Quebecor Inc dividend calculator – Quebecor Inc Declares 0.3 Cash Dividend

June 8, 2023

🌥️Dividends Yield

On May 26 2023, Quebecor Inc ($TSX:QBR.A) declared a 0.3 cash dividend. This marks the fourth year in a row that the company has declared an annual dividend per share, with the amount standing at 1.2 CAD in 2021, 1.2 CAD in 2022 and 1.1 CAD in 2023. The dividend yields from 2021 to 2023 were 4.14%, 4.3% and 3.4% respectively, giving an average dividend yield of 3.95% for the three years.

If you are looking into investing in dividend stocks, QUEBECOR INC might be worth considering, as its ex-dividend date has been set on May 25 2023. The company’s past performance indicates that it is likely to continue to pay regular dividends and provide returns to its shareholders in the future.

Market Price

The stock opened at CA$33.2 and closed at the same price, up by 2.1 percent from its prior closing price of CA$32.6. This signifies an increase in investor confidence in the company, which is a good sign for the future performance of the firm. Quebecor Inc has been a reliable provider of financial returns for its shareholders, and this dividend serves as yet another example of its commitment to rewarding them for their continued support. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Quebecor Inc. More…

| Total Revenues | Net Income | Net Margin |

| 4.56k | 599.2 | 13.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Quebecor Inc. More…

| Operations | Investing | Financing |

| 1.31k | -627.2 | -812.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Quebecor Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.18k | 8.65k | 6.14 |

Key Ratios Snapshot

Some of the financial key ratios for Quebecor Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.8% | 1.1% | 24.6% |

| FCF Margin | ROE | ROA |

| 15.3% | 50.5% | 6.9% |

Analysis

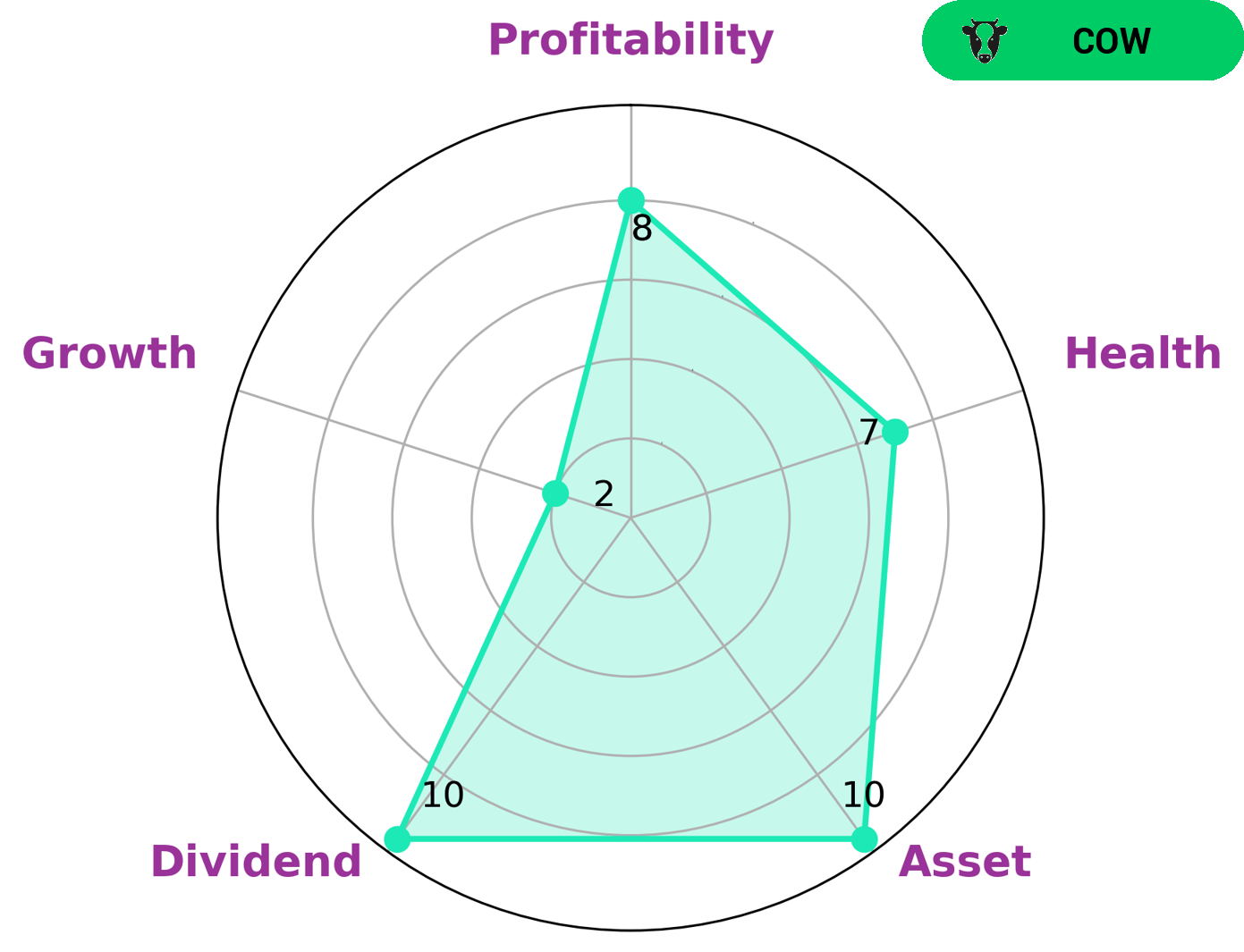

At GoodWhale, we analyze the fundamentals of QUEBECOR INC to help investors make informed decisions. Our Star Chart classifies the company as a ‘cow’, indicating that it has the track record of paying out consistent and sustainable dividends. This type of company is likely to be very attractive to dividend investors, who seek a steady income stream. When it comes to financial health, QUEBECOR INC scores highly, with a health score of 7/10. This suggests that the company is financially sound and capable of riding out any crisis without having to worry about the risk of bankruptcy. Moreover, the company is strong in terms of its assets, dividend payments, and profitability, but weak in terms of growth. All these factors make QUEBECOR INC an attractive choice for investors looking for a reliable and stable investment. More…

Summary

Investing in Quebecor Inc. has been a relatively safe bet in the past three years, with the company consistently paying out a dividend per share of 1.2 CAD. This has resulted in average dividend yields of around 3.95%, with the 2021 dividend yielding 4.14% and the 2022 dividend yielding 4.3%, while the 2023 dividend yielded 3.4%. For investors looking for a steady and reliable income stream, Quebecor Inc. would be a viable option, as its consistent dividend payments make it a reliable source of income.

Recent Posts