Richards Packaging dividend yield – Richards Packaging Income Fund Declares 0.11 Cash Dividend

June 9, 2023

🌥️Dividends Yield

This marks the continuation of their consistent annual dividend payments over the past three years, with dividend yields of 2.93%, 2.75%, and 2.09% for 2021 to 2023 respectively, giving an average yield of 2.59%. For those looking for reliable income streams, RICHARDS PACKAGING ($TSX:RPI.UN) could be the stock for you. Their consistent dividend payments have made them a popular investment choice among dividend-seeking investors. The ex-dividend date for this year is May 30 2023, meaning that shareholders must own the stock before that date to be eligible to receive the dividend payment.

It is important to note that dividend yields are not guaranteed and can be subject to change from year to year depending on the company’s profitability and financial performance. Therefore, investors should do their own due diligence before investing in RICHARDS PACKAGING.

Price History

The stock opened at CA$36.0 and closed at the same price, thus making no change in the market cap. This dividend is applicable to all stockholders of RPIF, regardless of the number of units owned. It is based in Toronto, Ontario and listed on the Toronto Stock Exchange (TSX). This announcement of dividend payment demonstrates RPIF’s commitment to creating value for its shareholders and investing in quality businesses. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Richards Packaging. More…

| Total Revenues | Net Income | Net Margin |

| 443.75 | 41.8 | 8.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Richards Packaging. More…

| Operations | Investing | Financing |

| 58.42 | -2.32 | -52.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Richards Packaging. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 340.56 | 176.98 | 14.93 |

Key Ratios Snapshot

Some of the financial key ratios for Richards Packaging are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.1% | 3.8% | 13.5% |

| FCF Margin | ROE | ROA |

| 12.6% | 23.0% | 11.0% |

Analysis

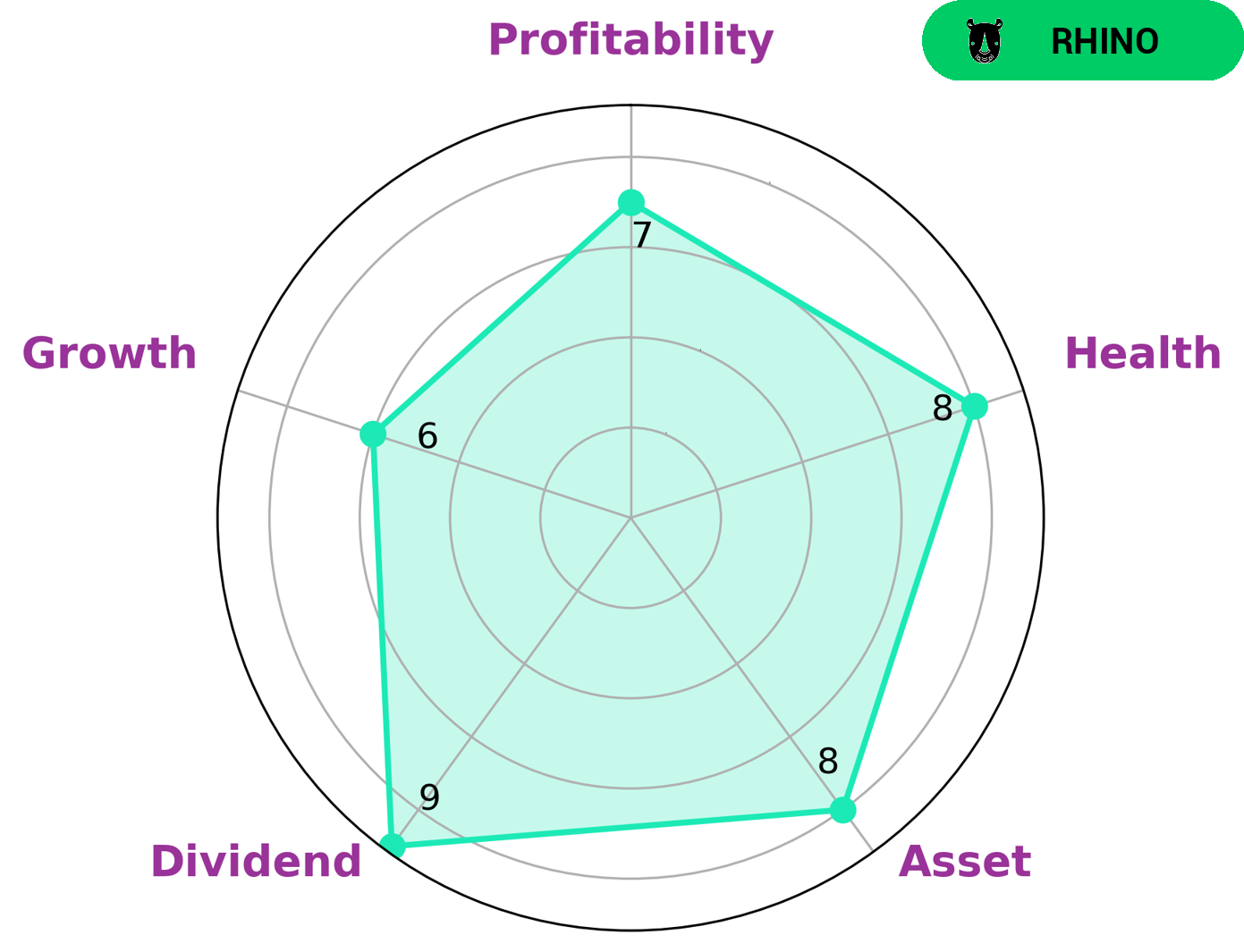

At GoodWhale, we have analyzed the fundamentals of RICHARDS PACKAGING and we are pleased to provide our analysis. Based on our Star Chart, RICHARDS PACKAGING has a high health score of 8/10, indicating that it is capable of riding out any crisis without the risk of bankruptcy. We have also classified RICHARDS PACKAGING as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. We believe that this kind of company could be attractive to value investors who are looking for companies with strong assets, dividends, and profitability. While it may not offer the same level of growth potential as some other investments, it does provide an opportunity to generate returns from a well-managed and consistent business. We believe that RICHARDS PACKAGING is an ideal choice for those investors who want to invest in a low-risk, medium-growth company. More…

Peers

The competition between Richards Packaging Income Fund and its competitors is fierce. Each company is striving to be the top dog in the industry, and each one has its own strengths and weaknesses. Richards Packaging Income Fund has the advantage of being a publicly-traded company, which gives it more visibility than its privately-held competitors. Robinson PLC has a strong market share in the UK, while TCPL Packaging Ltd is a major player in Asia. Huhtamäki Oyj is a Finnish company with a strong presence in Europe.

– Robinson PLC ($LSE:RBN)

Robinson PLC is a public limited company that is listed on the London Stock Exchange. The company has a market capitalization of 13.4 million as of 2022 and a return on equity of 9.8%. The company is engaged in the business of providing professional services to the oil and gas industry. The company has its headquarters in London, United Kingdom.

– TCPL Packaging Ltd ($BSE:523301)

TCPL Packaging Ltd has a market cap of 12.09B as of 2022, a Return on Equity of 23.0%. The company is engaged in the business of manufacturing and selling of corrugated packaging products and allied products. It has a network of 12 packaging plants across India.

– Huhtamäki Oyj ($LTS:0K9W)

Huthamaki Oyj is a Finnish food packaging company. It is headquartered in Espoo, Finland. The company was founded in 1920. It is one of the world’s largest producers of food packaging. The company has a market cap of 3.86B as of 2022 and a return on equity of 14.22%. Huthamaki Oyj is a publicly traded company listed on the Nasdaq Helsinki stock exchange.

Summary

Richards Packaging is a great stock pick for any investor seeking steady dividends. Over the past three years, the company has issued an annual dividend per share of 1.32 CAD, with dividend yields of 2.93%, 2.75%, and 2.09% for 2021 to 2023 respectively, giving an average yield of 2.59%. Its a sound stock investment for investors looking for reliable income streams with minimal risk. Its track record is one of stability and dependability, making it a solid option for any investor looking to invest in a dividend-yielding stock.

Recent Posts