Riverstone Holdings dividend yield calculator – Riverstone Holdings Ltd Announces Special 0.08 Dividend

March 19, 2023

Dividends Yield

On March 3 2023, Riverstone Holdings ($SGX:AP4) Ltd announced a special 0.08 MYR dividend. This comes on the heels of the company’s recent annual dividend history; in 2020, RIVERSTONE HOLDINGS paid out a 0.38 MYR dividend per share, followed by 0.26 MYR and 0.05 MYR in 2021 and 2022 respectively. This results in a dividend yield of 15.84%, 6.84%, and 1.28% from 2020 to 2022 with an average dividend yield of 7.99%.

With ex-dividend date on March 10 2023, RIVERSTONE HOLDINGS may be an attractive option for dividend stock seekers looking for consistent and sustainable income. Investors looking for short-term gains may have to take into account the current market conditions and the overall performance of the company before investing in RIVERSTONE HOLDINGS.

Share Price

In response to the news, RIVERSTONE HOLDINGS stock opened at SG$0.6 and closed at SG$0.6, up by 4.2% from the previous closing price of 0.6. This marked the company’s highest closing price since mid-February. Investors were encouraged by the dividend announcement as it led to a surge in stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Riverstone Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.43k | 383.1 | 26.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Riverstone Holdings. More…

| Operations | Investing | Financing |

| 322.6 | -122.98 | -714.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Riverstone Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.23k | 181.51 | 1.38 |

Key Ratios Snapshot

Some of the financial key ratios for Riverstone Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.2% | 48.4% | 35.4% |

| FCF Margin | ROE | ROA |

| 13.9% | 15.7% | 14.2% |

Analysis

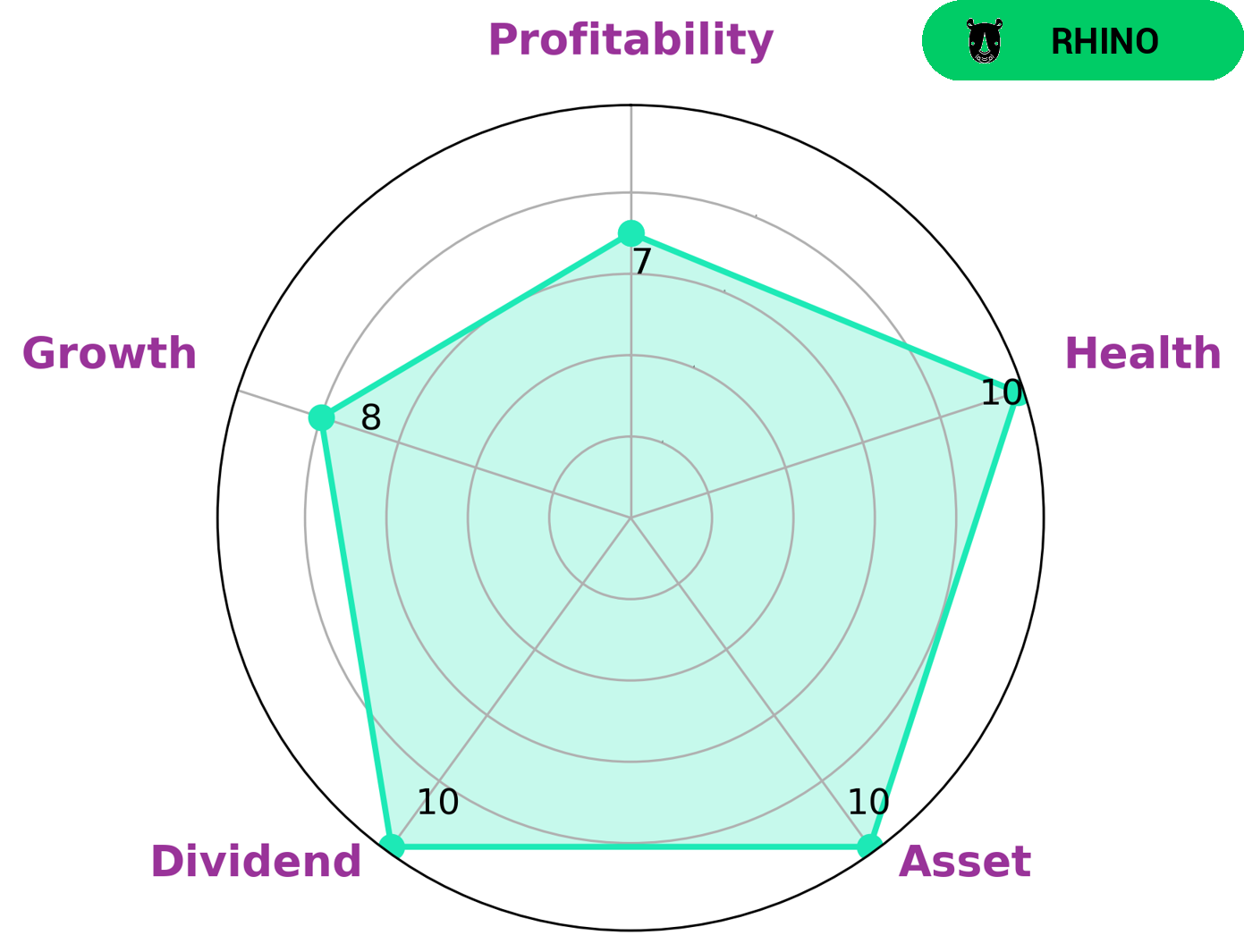

GoodWhale has conducted an analysis of RIVERSTONE HOLDINGS‘s wellbeing, and the results are very promising. The Star Chart indicates that RIVERSTONE HOLDINGS is strong in asset, dividend, growth, and profitability. We have classified RIVERSTONE HOLDINGS as a ‘rhino’, which we have concluded is a company that has achieved moderate revenue or earnings growth. Given this classification, investors that are interested in RIVERSTONE HOLDINGS may be those who are looking for moderate growth, but also value stability. This is further supported by GoodWhale’s health score of 10/10 considering its cashflows and debt, indicating that RIVERSTONE HOLDINGS is capable to sustain future operations in times of crisis. More…

Peers

Riverstone Holdings Ltd is one of the leading players in the market, facing tough competition from the likes of UG Healthcare Corp Ltd, PT Mark Dynamics Indonesia Tbk, Adventa Bhd and other competitors. The competition is fierce and has been ongoing for some time now as companies strive to maintain market share and stay ahead of the competition.

– UG Healthcare Corp Ltd ($SGX:8K7)

HUG Healthcare Corp Ltd is a healthcare services and products company based in Hong Kong. The company provides a wide range of services, such as hospital and clinic management, medical equipment, home care and other health-related services. As of 2023, the company has a market cap of 99.19M, which is an indication of its relative size and market presence in the sector. Additionally, the company has a Return on Equity of 4.03%, indicating the efficiency with which the company’s management team is able to generate profits from its investments.

– PT Mark Dynamics Indonesia Tbk ($IDX:MARK)

PT Mark Dynamics Indonesia Tbk is an Indonesian-based company that is engaged in the production and distribution of industrial machinery and equipment. As of 2023, the company has an impressive market capitalization of 2.19T and a Return on Equity (ROE) of 35.17%. This suggests that the company is well-managed and able to generate a significant return on the funds shareholders have invested in it. Furthermore, the impressive market cap shows that the company has been able to attract investors who are willing to invest significant amounts in it. This is indicative of a strong financial performance and the potential for future growth.

– Adventa Bhd ($KLSE:7191)

Adventa Bhd is a Malaysian-based health care provider, providing medical services and supplies to healthcare professionals. The company has a market capitalization of 90.14M as of 2023, indicating a strong financial performance in the health care sector. Adventa’s Return on Equity (ROE) of -3.05% shows that the company is not generating a positive return on invested capital, indicating an overall decrease in profitability. This low return on equity may be due to increased costs or decreased sales, or both. Despite this, the company continues to have a strong presence in the health care sector due to its wide range of products and services.

Summary

Investing in RIVERSTONE HOLDINGS is an attractive option given its robust dividend yield history. Over the past three years, the annual dividend per share has been 0.38, 0.26, and 0.05 MYR, resulting in yields of 15.84%, 6.84%, and 1.28% respectively. This adds up to an average dividend yield of 7.99%, which is significantly higher than many other companies in the industry. Furthermore, the dividend yield growth trend is promising, indicating that this company may be a good long-term investment option.

Recent Posts