S Line dividend yield calculator – S Line Co Ltd Declares 14.0 Cash Dividend

March 19, 2023

Dividends Yield

On March 1 2023, S Line ($TSE:9078) Co Ltd announced that they will be declaring a 14.0 Cash Dividend, which is slightly lower than the annual dividend per share of 22 JPY that they have been distributing for the past three years. Despite this slight decline in dividend, the company’s yields in 2021 to 2023 have been 2.44%, 2.38% and 2.21% respectively, giving an average dividend yield of 2.34%. This makes S LINE a worthwhile option if you are looking for a dividend stock, with its ex-dividend date set to March 30 2023.

Market Price

On Wednesday, S LINE stock opened at JP¥846.0 and closed at JP¥838.0, down by 0.2% from the previous closing price of 840.0. This is the first dividend to be declared by the company since it went public last year. Analysts are expecting the dividend to boost the company’s share price in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for S Line. More…

| Total Revenues | Net Income | Net Margin |

| 48.08k | 777 | 1.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for S Line. More…

| Operations | Investing | Financing |

| 2.38k | -3.63k | 788 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for S Line. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 41.28k | 15.34k | 2.36k |

Key Ratios Snapshot

Some of the financial key ratios for S Line are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.7% | 1.8% | 2.6% |

| FCF Margin | ROE | ROA |

| -1.1% | 3.0% | 1.9% |

Analysis

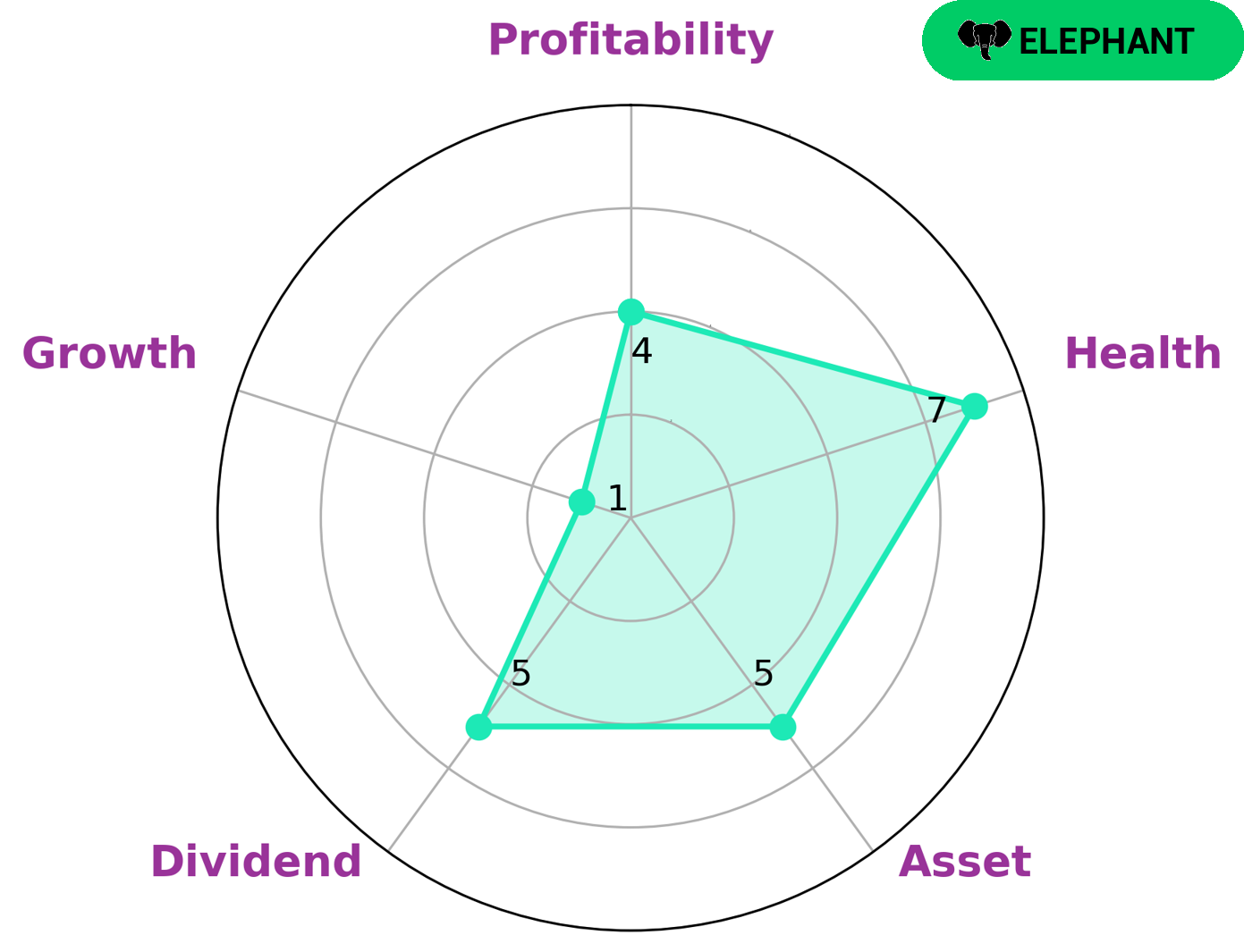

GoodWhale’s analysis of S LINE‘s financials reveals the company is strong in asset, dividend, and profitability, but weak in growth. We classify S LINE as an ‘elephant’ company – a company that is rich in assets after deducting off liabilities. The company’s star chart also shows a high health score of 7 out of 10 considering its cashflows and debt, indicating it is capable of safely riding out any crisis without the risk of bankruptcy. This type of company may be an attractive option for investors who are looking for a secure and stable investment. Additionally, S LINE’s assets and dividend payments are also likely to appeal to investors who are seeking a higher return without taking on excessive risk. However, prospective investors should bear in mind that S LINE’s growth prospects may be limited. More…

Peers

Competition amongst the leading freight transportation companies, S Line Co Ltd, Okayamaken Freight Transportation Co Ltd, Kanda Holdings Co Ltd, and Kyushu Railway Co, is fierce in the current market. Each company has their own strengths and strategies that they employ in order to gain an advantage over their rivals, resulting in intense competition and innovation in the industry.

– Okayamaken Freight Transportation Co Ltd ($TSE:9063)

Okamaken Freight Transportation Co Ltd is a transportation company that provides freight services in Japan. The company has a market cap of 5.57 billion dollars as of 2023, which is a significant increase from the previous year. Additionally, the company has a Return on Equity (ROE) of 6.55%. This indicates that the company is profitable and that it is returning a healthy amount of its investment back to shareholders.

– Kanda Holdings Co Ltd ($TSE:9059)

Kanda Holdings Co. Ltd is a Japanese holding company that specializes in the production and sale of various food products. With a market capitalization of 12.92 billion as of 2023, Kanda Holdings Co. Ltd is one of the largest food companies in Japan. Moreover, the company has achieved a return on equity (ROE) of 7.86%, which indicates that the company is generating profits efficiently and effectively. This attractive return on equity has made Kanda Holdings Co. Ltd an attractive option for investors looking to realize long-term capital gains.

– Kyushu Railway Co ($TSE:9142)

Kyushu Railway Co is one of the largest companies in Japan, with a market cap of 475.28 billion as of 2023. The company operates railways, buses, and other transportation services across Kyushu in Japan. Their Return on Equity measures the amount of profit returned to shareholders and is currently 4.53%. This shows that Kyushu Railway Co is a profitable company and is returning a satisfactory amount to its shareholders.

Summary

S LINE is a good investment option for those looking for steady returns. The company has been paying an annual dividend per share of 22 JPY for the past three years, with dividend yields of 2.44%, 2.38% and 2.21% in 2021 to 2023 respectively. This translates to an average dividend yield of 2.34%. With its stable dividend yields, investors can count on consistent returns when investing in S LINE.

Recent Posts