REI.UN dividend yield calculator – Riocan Real Estate Investment Trust Announces 0.09 Cash Dividend

June 11, 2023

☀️Dividends Yield

On May 26 2023, Riocan Real Estate ($TSX:REI.UN) Investment Trust announced a cash dividend of 0.09 CAD per share. For the past three years, the trust has issued an annual dividend per share of 1.03 CAD, 1.01 CAD, and 0.96 CAD respectively, giving a dividend yield of 4.87%, 4.68%, and 4.55% respectively. Over this period, the average dividend yield from 2021 to 2023 is 4.7%.

This is a great opportunity for investors looking for dividend stocks, as it offers a high yield and potential returns that can be gained from investing in Riocan Real Estate Investment Trust. Investing in Riocan Real Estate Investment Trust could provide significant returns over the long term.

Price History

The news boosted RIOCAN’s stock on Friday, with the stock opening at CA$19.9 and closing at CA$20.1, up 1.0% from its last closing price of $19.9. This marks the sixth consecutive quarter in which the trust has increased its dividend payments. RIOCAN’s cash dividend is attractive to investors seeking regular income, and the trust is expected to continue to increase its cash dividend payments in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for REI.UN. More…

| Total Revenues | Net Income | Net Margin |

| 1.2k | 194.72 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for REI.UN. More…

| Operations | Investing | Financing |

| 491.06 | -55.39 | -423.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for REI.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.18k | 7.42k | 25.83 |

Key Ratios Snapshot

Some of the financial key ratios for REI.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 53.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

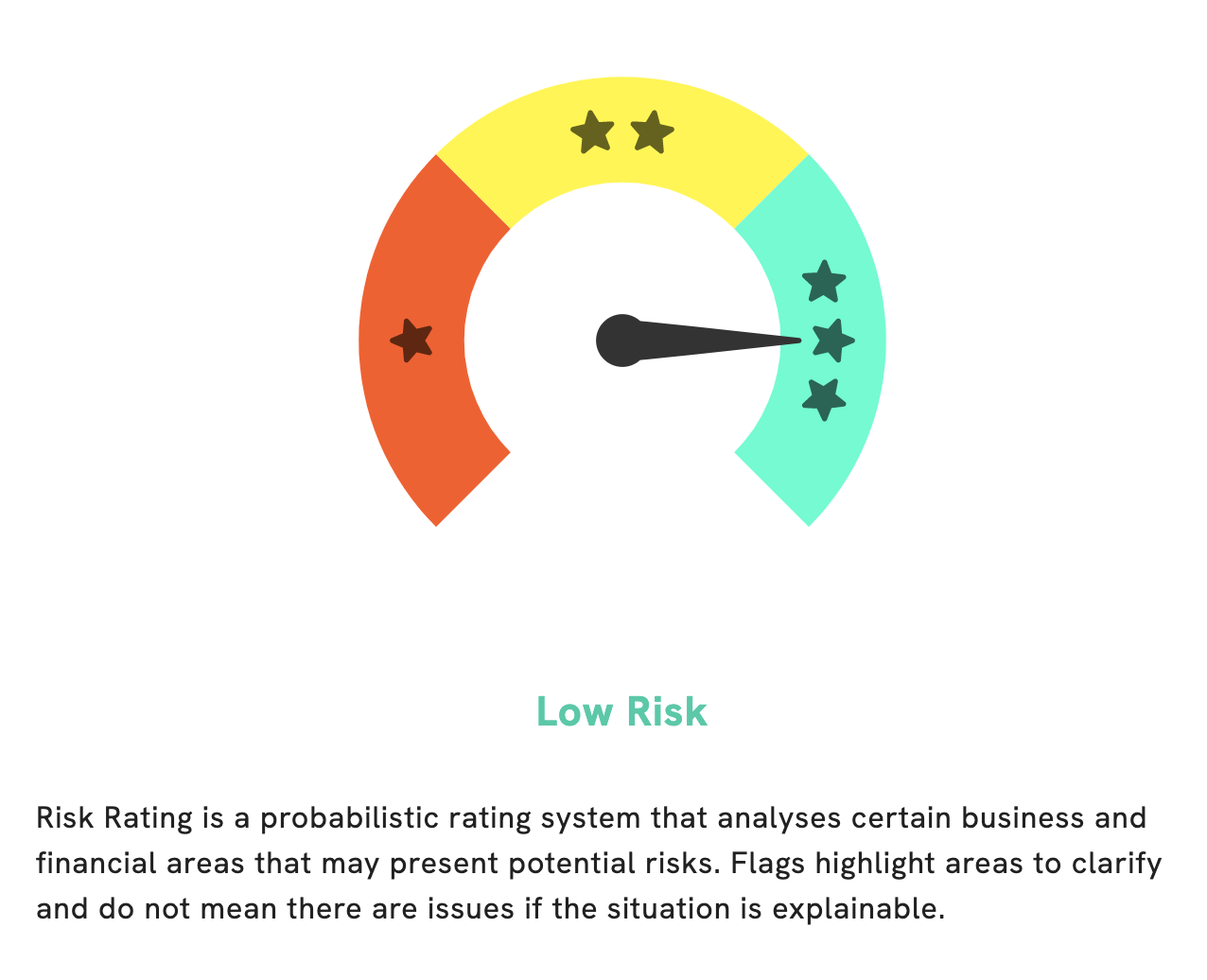

At GoodWhale, we have analyzed the wellbeing of RIOCAN REAL ESTATE INVESTMENT TRUST. We are pleased to let you know that the Risk Rating for RIOCAN REAL ESTATE INVESTMENT TRUST is low, indicating a relatively safe investment in terms of financial and business aspects. We have also detected 2 risk warnings in the balance sheet and cashflow statement of RIOCAN REAL ESTATE INVESTMENT TRUST. If you want to find out more about these warnings and why they were flagged, then do register with us to get full access to our comprehensive risk analysis. More…

Peers

Riocan Real Estate Investment Trust, CT Real Estate Investment Trust, Crombie Real Estate Investment Trust, and Plaza Retail REIT are all companies that invest in real estate. They each have different strategies and focus on different types of properties, but they all compete for the same investment dollars.

– CT Real Estate Investment Trust ($TSX:CRT.UN)

As of 2022, H&R REIT’s market cap is 3.64B. The company is a real estate investment trust that owns, operates, and develops a portfolio of office, retail, and mixed-use properties.

– Crombie Real Estate Investment Trust ($TSX:CRR.UN)

Crombie Real Estate Investment Trust is a real estate investment trust that owns, operates, and develops retail, office, and mixed-use properties in Canada. The company has a market cap of $2.66 billion as of 2022. Crombie’s portfolio includes properties in major Canadian markets such as Toronto, Montreal, Calgary, and Vancouver. The company’s properties are leased to a diversified group of national and international tenants.

– Plaza Retail REIT ($TSX:PLZ.UN)

Plaza Retail REIT is a company that operates in the retail real estate sector. The company owns and operates a portfolio of retail properties across Canada. As of 2022, the company had a market capitalization of $422.5 million. The company’s primary business is owning and operating retail properties. The company’s portfolio consists of over 200 properties, totaling over 18 million square feet of leasable space. The company’s properties are located in major markets across Canada, including Toronto, Vancouver, Calgary, Montreal, and Halifax.

Summary

RIOCAN Real Estate Investment Trust is an attractive investment option for those looking for a reliable and steady income stream. The company has consistently paid out dividends over the past three years, with yields of 4.87%, 4.68%, and 4.55% respectively. As a result, investors can expect an average dividend yield of 4.7%. Furthermore, the company’s portfolio of shopping centres and other retail properties have provided steady returns over the long-term, making it a safe and predictable option for income investors.

Recent Posts