Re Royalties dividend calculator – RE Royalties Ltd. Declares 0.01 Cash Dividend

June 2, 2023

🌥️Dividends Yield

On May 26 2023, RE Royalties Ltd. declared a 0.01 cash dividend of their stock. This marks the lowest dividend the company has ever issued in its 3 year history, with annual dividends of 0.04 CAD per share in the last 3 years. The dividend yield from 2020 to 2022 has been 4.21%, 3.21%, and 3.69%, respectively, with an average yield of 3.7%. These dividends have been distributed on a quarterly basis to shareholders of record on the ex-dividend date of May 2 2023.

Investors seeking stocks that pay dividends should keep RE ROYALTIES ($TSXV:RE) on their list of considerations. The company has consistently paid out dividends over the past few years, providing investors with a steady income stream and potential appreciation in the stock’s value. Its dividend yield is also higher than that of many competitors, making it a strong investment option for dividend investors.

Share Price

The company’s stock opened at CA$0.7 and closed at CA$0.7, down by 2.7% from its previous closing price of CA$0.7. This dividend is the first of its kind to be declared by RE Royalties Ltd. and is expected to be paid out to shareholders in the near future. The stock market responded to the dividend announcement by dropping 2.7%. It will be interesting to see whether the market will remain bearish on RE Royalties Ltd. in the coming weeks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Re Royalties. More…

| Total Revenues | Net Income | Net Margin |

| 3.2 | -0.09 | -16.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Re Royalties. More…

| Operations | Investing | Financing |

| -0.45 | -21.58 | 14.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Re Royalties. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.35 | 21.82 | 0.49 |

Key Ratios Snapshot

Some of the financial key ratios for Re Royalties are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.6% | – | 44.3% |

| FCF Margin | ROE | ROA |

| -582.4% | 4.2% | 2.0% |

Analysis

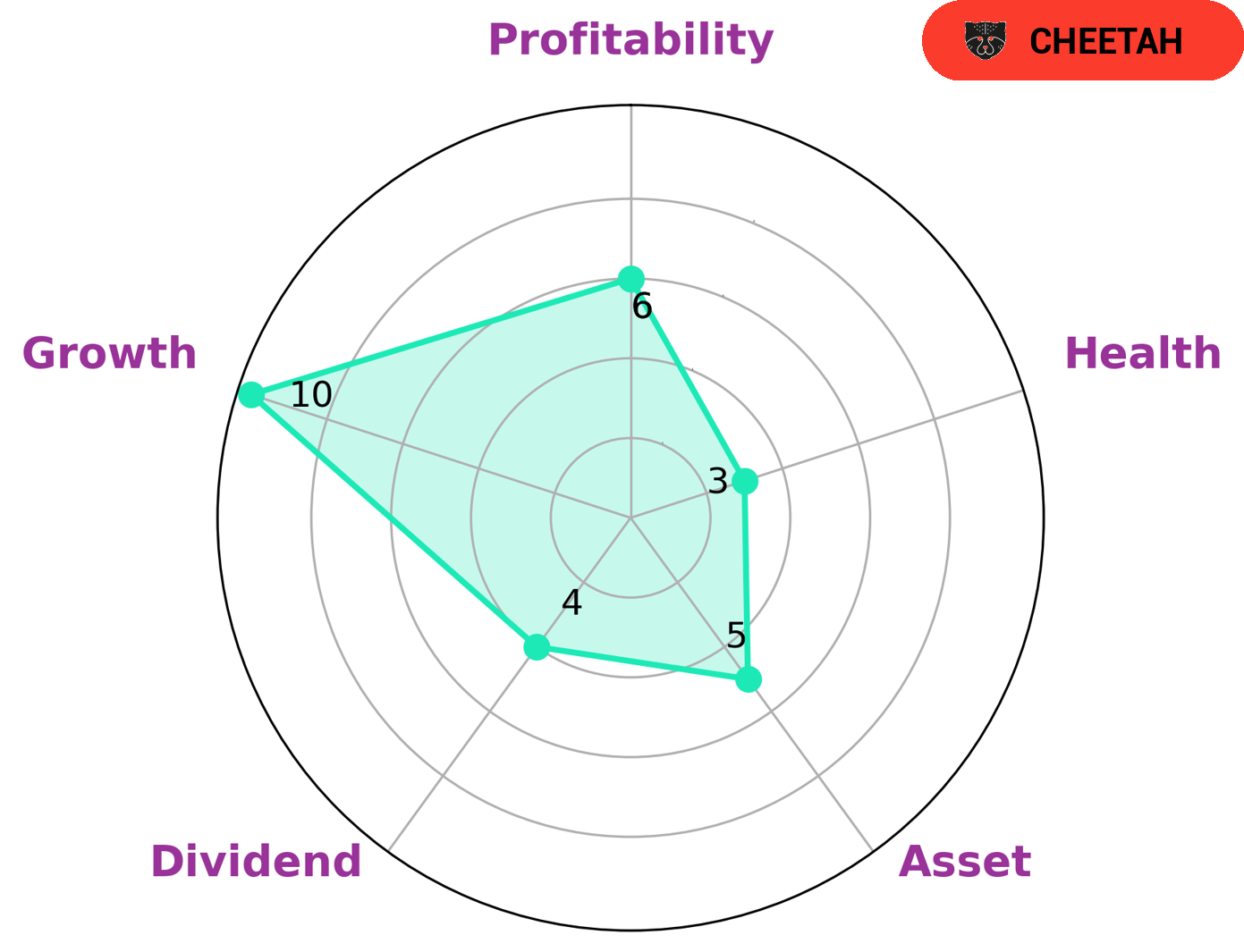

At GoodWhale, we conducted an analysis of RE ROYALTIES‘s fundamentals and discovered that the company’s Star Chart score is 3/10, indicating that it is less likely to safely ride out any crisis without the risk of bankruptcy. While RE ROYALTIES is strong in growth, and medium in asset, dividend, profitability, it has a low health score considering its cashflows and debt. After further investigation, we concluded that RE ROYALTIES is classified as a ‘cheetah’ company – one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given these factors, we can make assumptions as to what type of investors may be interested in such a company. Investors seeking higher risk investments may be attracted to RE ROYALTIES due to the potential for higher returns, while more conservative investors may decide to stay away due to the lower stability of the company. Ultimately, investors should consider their own risk tolerance before deciding if RE ROYALTIES is a good fit for their portfolio. More…

Peers

The competition in the renewable energy royalty sector is fierce, with several major players in the market vying for supremacy. RE Royalties Ltd is one such company, competing vigorously against Westbridge Renewable Energy Corp, Altius Renewable Royalties Corp and CGE Energy Inc to remain at the forefront of the industry. All of these companies have been striving to deliver the best possible services to their customers and gain a larger market share.

– Westbridge Renewable Energy Corp ($TSXV:WEB)

Westbridge Renewable Energy Corp is a renewable energy company that utilizes solar and wind power to provide sustainable and reliable energy solutions. The company has a market cap of 119.34 million as of 2023, which indicates investor confidence in its ability to generate long-term value. Westbridge Renewable Energy Corp has an ROE of -20.08%, showing that the company has not been able to generate a profit on its equity investments. This could be due to a range of factors, such as low revenue, high costs, or inefficient management decisions. Despite its negative ROE, investors remain optimistic about Westbridge Renewable Energy’s potential to become a major player in the renewable energy industry.

– Altius Renewable Royalties Corp ($TSX:ARR)

Altius Renewable Royalties Corp is a Canadian company that specializes in renewable energy investments. The company’s market cap as of 2023 is 268.12M, which indicates the size and reach of its investments. Additionally, Altius Renewable Royalties Corp has a Return on Equity of -0.37%, which indicates its overall financial performance in relation to its invested capital. Through its investments, the company aims to generate long-term returns and create positive environmental impact.

– CGE Energy Inc ($OTCPK:CGEI)

CGE Energy Inc is a diversified energy services company based in Detroit, Michigan that provides custom engineering and integrated energy solutions for businesses and private customers. The company has a market capitalization of 11.2M as of 2023, which means that its total market value is equal to the current share price times the number of outstanding shares. The company has seen steady growth since its founding in 2006, and is a leader in providing clean energy solutions to its customers. CGE Energy Inc provides a broad range of services, including energy efficiency and sustainability solutions, renewable energy project development, and energy infrastructure solutions. The company has also focused on reducing their environmental impact through carbon offsets and renewable energy technologies. With their strong commitment to sustainability and energy efficiency, CGE Energy Inc is well-positioned to continue its growth in the energy sector.

Summary

RE ROYALTIES has been a reliable source of income for investors over the last three years, issuing annual dividends of 0.04 CAD per share. The dividend yield from 2020 – 2022 has been 4.21%, 3.21%, and 3.69%, respectively, with an average yield of 3.7%. As such, RE ROYALTIES makes an attractive investment option for those seeking consistent and steady returns with a low-risk profile. Investors should analyze the company’s financials in terms of its historical performance, future growth prospects, and current market conditions before taking any investment decision.

Additionally, they should compare the company’s dividend yield to other potential investments to ensure they are getting the most for their investments.

Recent Posts