RS dividend calculator – Reliance Steel & Aluminum: Buy Now for Attractive Dividend Score Card!

June 21, 2023

☀️Trending News

Reliance Steel & Aluminum ($NYSE:RS) is an attractive stock for investors looking for generous dividends. The company is the largest metals service center in North America and prides itself in offering a comprehensive range of value-added products and services. This makes it a great option for investors looking for reliable income streams. Furthermore, its dividend payout ratio is relatively low, indicating that the company has ample cash reserves to finance the dividend payments.

Reliance Steel & Aluminum’s strong balance sheet and long history of consistent dividend payments make it a great buy for investors. The company’s many locations provide it with access to a wide variety of metals and metal-related products, ensuring a steady stream of revenue. The attractive dividend score card is a major plus, providing investors with an attractive yield and a reliable income stream.

Dividends – RS dividend calculator

Over the last three years, the company has consistently issued dividends per share of $3.62, $3.5, and $2.75 USD, representing a solid 1.76%, 1.88%, and 1.88% dividend yields in 2021, 2022, and 2023 respectively. The average dividend yield of these three years is 1.84%, providing investors with a steady stream of income. With a relatively low cost of entry and strong dividend returns, Reliance Steel & Aluminum is an excellent choice for those looking to diversify their portfolio with a reliable dividend stock.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RS. More…

| Total Revenues | Net Income | Net Margin |

| 16.5k | 1.7k | 9.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RS. More…

| Operations | Investing | Financing |

| 2.1k | -387.8 | -1.44k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.2k | 2.85k | 124.84 |

Key Ratios Snapshot

Some of the financial key ratios for RS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.9% | 35.4% | 14.5% |

| FCF Margin | ROE | ROA |

| 10.4% | 20.7% | 14.6% |

Share Price

Reliance Steel & Aluminum is a leading metals service center in the United States. On Wednesday, its stock opened at $230.6 and closed at $234.7, up by 1.1% from the last closing price of 232.1. This dividend is expected to drive the stock prices higher and should be seen as a great opportunity for investors to retain a heavy stake in this company. Live Quote…

Analysis

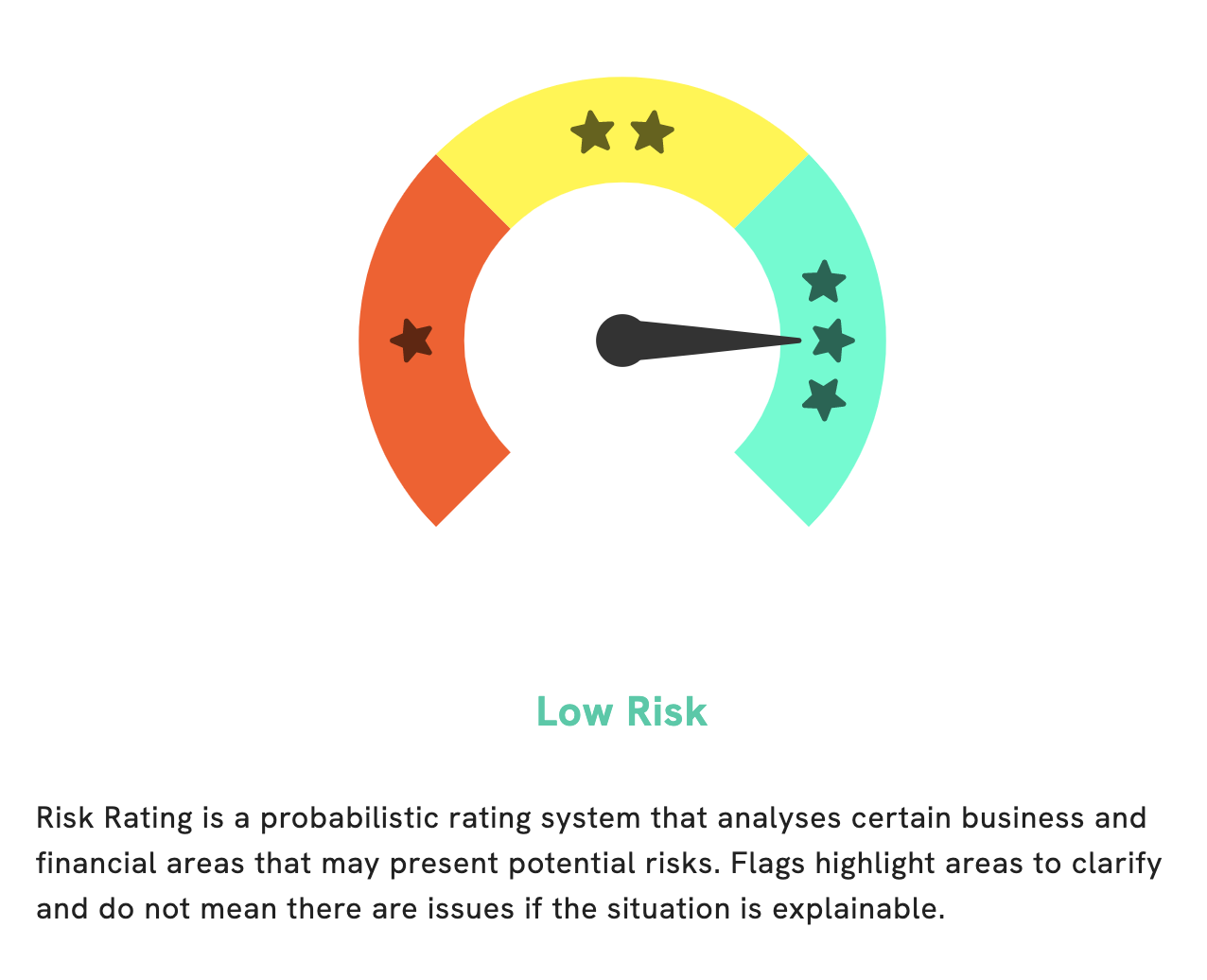

At GoodWhale, we specialize in providing comprehensive analysis of RELIANCE STEEL & ALUMINUM’s fundamentals. After careful review, we have determined that this company is a low risk investment overall. This conclusion is based on our Risk Rating, which takes into account both financial and business aspects of the company. For a more detailed assessment of the company’s potential risks, we encourage our users to become registered users. Doing so will give them access to our in-depth review of all areas with potential risks. This includes areas such as financial solvency, operational performance, competitive environment and legal issues. With this knowledge, our users can make informed decisions about whether or not an investment in RELIANCE STEEL & ALUMINUM is right for them. More…

Peers

Reliance Steel & Aluminum Co., Universal Stainless & Alloy Products Inc., Jiangsu Shagang Co Ltd, and Xinjiang Ba Yi Iron & Steel Co Ltd are all steel and aluminum companies. They all have their own unique offerings, but they compete with each other in the market.

– Universal Stainless & Alloy Products Inc ($NASDAQ:USAP)

Universal Stainless & Alloy Products Inc is a company that manufactures and sells stainless steel and nickel alloy mill products. The company has a market cap of 65.99M as of 2022 and a Return on Equity of -1.12%. Universal Stainless & Alloy Products Inc is a publicly traded company on the NASDAQ Stock Market under the ticker symbol “USAP”.

– Jiangsu Shagang Co Ltd ($SZSE:002075)

Jiangsu Shagang Co., Ltd. is a Chinese state-owned steel producer. The company is based in Zhangjiagang, Jiangsu Province, and is listed on the Shanghai Stock Exchange. Jiangsu Shagang is one of the largest private steel companies in China, with an annual output of over 20 million tons of steel. The company produces a wide range of steel products, including hot and cold rolled coils, galvanized sheets, and stainless steel products. In addition to its steel operations, Jiangsu Shagang also has businesses in coal mining, power generation, and real estate development.

– Xinjiang Ba Yi Iron & Steel Co Ltd ($SHSE:600581)

Xinjiang Ba Yi Iron & Steel Co Ltd has a market cap of 5.58B as of 2022, a Return on Equity of -24.16%. The company is engaged in the production and sale of iron and steel products. It is one of the largest iron and steel companies in China. The company’s products are used in a variety of industries, including construction, automotive, machinery manufacturing, and shipbuilding.

Summary

Reliance Steel & Aluminum (RS&A) is an attractive dividend stock for investors. All in all, RS&A is an attractive dividend stock for investors, with a robust dividend yield, low payout ratio, strong balance sheet, and earnings growth prospects.

Recent Posts