SCC stock dividend – Semirara Mining and Power Corp Declares 1.8 Cash Dividend

April 5, 2023

Dividends Yield

On April 1 2023, Semirara ($PSE:SCC) Mining and Power Corp (SEMIRARA) declared a 1.8 PHP cash dividend to investors. This makes SEMIRARA an attractive option for those looking to receive a dividend. The company has consistently paid out dividends over the past three years at a rate of 1.5 PHP in 2020 (yielding 5.34%), 1.25 PHP in 2021 (yielding 10.91%) and 1.25 PHP in 2022 (yielding 7.49%). This brings their average dividend yield over the last three years to 7.91%.

The ex-dividend date for this latest dividend payment is April 5 2023. Overall, SEMIRARA is a reliable and consistent dividend payer, making it an ideal investment for those looking for a steady stream of income. For investors who want to benefit from long-term growth as well as from dividends, SEMIRARA is an excellent investment to consider.

Stock Price

On Monday, Semirara Mining and Power Corp (SEMIRARA) opened its stock at PHP32.7 and closed at PHP32.6, representing a 0.8% increase from its prior closing of PHP32.4. This news follows the declaration of a 1.8 cash dividend per share, payable to all shareholders of record on June 8, 2021. The 1.8 cash dividend per share declared by SEMIRARA is an indication of the company’s financial strength and commitment to returning value to its investors. It also shows the confidence that the company has in its ability to generate sufficient profits to pay for its dividend obligations.

It operates a coal mine on Semirara Island and several power plants supplying electricity to customers throughout the country. The company is publicly listed on the Philippine Stock Exchange and is majority owned by DMCI Holdings Inc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SCC. More…

| Total Revenues | Net Income | Net Margin |

| 87.56k | 41.86k | 47.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SCC. More…

| Operations | Investing | Financing |

| 42.43k | -3.67k | -17.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SCC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 99.85k | 24.66k | 17.69 |

Key Ratios Snapshot

Some of the financial key ratios for SCC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.6% | 53.5% | 50.1% |

| FCF Margin | ROE | ROA |

| 44.0% | 39.1% | 27.5% |

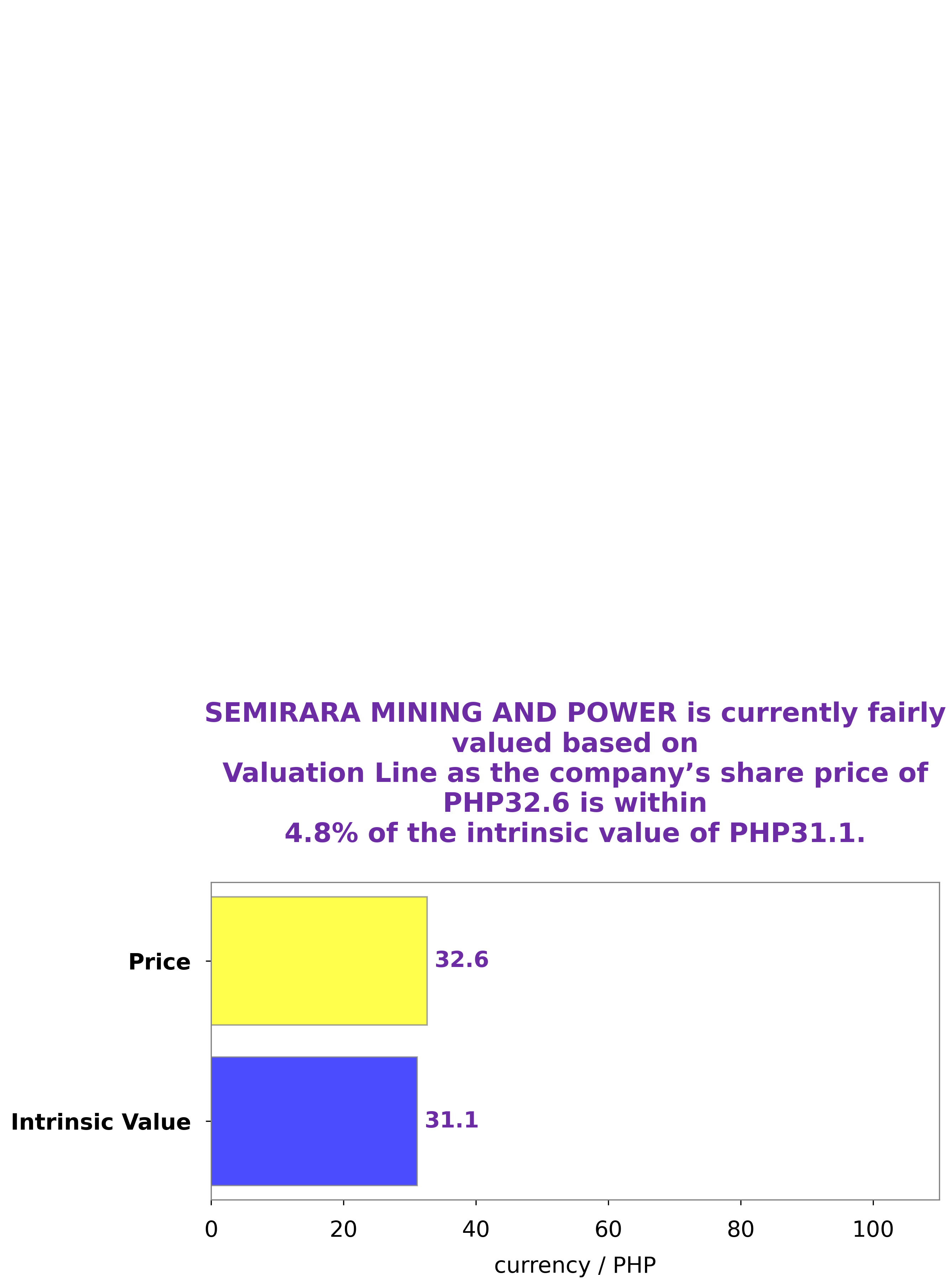

Analysis – SCC Intrinsic Value Calculator

At GoodWhale, we recently conducted a financial analysis of SEMIRARA MINING AND POWER, and have determined that the intrinsic value of their share is around PHP31.1. This figure was calculated using our proprietary Valuation Line, which takes into account multiple factors such as financial performance, dividend yields and cash flows. We believe that there is an opportunity for investors to purchase SEMIRARA MINING AND POWER stock at the current rate and potentially earn a return on their investment. More…

Peers

It is one of the largest coal producers in the country, competing with major international companies such as China Coal Energy Co Ltd, Pingdingshan Tianan Coal Mining Co Ltd, and Geo Energy Resources Ltd. Through its integrated operations and production of electricity, the company has become a significant contributor to the Philippine economy.

– China Coal Energy Co Ltd ($SHSE:601898)

China Coal Energy Co Ltd is a Chinese energy and chemical company that specializes in coal production and sales, as well as chemical production and sales. As of 2023, the company has a market cap of 94.55 billion, making it one of the largest energy companies in China. Additionally, the company boasts a high Return on Equity, with a rate of 17.52%, indicating the effectiveness of their investments. China Coal Energy Co Ltd has been able to become one of the leading companies in its sector due to its strong financial performance.

– Pingdingshan Tianan Coal Mining Co Ltd ($SHSE:601666)

Pingdingshan Tianan Coal Mining Co Ltd is a large coal mining company based in China with a market cap of 24.08B as of 2023. The company has been successful in its operations, reporting a Return on Equity (ROE) of 29.97%. This ROE indicates the company’s ability to generate profits from the money invested by shareholders. Pingdingshan Tianan Coal Mining Co Ltd engages in the production of coal, coal bed methane, and other related products. The company also provides power generation and sales services. The company operates in four segments: Coal Mining, Coal Chemistry, Power Generation, and Others.

– Geo Energy Resources Ltd ($SGX:RE4)

Geo Energy Resources Ltd is a coal mining and trading company. It has grown significantly since its founding in 2003 and, as of 2023, has a market cap of 478.72M. This indicates that the company is doing well and is supporting a strong base of shareholders. Additionally, the company’s Return on Equity (ROE) of 51.27% is impressive, indicating that Geo Energy is efficient in utilizing its capital to generate profit.

Summary

Semirara Mining and Power is an attractive option for investors looking to make dividend income. Over the last three years, it has maintained an average dividend yield of 7.91%, making it one of the highest yielding stocks in the Philippine Stock Exchange. In 2020, it issued 1.5 PHP in dividends yielding 5.34%, followed by 1.25 PHP in 2021 and 2022, both yielding 10.91% and 7.49% respectively. These high dividends make Semirara Mining and Power a good option for long-term investors looking to generate consistent income from their investments.

Recent Posts