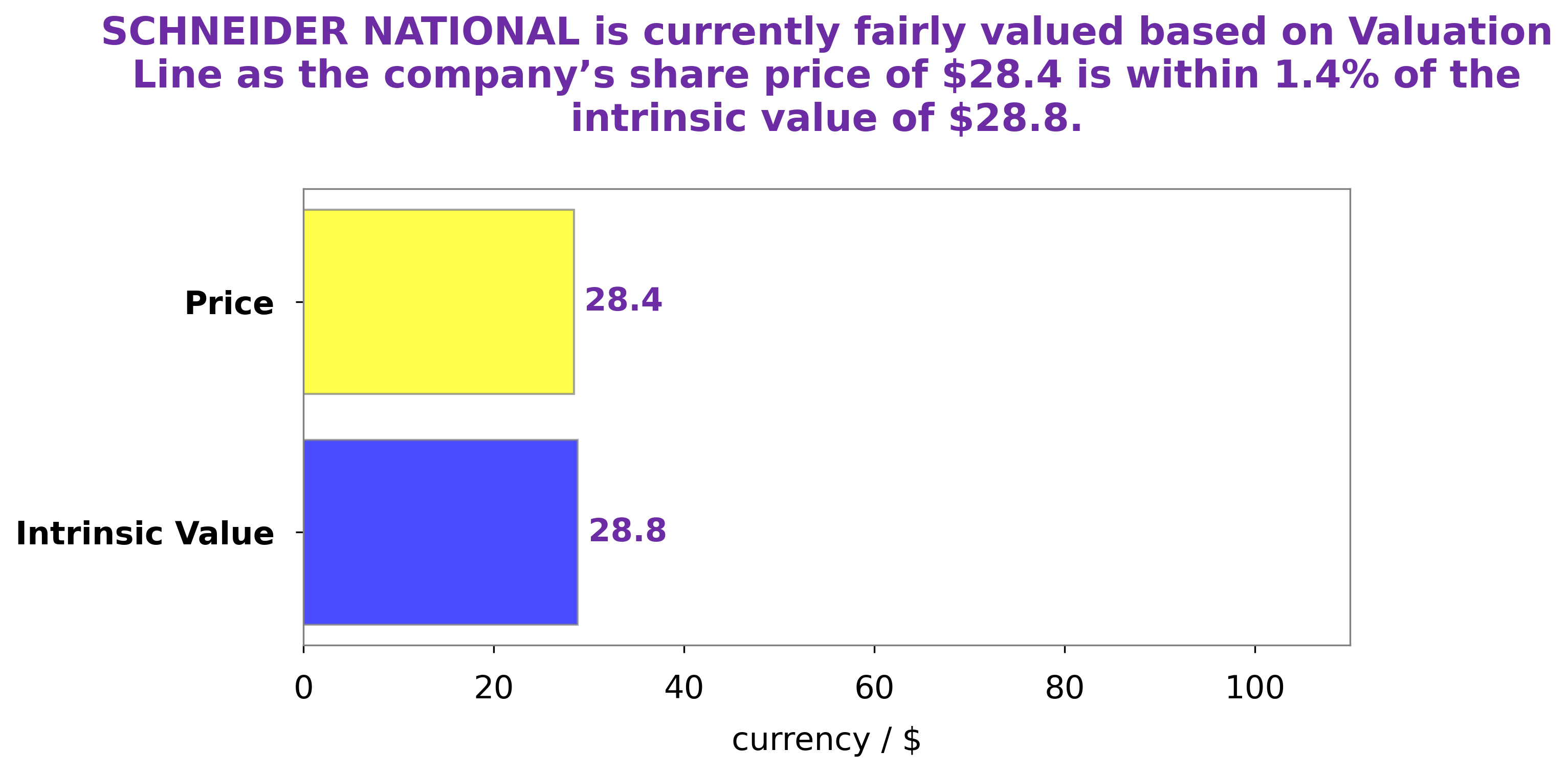

Analysis – Schneider National Intrinsic Value Calculator

At GoodWhale, we recently undertook an analysis of the fundamentals of Schneider National, a U.S based freight transport and logistics services provider. Through our proprietary Valuation Line, we determined that the intrinsic value of the Schneider National share was around $27.5. Currently, the company’s stock is trading at $29.7, implying that it is overvalued by 8.0%. Our analysis indicates that the company is in a good financial position with a solid balance sheet and a strong cash flow. We believe that, given the current market conditions, this stock is fairly priced and could be a good long-term investment. More…

Peers

It has a wide variety of competitors, including Xinjiang Tianshun Supply Chain Co Ltd, Shanghai Ace Investment & Development Co Ltd, and Deppon Logistics Co Ltd.

– Xinjiang Tianshun Supply Chain Co Ltd ($SZSE:002800)

Xinjiang Tianshun Supply Chain Co Ltd is a company that operates in the supply chain industry. The company has a market cap of 2.48B as of 2022 and a return on equity of 8.22%. The company has a strong market position and is a well-known player in the industry. The company’s main business is the provision of supply chain services to businesses. The company has a diversified client base and a strong track record. The company is headquartered in Xinjiang, China.

– Shanghai Ace Investment & Development Co Ltd ($SHSE:603329)

Shanghai Ace Investment & Development Co Ltd is a 3B market cap company with an ROE of 18.67%. The company is involved in the development and management of real estate projects.

– Deppon Logistics Co Ltd ($SHSE:603056)

Deppon Logistics Co Ltd is a leading Chinese logistics company with a market cap of 18.11B as of 2022. The company provides comprehensive logistics services to businesses and individuals in China, including transportation, warehousing, distribution, and e-commerce logistics. The company has a strong focus on customer service and has a reputation for providing high-quality, reliable logistics services. Deppon Logistics Co Ltd has a return on equity of 4.31%. The company is well-positioned to continue its growth in the Chinese logistics market.

Summary

Schneider National, Inc. is an attractive stock for investors due to its strong financial performance and stable dividend payments. The company is a leading provider of transportation and logistics services in North America, and has steadily grown its revenue, operating income, and net income in recent years. In addition, the company recently announced a dividend of $0.09 per share on October 10th, which is another positive signal of the company’s future financial outlook. Overall, Schneider National Inc. is a strong stock for long-term investors, and short-term investors may also benefit from its consistent dividend payments.

Recent Posts