RRR stock dividend – Red Rock Resorts Declares 0.25 Cash Dividend.

March 20, 2023

Dividends Yield

Red Rock Resorts ($NASDAQ:RRR) Inc. has recently declared a 0.25 cash dividend on March 1st, 2023. This makes Red Rock Resorts the ideal choice for investors who are in search of a reliable dividend stock. The company has maintained a consistent 3-year track record of paying an annual dividend per share of 1.0 USD and has an average dividend yield of 2.34%. The ex-dividend date of this particular dividend falls on March 14, 2023.

Therefore, any shareholders who purchase the stock before this date will be eligible to receive the dividend. Those who purchase after this date will not be eligible for the same. For those looking for a reliable dividend stock, Red Rock Resorts Inc. is the perfect option with its record of consistent payouts and high yield.

Stock Price

This caused their stock price to spike, with the opening price of $43.9 and closing at $44.3, which was up by 1.5% from the prior day’s closing price of $43.7. This dividend is indicative of the confidence Red Rock Resorts has in its financial position and future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RRR. More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | 205.46 | 14.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RRR. More…

| Operations | Investing | Financing |

| 542.22 | -442.14 | -290.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RRR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.35k | 3.31k | 0.75 |

Key Ratios Snapshot

Some of the financial key ratios for RRR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.6% | 30.3% | 33.9% |

| FCF Margin | ROE | ROA |

| -1.1% | 926.4% | 10.6% |

Analysis

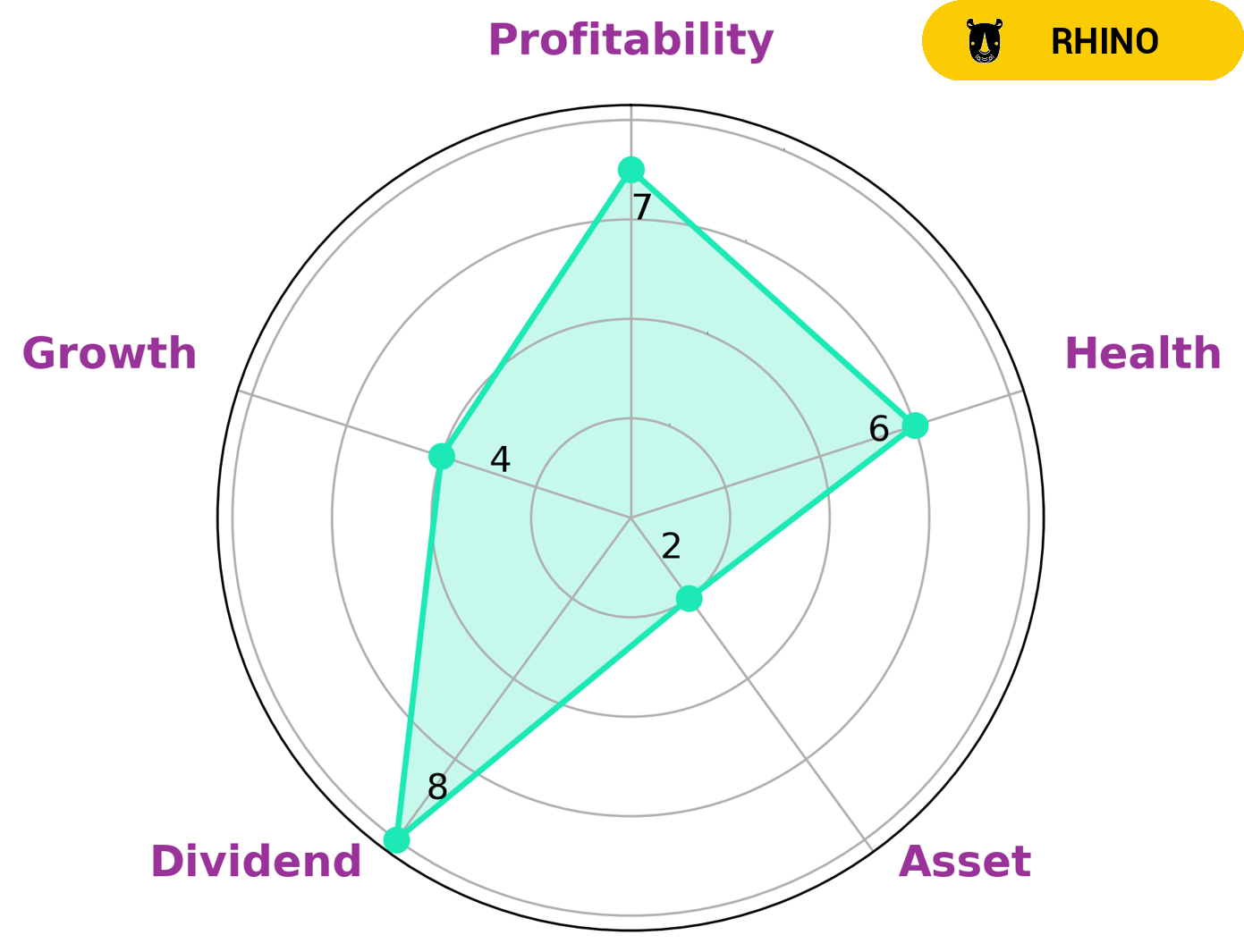

GoodWhale has analyzed the fundamentals of RED ROCK RESORTS to provide investors with an understanding of their financial health. Our Star Chart shows that RED ROCK RESORTS has an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that it might be able to sustain future operations in times of crisis. Further analysis indicates that RED ROCK RESORTS is strong in dividend and profitability, medium in growth, and weak in assets. This means that RED ROCK RESORTS is classified as a “rhino,” a type of company that has achieved moderate revenue or earnings growth. From a long-term investing perspective, RED ROCK RESORTS may be attractive to value and/or dividend investors who are looking to generate steady returns over the long-term. On the other hand, investors looking for high-growth opportunities may find RED ROCK RESORTS less attractive and may look to other companies with higher growth potential. More…

Peers

The company’s main competitors are Boyd Gaming Corp, Golden Entertainment Inc, and Bloomberry Resorts Corp.

– Boyd Gaming Corp ($NYSE:BYD)

Boyd Gaming Corporation is a leading diversified owner and operator of 22 gaming entertainment properties located in Nevada, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi and Ohio. Boyd Gaming press releases are available at boydgaming.com. Additional information about Boyd Gaming can be found at https://www.boydgaming.com/.

The company has a market cap of 5.86B as of 2022 and a ROE of 36.77%. The company operates gaming entertainment properties located in various states in the US.

– Golden Entertainment Inc ($NASDAQ:GDEN)

As of 2022, Golden Entertainment, Inc. had a market capitalization of 1.19 billion and a return on equity of 28.98%. The company is a gaming and hospitality company that owns and operates casinos, taverns, and gaming machines in the United States.

– Bloomberry Resorts Corp ($PSE:BLOOM)

The company’s market cap stands at 77.45B as of 2022 and its ROE is 11.83%. The company is engaged in the business of developing, owning and operating resorts.

Summary

RED ROCK RESORTS has demonstrated a strong commitment to rewarding shareholders with dividends, having paid out an annual dividend per share of 1.0 USD for the past three years. Analyzing the company’s fundamentals and financial performance is imperative for determining if it is a viable long-term investment option. Investors should consider factors such as the company’s revenues, earnings, debt levels, and growth potential when making their decision.

Recent Posts