Sanyo Trading stock dividend – Sanyo Trading Co Ltd Announces 21.0 Cash Dividend

March 24, 2023

Dividends Yield

On March 2 2023, Sanyo Trading ($TSE:3176) Co Ltd Announces 21.0 Cash Dividend. This marks the fourth consecutive year of dividend payment for the company. For the past three years, SANYO TRADING has issued an annual dividend per share of 40.0, 40.0 and 37.5 JPY. With the average dividend yield standing at 3.55%, the dividend yields for 2021-2023 are 3.54%, 3.54% and 3.57% respectively. This dividend payment could be of great interest to dividend investors in search of yield stocks, as SANYO TRADING is offering a consistently attractive dividend yield.

The ex-dividend date in this case is March 30 2023, so investors have to own the stock before this date to be eligible for the dividend. All in all, SANYO TRADING may be an interesting option for investors looking for a reliable and consistent dividend yield, as it has been paying out dividends for four consecutive years with no indications of stopping anytime soon. Investors are advised to do their own due diligence before investing in the stock.

Stock Price

The stock opened at JP¥1165.0 and closed at JP¥1168.0, which was an increase of 0.4% from the previous closing price of JP¥1163.0. This news was welcomed by investors, who have been eagerly awaiting the dividend announcement. It is expected that this dividend payment will further increase investor confidence in SANYO TRADING Co Ltd. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sanyo Trading. More…

| Total Revenues | Net Income | Net Margin |

| 118.04k | 4.39k | 3.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sanyo Trading. More…

| Operations | Investing | Financing |

| -3.4k | -1.81k | 1.86k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sanyo Trading. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 68.75k | 29.22k | 1.36k |

Key Ratios Snapshot

Some of the financial key ratios for Sanyo Trading are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.0% | 0.4% | 5.7% |

| FCF Margin | ROE | ROA |

| -3.1% | 10.8% | 6.1% |

Analysis

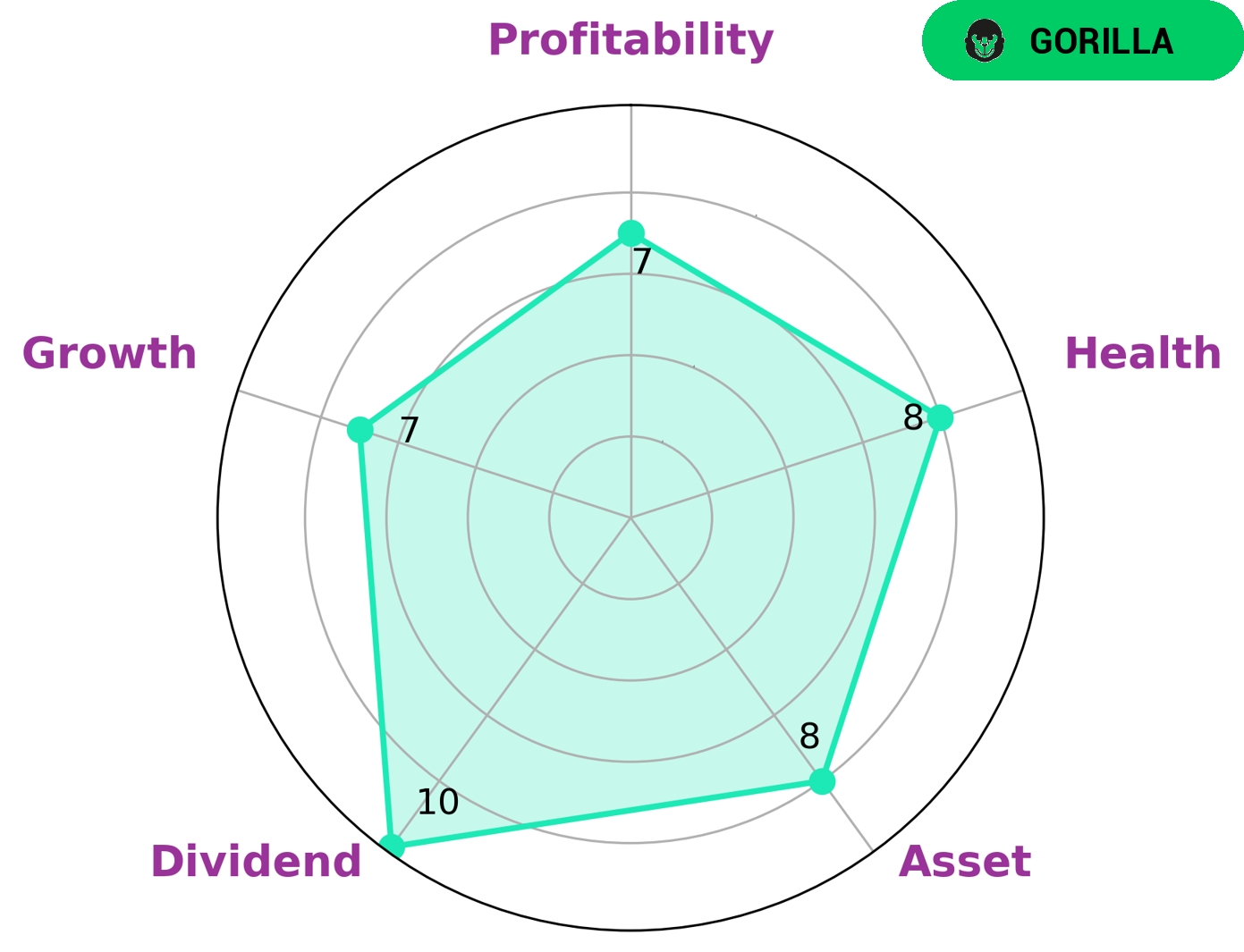

As part of our analysis of SANYO TRADING, GoodWhale has presented a Star Chart evaluation of the company’s financials. The Star Chart shows that SANYO TRADING has strong assets, dividend, growth, and profitability. Based on this, we classify SANYO TRADING as a ‘gorilla’ – a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are interested in finding companies that are on a growth trajectory, and that have a competitive advantage over their competitors would be interested in investing in SANYO TRADING. The company also has a high health score of 8/10 with regard to its cash flows and debt, meaning that it is capable of sustaining future operations in times of crisis. More…

Peers

The competition between Sanyo Trading Co Ltd and its competitors Ben Thanh Trading & Service JSC, Samyung Trading Co Ltd, Intraco Ltd is fierce, as each strives to gain a competitive advantage in the marketplace. All companies are looking for ways to stand out from the competition, from new products and services to effective marketing strategies. The competition between these companies keeps prices low and encourages innovation, ultimately benefitting the consumer.

– Ben Thanh Trading & Service JSC ($HOSE:BTT)

Samyung Trading Co Ltd is a South Korean company that specializes in trading goods such as chemicals, machinery, and electronics. As of 2023, the company has a market cap of 228.11B and a Return on Equity of 7.74%. The company’s market cap is a reflection of its strong financial performance and continued growth as a leading trading company in the Korean market. The Return on Equity reflects the company’s ability to generate profits from its shareholders’ investments. This is a positive indicator of the company’s profitability and strength in the market.

– Samyung Trading Co Ltd ($KOSE:002810)

Intraco Ltd is an international company that specializes in engineering, procurement, construction and project management services. With a market cap of $29.3 million as of 2023, the company has a moderate size. However, its Return on Equity (ROE) of -1.63% is not particularly impressive, which suggests that the company has not been making effective use of its assets and shareholder funds.

Summary

SANYO TRADING is a potential investment opportunity for those looking to receive consistent dividends. Over the past three years, the company has issued an annual dividend per share of 40.0, 40.0 and 37.5 JPY, respectively. This translates to an average dividend yield of 3.55%.

For 2021-2023, the estimated dividend yields are 3.54%, 3.54% and 3.57%, respectively. Those interested in investing in SANYO TRADING should do due diligence and research further to determine if it is the right fit for their portfolio.

Recent Posts