San Shing Fastech dividend yield calculator – San Shing Fastech Corp Declares 3.0 Cash Dividend

March 14, 2023

Dividends Yield

On March 11 2023, San Shing Fastech ($TWSE:5007) Corp declared its 3.0 cash dividend for the upcoming year. This marks a continuation of the company’s steady dividend policy. The ex-dividend date for the next dividend payment is set for March 28 2023. Investors looking for an income through dividends should consider SAN SHING FASTECH. Over the last three years, the company has consistently issued a 3.0 TWD annual dividend per share, resulting in a dividend yield of 5.21% each year.

This average dividend yield between 2020 and 2022 is thus 5.21%. SAN SHING FASTECH is a reliable investment for those seeking to generate a steady income through dividends, with a history of consistent dividend payments and yields over the last three years. The company’s 3.0 cash dividend provides a stable and attractive investment option for dividend seeking investors.

Market Price

The stock opened at NT$52.0 and closed at NT$52.7, showing a 0.6% increase from the previous closing price of NT$52.4. This news was welcomed by the investors, as it indicates the company’s commitment to increase shareholder return. The dividend announcement was another indication of its strong financial performance and firm commitment towards investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for San Shing Fastech. More…

| Total Revenues | Net Income | Net Margin |

| 7.17k | 1.06k | 14.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for San Shing Fastech. More…

| Operations | Investing | Financing |

| 1.52k | -74.34 | -891.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for San Shing Fastech. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.58k | 1.48k | 22.41 |

Key Ratios Snapshot

Some of the financial key ratios for San Shing Fastech are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.0% | 8.4% | 19.2% |

| FCF Margin | ROE | ROA |

| 19.5% | 12.8% | 10.0% |

Analysis

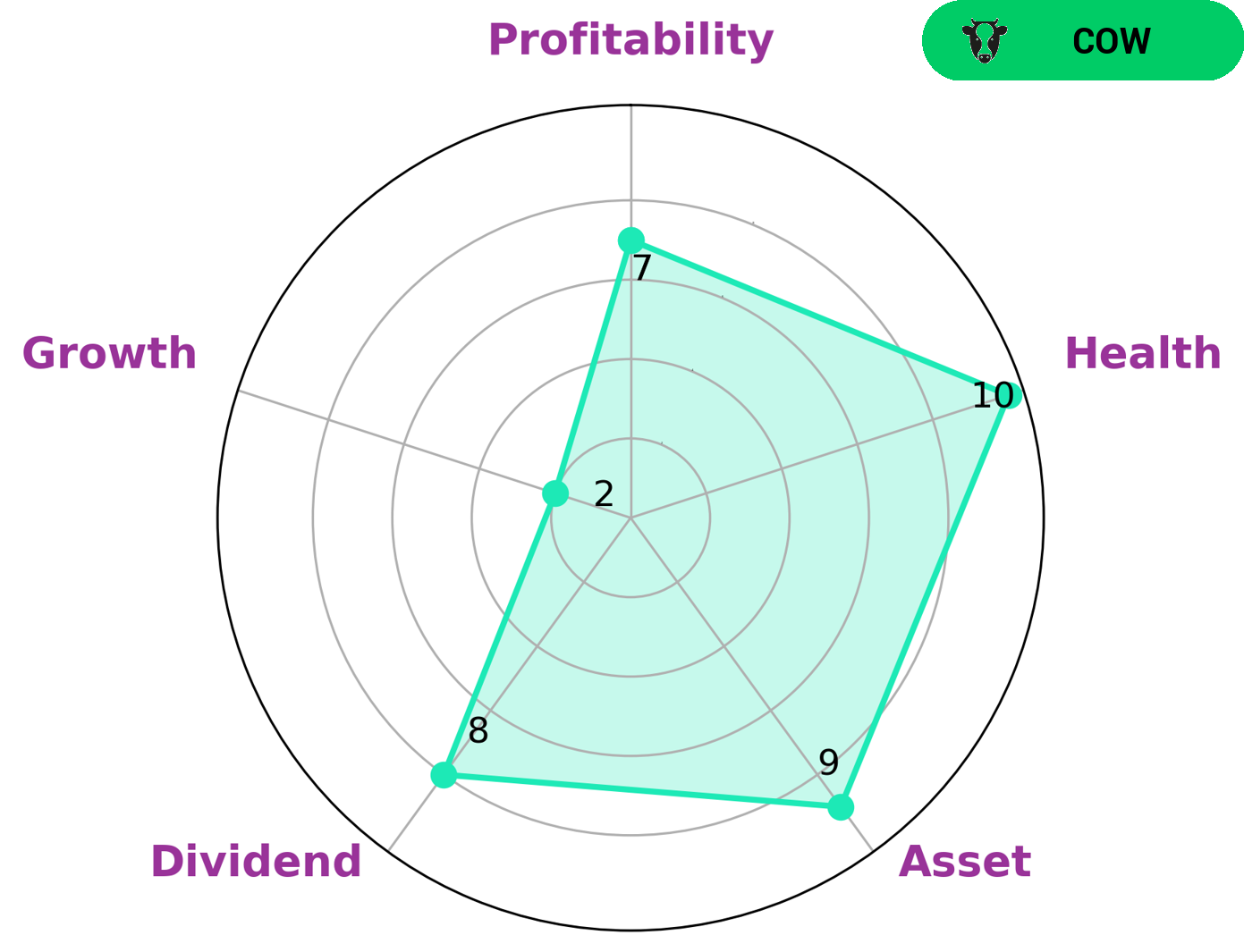

As GoodWhale, after conducting an analysis of SAN SHING FASTECH’s fundamentals, we have classified the company as a ‘cow’, a type of company that pays consistent and sustainable dividends. This type of company is attractive to income investors who are looking for reliable and consistent dividend payments. SAN SHING FASTECH exhibits strong fundamentals in asset, dividend, and profitability and weaker growth. Despite this, the company has a high health score of 10/10 considering its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. This makes SAN SHING FASTECH an attractive option for conservative investors who are looking for a stable and reliable income stream. More…

Peers

San Shing Fastech Corp is one of the leading global manufacturers in the industrial products industry, competing with other renowned firms such as OFCO Industrial Corp, Nichia Steel Works Ltd, and Sheh Kai Precision Co Ltd. With its innovative designs, cutting-edge technologies, and exceptional customer service, San Shing Fastech Corp strives to be the leader in its field.

– OFCO Industrial Corp ($TPEX:5011)

OFCO Industrial Corp is a global industrial supply company that provides products and services for use in a variety of industries. The company’s market cap as of 2023 is 2.54B and its Return on Equity is 10.36%. This signifies the company’s strong financials and robust growth in its stock price as investors continue to value the company highly. The company’s focus on providing quality products and services has also enabled them to remain competitive in their respective markets.

– Nichia Steel Works Ltd ($TSE:5658)

Nikia Steel Works Ltd is a leading steel manufacturer based in Japan, with a long history of producing quality steel for customers around the world. As of 2023, the company has a market capitalization of 14.33B, indicating its significant presence in the global steel market. The company also has a Return on Equity (ROE) of 3.1%, which is an indicator of the company’s financial health and profitability. This suggests that Nikia Steel Works Ltd is a strong and prosperous business that has successfully been able to generate returns for its investors.

– Sheh Kai Precision Co Ltd ($TPEX:2063)

Sheh Kai Precision Co Ltd is a Taiwan-based manufacturer and distributor of computer, communication and consumer electronic products. As of 2023, it has a market cap of 2.26B and a Return on Equity (ROE) of 18.72%. This indicates that Sheh Kai Precision Co Ltd is performing well in terms of generating profit for its shareholders. Its market capitalization reflects the company’s value in terms of its stock price multiplied by its total outstanding shares, while its Return on Equity suggests that the company is creating value for shareholders by efficiently utilizing its resources.

Summary

SAN SHING FASTECH is an excellent choice for investors looking for income through dividends. Over the last three years, it has issued an average annual dividend per share of 3.0 TWD, resulting in a yield of 5.21%. This makes it an attractive choice for investors seeking steady income. Its strong financial performance and conservative dividend payout policy make it a sound long-term investment.

The board of directors has maintained its commitment to the dividend policy and this is likely to continue into the future. Investors should do their own research and take into consideration the risk and reward of investing in SAN SHING FASTECH before taking a decision.

Recent Posts