Pearson Plc dividend yield – Pearson PLC Announces 0.149 Cash Dividend

March 18, 2023

Dividends Yield

On March 4, 2023, Pearson PLC announced a 0.149 GBP cash dividend for eligible shareholders of record as of March 23, 2023. This dividend is consistent with the company’s track record of issuing an annual dividend per share of 0.2 GBP over the past three years, yielding an average of 2.97% from 2020 to 2022 (2.87%, 2.51%, 3.53% respectively). This makes PEARSON PLC ($BER:PES) a great stock to consider if you are looking for dividend stocks that have a reliable history of dividend payouts.

The ex-dividend date of March 23, 2023 also provides investors with enough time to make sure they are qualified to receive the 0.149 GBP dividend payment. Overall, PEARSON PLC is a solid dividend stock to consider for any investor searching for income-generating investments.

Market Price

The news of the dividend saw the stock open at €9.9 and close at €9.9, a 5.5% drop from the prior closing price of 10.4. The dividend marks PEARSON PLC‘s commitment to returning value to its shareholders while continuing to build a strong and sustainable business model. Shareholders who hold their shares on record as of October 30th, 2020 will be eligible to receive the dividend. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pearson Plc. More…

| Total Revenues | Net Income | Net Margin |

| 3.84k | 242 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pearson Plc. More…

| Operations | Investing | Financing |

| 361 | 13 | -804 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pearson Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.31k | 2.89k | 6.15 |

Key Ratios Snapshot

Some of the financial key ratios for Pearson Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.2% | -12.1% | 10.2% |

| FCF Margin | ROE | ROA |

| 5.6% | 5.5% | 3.4% |

Analysis

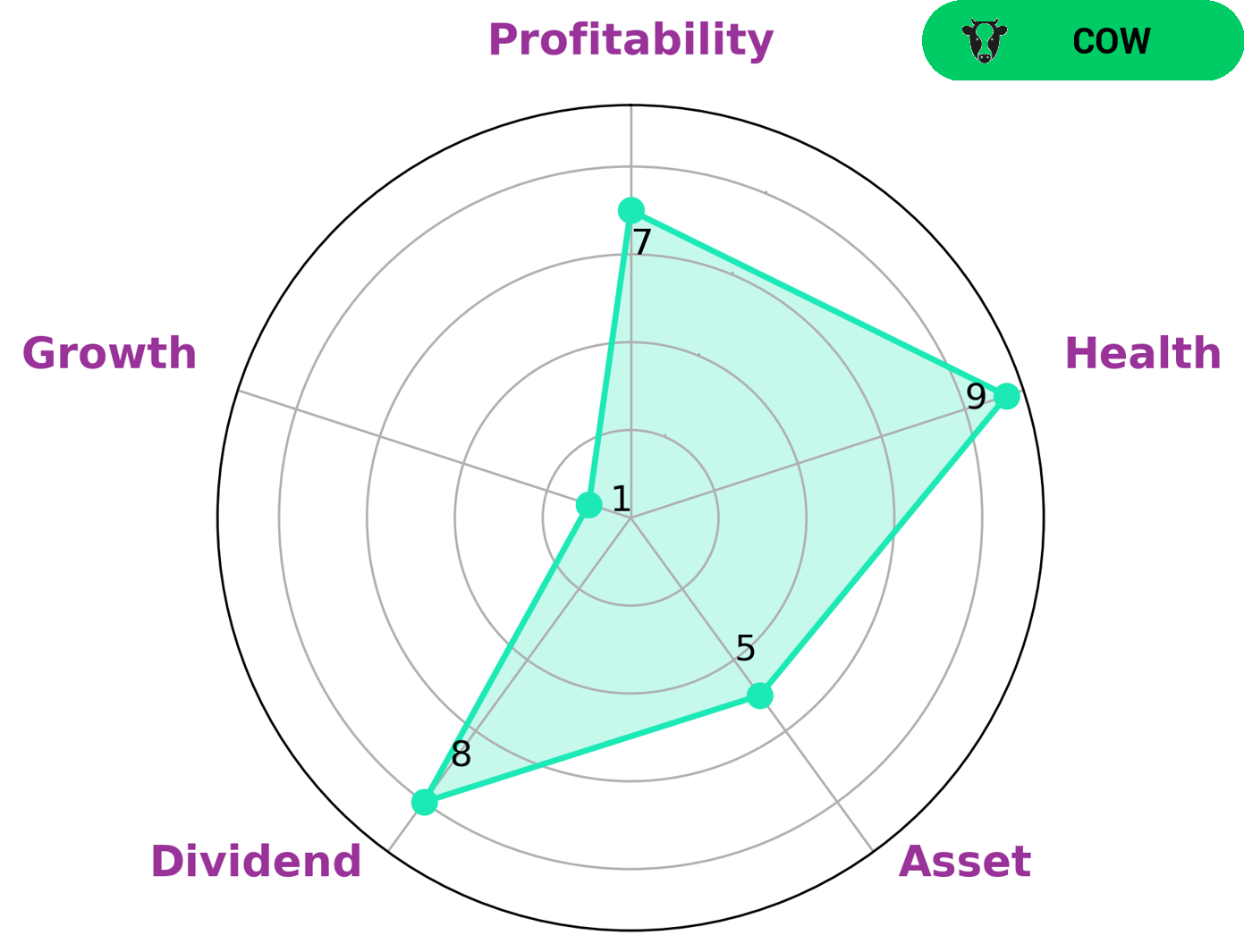

As part of our analysis of PEARSON PLC‘s fundamentals, GoodWhale has found that the company has a high health score of 9/10 with regard to its cashflows and debt. This means it is capable of paying off debt and funding future operations. Additionally, we have classified PEARSON PLC as ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. From this information, we can assume that this makes PEARSON PLC an attractive option for investors looking for a reliable dividend yield. Furthermore, we have observed that the company is strong in dividend, profitability, and medium in asset and weak in growth. Therefore, investors who are looking for a steady stream of dividend income with low risk may be interested in investing in PEARSON PLC. More…

Summary

Pearson PLC is an attractive option for dividend investors, offering a consistent annual dividend of 0.2 GBP per share over the past three years, with an average yield of 2.97%. Its dividends have shown a steady growth rate of 3.53%, 2.51%, and 2.87% in 2020, 2021, and 2022 respectively. Before investing in Pearson PLC, investors should consider their long-term goals, risk tolerance, and research the company’s performance, financials, and analysis. Analyzing the company’s financial health and analyzing market trends can help investors make an informed decision about their investment.

Recent Posts