Polaris Inc dividend calculator – Polaris Inc Declares 0.65 Cash Dividend

June 11, 2023

🌥️Dividends Yield

On May 26 2023, Polaris Inc ($NYSE:PII) announced a 0.65 cash dividend for its shareholders. This dividend is significantly higher than the average dividend yield of 2.28% that Polaris Inc has provided its shareholders over the past 3 years – 2.57 USD, 2.56 USD and 2.52 USD per share, respectively. For those seeking out dividend stocks, this could be a viable option, with the ex-dividend date set for May 31 2023.

This dividend is expected to further strengthen Polaris Inc’s position as a reliable dividend stock for investors. Besides the announcement of a cash dividend, Polaris Inc also declared that it plans to reinvest the profits to further grow its business and increase its returns for shareholders in the future.

Share Price

This news pushed the stock price of Polaris up by 1.8%, from a previous closing price of 106.2 to 108.2 when the markets closed on the same day. The dividend will be paid out on February 2nd and is expected to provide a financial boost for the stockholders in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Polaris Inc. More…

| Total Revenues | Net Income | Net Margin |

| 8.99k | 490.6 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Polaris Inc. More…

| Operations | Investing | Financing |

| 681.9 | -374.5 | -356.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Polaris Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.29k | 4.14k | 20.22 |

Key Ratios Snapshot

Some of the financial key ratios for Polaris Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | 28.6% | 10.0% |

| FCF Margin | ROE | ROA |

| 3.7% | 50.1% | 10.7% |

Analysis

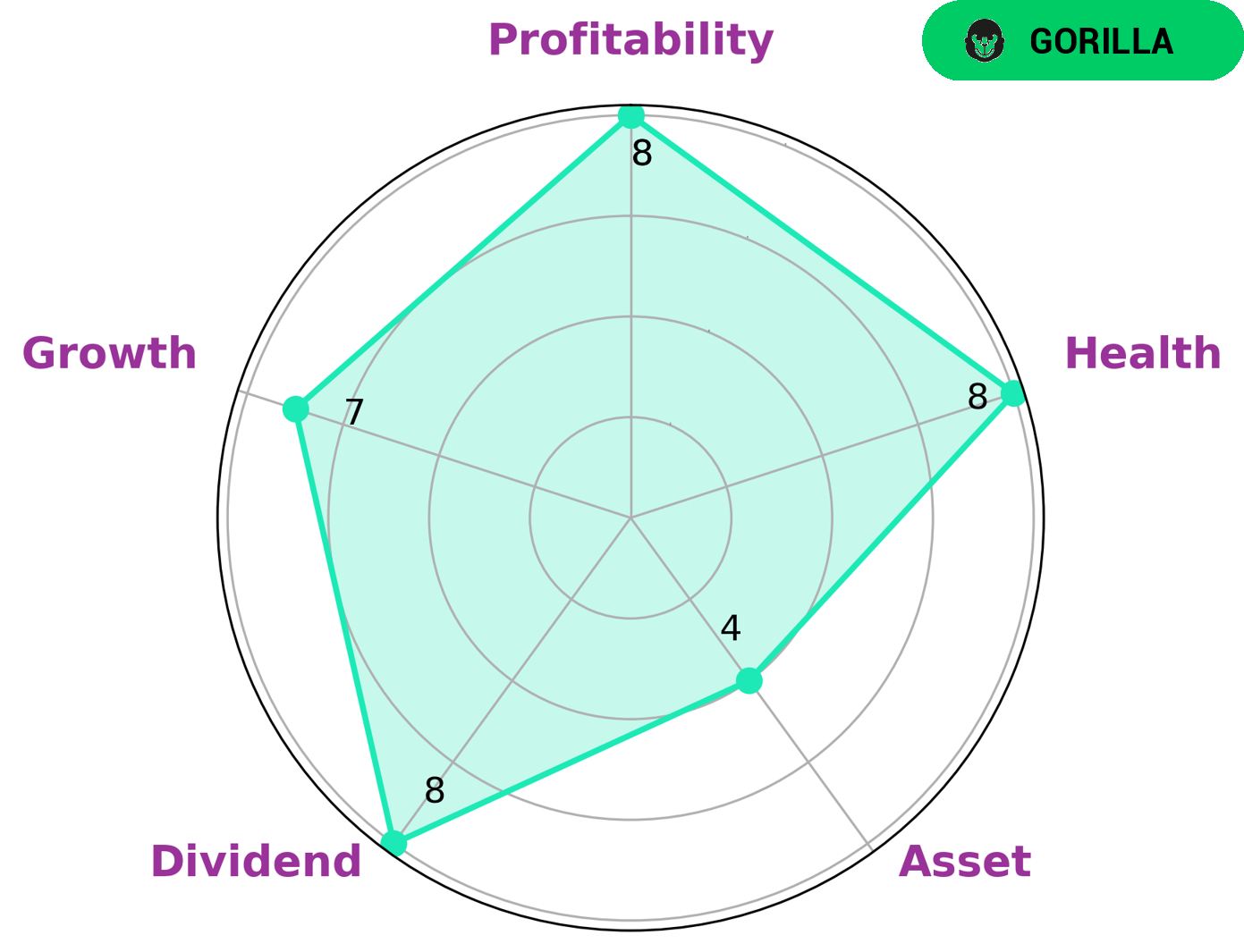

GoodWhale has conducted an extensive analysis of POLARIS INC‘s wellbeing, utilizing our proprietary Star Chart technology. Our assessment reveals that POLARIS INC is strong in dividend, growth, profitability, and medium in asset. In addition, our analysis reveals that POLARIS INC has an impressive health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. Furthermore, POLARIS INC is classified as a “gorilla”, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. As such, investors who are looking for long-term growth and stability may find POLARIS INC an attractive option. More…

Peers

Polaris Inc, Zhejiang CF Moto Power Co Ltd, Nissan Shatai Co Ltd, and Auto Parts 4Less Group Inc are all companies that manufacture and sell vehicles. Each company has its own unique history and set of products.

– Zhejiang CF Moto Power Co Ltd ($SHSE:603129)

Zhejiang CF Moto Power Co Ltd is a Chinese company that manufactures and sells motorcycles, ATVs, and scooters. The company has a market cap of 21.52B as of 2022 and a Return on Equity of 11.52%. CF Moto was founded in 1989 and is headquartered in Hangzhou, China. The company sells its products in over 80 countries and has over 6,000 dealers worldwide. CF Moto’s product line includes street bikes, dirt bikes, and ATVs. The company also offers a line of electric vehicles.

– Nissan Shatai Co Ltd ($TSE:7222)

Nissan Shatai Co Ltd is a Japanese automotive manufacturer with a market cap of 112.16B as of 2022. The company has a Return on Equity of -1.77%. Nissan Shatai Co Ltd manufactures cars, trucks, and SUVs. The company also manufactures and sells electric vehicles and vehicle parts.

Summary

Polaris Inc is a great option for investors seeking solid dividends. Over the past three years, Polaris Inc has consistently provided shareholders with an average dividend yield of 2.28%. This demonstrates Polaris Inc’s commitment to rewarding its investors with attractive returns. Potential investors should consider this company’s strong dividend yield as well as its consistent track record of reliable returns.

In addition, the company currently boasts a price-to-earnings ratio below the industry average, making it an attractive investment for those looking for long-term value.

Recent Posts