Public Storage dividend – Investing in Public Storage: A High-Conviction Dividend Play for Building Wealth

May 25, 2023

Trending News ☀️

Investing in Public Storage ($NYSE:PSA) is a high-conviction dividend play for building wealth. As one of the largest self-storage companies in the world, Public Storage (NYSE: PSA) has a long history of consistent dividend payouts and strong financial performance. This makes it an attractive option for dividend investors looking to build their wealth over the long term. As an investment, Public Storage stock has proven to be both reliable and rewarding. The company’s strong fundamentals and competitive advantages make it a standout in the industry. Its core products and services include self-storage, vehicle storage, and business storage solutions.

The company also offers a variety of additional amenities such as climate-controlled units, insurance coverage, packing supplies, and moving services. This diversity helps to minimize risk while providing investors with a steady stream of income from dividends and capital gains. For those seeking an excellent dividend-paying stock with a long track record of success, investing in Public Storage is a high-conviction decision. Its competitive advantages, diversified sources of income, and attractive dividend yield make it a strong investment for building wealth over time.

Dividends – Public Storage dividend

Over the past three years, PUBLIC STORAGE has consistently issued annual dividends of 9.0, 8.0, and 8.0 USD per share. Looking forward into 2021 and beyond, they have announced dividend yields of 2.72%, 2.39%, and 2.9%, with an average dividend yield of 2.67%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Public Storage. More…

| Total Revenues | Net Income | Net Margin |

| 4.3k | 4.15k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Public Storage. More…

| Operations | Investing | Financing |

| 3.16k | 1.2k | -4.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Public Storage. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.51k | 7.37k | 32.46 |

Key Ratios Snapshot

Some of the financial key ratios for Public Storage are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 51.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Price History

On Wednesday, Public Storage stock opened at $287.3 and closed at $283.4, creating a daily drop of 1.4%. Public Storage also has a strong track record of increasing the dividend payout rate, with the company consistently increasing dividends over the last few years. Live Quote…

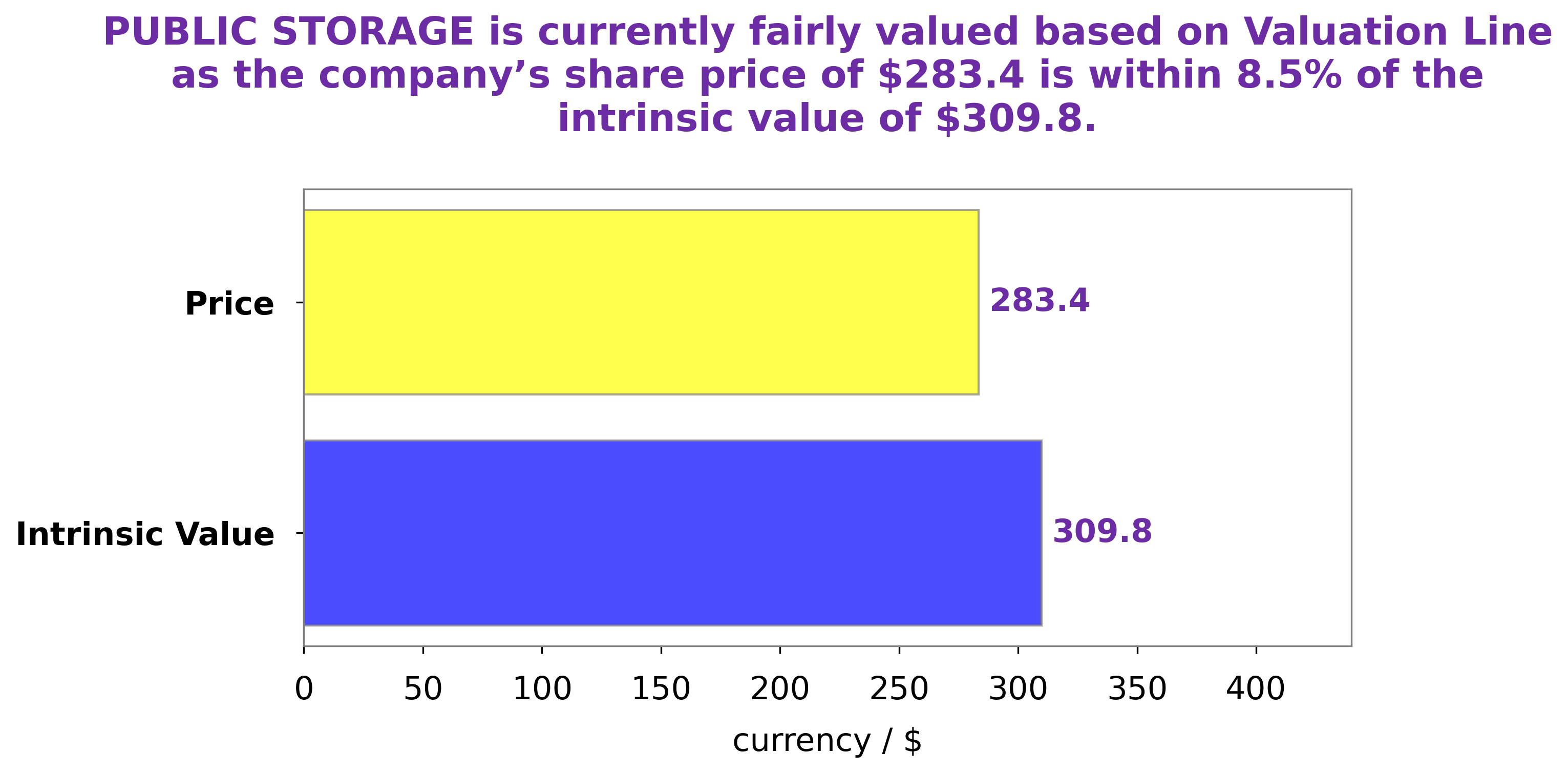

Analysis – Public Storage Stock Fair Value Calculator

At GoodWhale, we conducted an analysis of PUBLIC STORAGE’s wellbeing and calculated the intrinsic value of its share to be around $309.8. This figure was determined using our proprietary Valuation Line tool. In the current market, PUBLIC STORAGE stock is traded at $283.4, a fair price that is undervalued by 8.5%. This creates an opportunity for investors to acquire shares in PUBLIC STORAGE at a discount, potentially creating a better return on investment. More…

Peers

Public Storage is a real estate investment trust that invests in self-storage facilities. The company was founded in 1972 and is headquartered in Glendale, California. Public Storage has over 2,200 locations in the United States and Europe. The company’s competitors include Life Storage Inc, Extra Space Storage Inc, and National Storage Affiliates Trust.

– Life Storage Inc ($NYSE:LSI)

Life Storage Inc is a US based self storage company. As of December 31, 2020, it operated 969 self storage facilities across the United States. The company has a market capitalization of $8.69 billion as of February 2021.

– Extra Space Storage Inc ($NYSE:EXR)

Extra Space Storage is a real estate investment trust that owns and operates self-storage properties across the United States. As of December 31, 2020, the company had 1,871 self-storage properties located in 40 states, Washington, D.C., and Puerto Rico. Extra Space Storage is the second largest self-storage company in the United States with a market cap of $22.22 billion as of February 2021.

– National Storage Affiliates Trust ($NYSE:NSA)

National Storage Affiliates Trust is a publicly traded real estate investment trust focused on the ownership, operation and acquisition of self storage properties located within the United States. As of December 31, 2020, the Company owned and operated 783 self storage properties located in 38 states with approximately 54.3 million rentable square feet.

Summary

Public Storage is a well-known real estate investment trust (REIT) that is renowned for its attractive dividend yield. The firm has a history of dividend growth and provides investors with consistent long-term returns. It provides investors with exposure to real estate and a stable income stream. The stock has potential for significant appreciation if the company’s fundamentals continue to improve.

Public Storage has a strong balance sheet, low debt, and solid cash flow that make it a reliable investment for those looking to build wealth through dividend investing. The stock also offers a diversified portfolio of its storage properties, which can provide investors with some insulation against market volatility.

Recent Posts