RE4 dividend calculator – Geo Energy Resources Ltd Declares 0.005 Cash Dividend

May 29, 2023

Dividends Yield

On May 25 2023, Geo Energy Resources ($SGX:RE4) Ltd (GEO ENERGY RESOURCES) declared a 0.005 cash dividend, continuing its practice of increasing the annual dividend per share each year. In the last three years, GEO ENERGY RESOURCES has issued a dividend of 0.04, 0.07, and 0.04 USD, resulting in dividend yields of 23.72%, 23.72%, and 17.68% from 2021 to 2023 respectively. This has given an average yield of 21.71%.

If you are interested in stocks that pay dividends, GEO ENERGY RESOURCES is worth considering. The ex-dividend date for this dividend payout is May 30 2023.

Share Price

This news had a slight downward effect on GEO ENERGY RESOURCES’ share price, with the stock opening at SG$0.3 and closing at SG$0.3, down 1.8% from the previous day’s closing price of 0.3. The company’s portfolio includes upstream oil and gas exploration activities, as well as the development and production of oil and gas reserves. GEO ENERGY RESOURCES also has strategic investments and partnerships with leading energy companies.

This dividend declaration shows that GEO ENERGY RESOURCES is committed to creating value for its shareholders and delivering on its core mission of providing reliable and affordable energy resources and services for its customers. This latest dividend distribution is evidence of the company’s commitment to maximizing returns to its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RE4. More…

| Total Revenues | Net Income | Net Margin |

| 713.3 | 137.1 | 19.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RE4. More…

| Operations | Investing | Financing |

| 131.18 | -2.89 | -122.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RE4. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 548.57 | 126.91 | 0.29 |

Key Ratios Snapshot

Some of the financial key ratios for RE4 are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 38.0% | 376.3% | 29.1% |

| FCF Margin | ROE | ROA |

| 17.5% | 31.9% | 23.7% |

Analysis

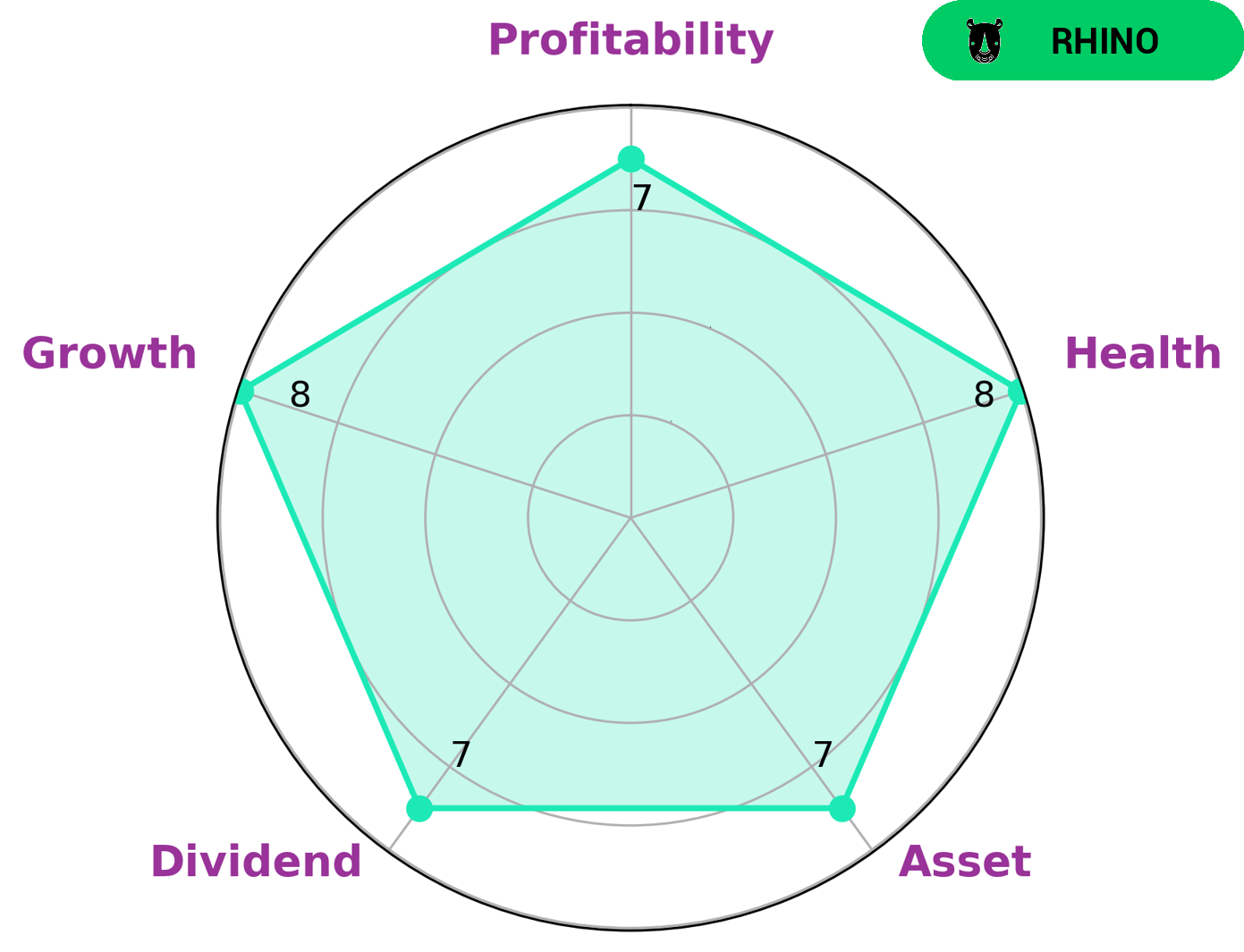

GoodWhale has conducted an analysis of GEO ENERGY RESOURCES’s financials. Our Star Chart analysis shows that GEO ENERGY RESOURCES has strong performance in asset, dividend, growth, and profitability. We classify this company as a ‘rhino’, meaning that it has achieved moderate revenue or earnings growth. With such a financial profile, GEO ENERGY RESOURCES may be of particular interest to value investors looking for steady returns. Additionally, GoodWhale has assigned GEO ENERGY RESOURCES a high health score of 8/10 with regard to its cashflows and debt, suggesting that it is capable of safely riding out any crisis without the risk of bankruptcy. More…

Peers

Geo Energy Resources Ltd is an established energy company that provides a variety of services related to coal mining, production, and exploration. It competes with other large energy companies such as Golden Energy and Resources Ltd, PT Dwi Guna Laksana Tbk, and PT Golden Energy Mines Tbk. These organisations are all significant players in the energy market, providing services related to energy production, mining, and exploration.

– Golden Energy and Resources Ltd ($SGX:AUE)

Golden Energy and Resources Ltd is a Singapore-based coal mining company that operates in Indonesia. With a market capitalization of 2.07B as of 2023, it is one of the largest coal miners in the region. The company’s return on equity (ROE) stands at 101.67%, showing a strong performance in terms of profitability and financial management. It is well-positioned to capitalize on the growing demand for energy and resources in the region.

– PT Dwi Guna Laksana Tbk ($IDX:DWGL)

PT Dwi Guna Laksana Tbk is a leading Indonesian company and one of the largest publicly traded companies on the Jakarta Stock Exchange. The company is engaged in the exploration and production of oil and gas, as well as downstream activities such as refining and marketing of products. As of 2023, the company had a market cap of 1.72T and a Return on Equity (ROE) of 45.14%. This indicates that the company is able to generate higher returns for investors as compared to its peers. Investors have confidence in the company’s ability to generate returns, as evidenced by its market cap and ROE.

– PT Golden Energy Mines Tbk ($IDX:GEMS)

PT Golden Energy Mines Tbk is a leading coal mining company with a market capitalization of 40.15T as of 2023. The company’s return on equity (ROE) stands at 108.83%. PT Golden Energy Mines Tbk is an integrated energy company and one of the largest coal mining companies in Indonesia. It produces thermal coal from its mining sites which are located in Jambi, South Sumatra, Central Kalimantan, West Kalimantan and South Kalimantan. The company has a strong portfolio of coal concessions which provides a stable and reliable supply of coal to its customers in Indonesia and other countries.

Summary

GEO ENERGY RESOURCES is a dividend-paying stock worth considering for investors. Over the last three years, the company has increased its annual dividend per share from 0.04 USD in 2021 to 0.07 USD in 2022 and back to 0.04 USD in 2023. This reflects dividend yields of 23.72%, 23.72%, and 17.68%, respectively, with an average yield of 21.71%. This makes GEO ENERGY RESOURCES an attractive option for investors looking for stocks with reliable income.

Recent Posts