Pnm Resources dividend calculator – PNM Resources Declares 0.3675 Cash Dividend.

April 8, 2023

Dividends Yield

On April 2 2023, PNM ($NYSE:PNM) Resources Inc. declared a 0.3675 cash dividend per share, amounting to 1.39 USD, which is in line with their previous three years of consistent payments and yields an average of 2.99%. This makes PNM Resources Inc. an attractive option for those looking to invest in stocks with high dividends. The ex-dividend date for this year is April 27 2023, so investors have time to decide whether or not to take advantage of this dividend opportunity. The company’s commitment to consistently providing a dividend has made PNM Resources Inc. a popular stock choice among investors seeking value and consistent dividend payouts.

With a yield of 2.99%, the dividend is sure to prove attractive to investors and provide returns that are above the average for the industry. PNM Resources Inc. has been able to maintain their consistent dividend payments as a result of their careful management and profitable operations. This is a clear indication that the company is committed to providing value and returns to their shareholders, which is why it has become an attractive option for those seeking investment opportunities with high dividends.

Market Price

Following the announcement, the stock opened at $48.7 and closed at $48.5, resulting in a 0.4% decrease compared to its prior closing price of 48.7. Shareholders should expect to receive the dividend within the timeframe mentioned. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pnm Resources. More…

| Total Revenues | Net Income | Net Margin |

| 2.25k | 169.53 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pnm Resources. More…

| Operations | Investing | Financing |

| 567.28 | -950.35 | 386.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pnm Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.26k | 7k | 25.67 |

Key Ratios Snapshot

Some of the financial key ratios for Pnm Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.6% | 10.1% | 15.1% |

| FCF Margin | ROE | ROA |

| -15.3% | 9.6% | 2.3% |

Analysis – Pnm Resources Stock Fair Value

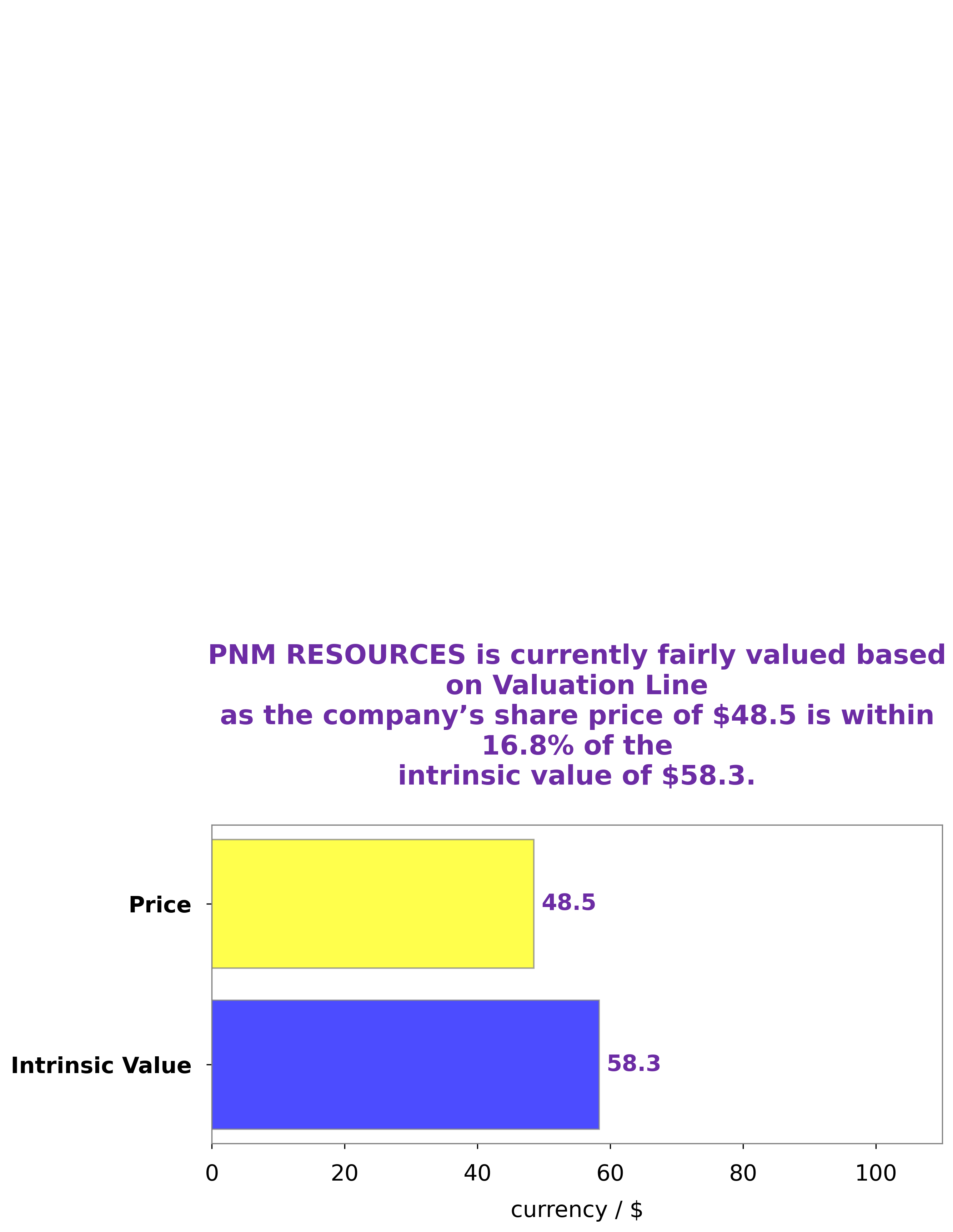

At GoodWhale, we recently did an analysis of the fundamentals of PNM RESOURCES. Using our proprietary Valuation Line, we determined that the fair value of the PNM RESOURCES share is around $58.3. However, currently, the stock is trading at $48.5 – this is a fair price that is undervalued by 16.8%. This provides a great opportunity for investors to buy up shares of PNM RESOURCES at an attractive price. More…

Peers

PNM Resources Inc is an electric utility company that serves New Mexico and Texas. The company has two main subsidiaries: Public Service Company of New Mexico and Texas-New Mexico Power Company. PNM Resources is the holding company for these two subsidiaries. The company has a market capitalization of $2.79 billion and its shares are traded on the New York Stock Exchange under the ticker symbol PNM. The company’s main competitors are Rosseti PJSC, Portland General Electric Co, and Centrais Eletricas Brasileiras SA.

– Rosseti PJSC ($NYSE:POR)

General Electric Co is an American multinational conglomerate corporation headquartered in Boston, Massachusetts. As of 2018, the company operates through the following segments: Power, Renewable Energy, Oil & Gas, Aviation, Healthcare, Transportation, and Capital. The company has a market cap of 3.91B as of 2022 and a return on equity of 9.64%.

– Portland General Electric Co ($NYSE:EBR.B)

Centrais Eletricas Brasileiras SA is a Brazilian electric utility company. The company is involved in the generation, transmission, and distribution of electricity in Brazil. The company has a market cap of 23.13B as of 2022 and a Return on Equity of 9.75%. The company is headquartered in Rio de Janeiro, Brazil.

Summary

PNM RESOURCES offers a consistent and reliable dividend of 1.39 USD per share over the past three years, yielding an average of 2.99%. This makes it an attractive investment opportunity, providing investors with a steady stream of income and potential long-term returns. The company has shown a dependable performance in the past, and its dividends are expected to remain steady in the future as well. This makes PNM RESOURCES a secure option for those looking to invest in stocks with high dividends.

Recent Posts