Packaging Corporation dividend – Packaging Corporation of America Declares 1.25 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1 2023, the Packaging Corporation ($NYSE:PKG) of America (PCA) declared a cash dividend of $1.25 per share. This announcement makes PCA a strong dividend stock, with an average dividend yield of 3.32% over the past three years. In 2021, PCA issued a dividend of $5.00 per share, followed by $4.75 in 2022, and $4.00 in 2023. This results in dividend yields of 3.68%, 3.45%, and 2.84% respectively. For those looking to invest in PCA as a dividend stock, the ex-dividend date for this stock is set to June 14, 2023.

This means that anyone who buys the stock before this date will receive the dividend. PCA is an attractive investment option for those looking for a consistent dividend paying stock. Investors can expect steady returns from this company for years to come.

Stock Price

On Thursday, PCA stock opened at $124.9 and closed at $124.8, representing a slight increase of 0.6% from the previous closing price of $124.0. Through their commitment to quality and innovation, PCA has become a leader in the packaging industry and are well-positioned to continue their growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Packaging Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 8.32k | 959.8 | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Packaging Corporation. More…

| Operations | Investing | Financing |

| 1.5k | -833.7 | -960 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Packaging Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8k | 4.34k | 40.8 |

Key Ratios Snapshot

Some of the financial key ratios for Packaging Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.2% | 10.8% | 16.2% |

| FCF Margin | ROE | ROA |

| 8.1% | 22.9% | 10.5% |

Analysis

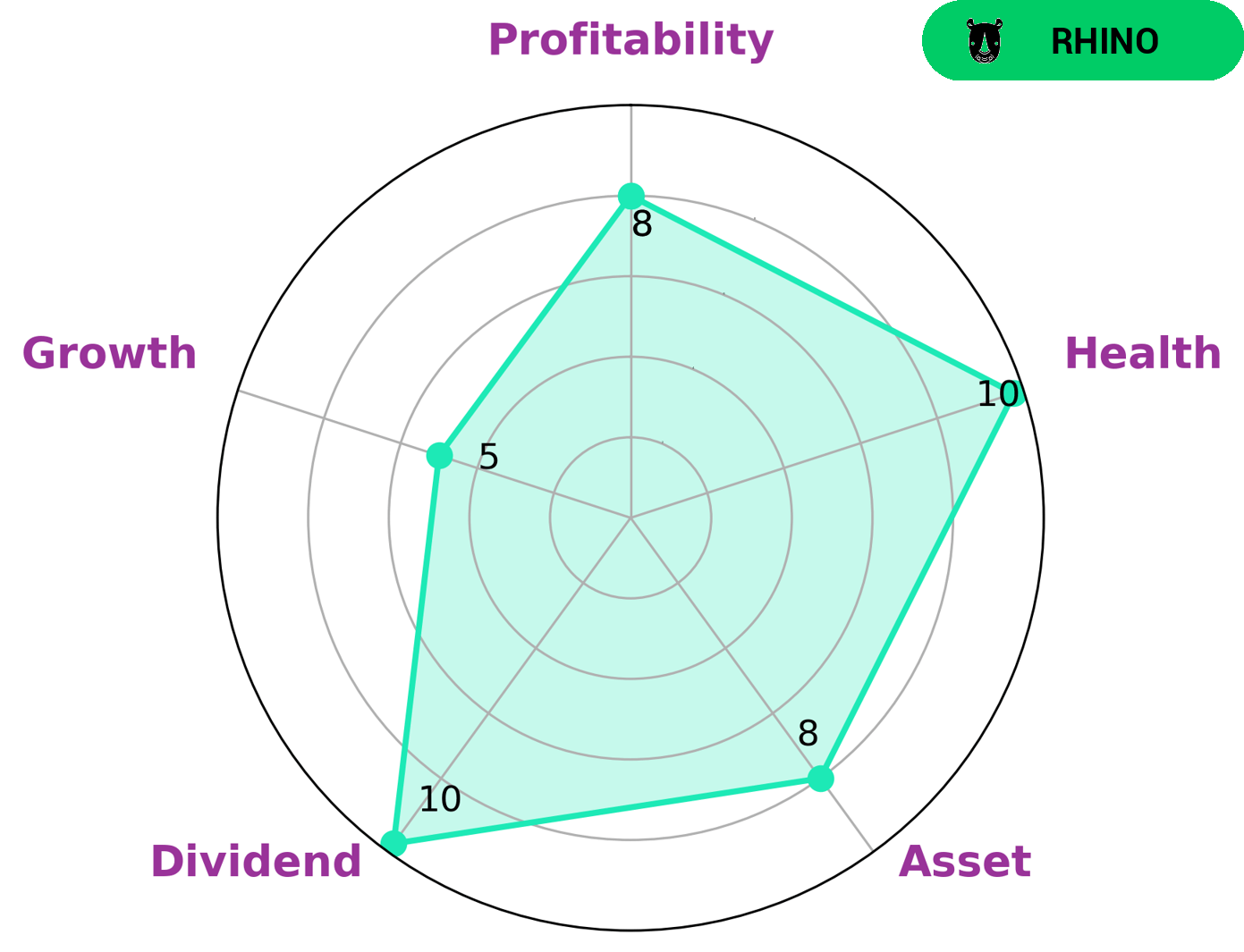

GoodWhale has conducted an analysis of PACKAGING CORPORATION‘s wellbeing. Our Star Chart shows that PACKAGING CORPORATION has a high health score of 10/10 with regard to its cashflows and debt, indicating it is well-equipped to sustain future operations in times of crisis. Looking at overall performance, we classify PACKAGING CORPORATION as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. PACKAGING CORPORATION is strong in asset, dividend, and profitability, while it is considered medium in terms of growth. As such, we believe it would be attractive to value-oriented investors who are looking for a steady stream of income. Investors who are not overly concerned about short-term growth can likely be rewarded by investing in PACKAGING CORPORATION in the long run. More…

Peers

Packaging Corp of America is one of the largest packaging companies in the world. Its competitors include Tomypak Holdings Bhd, PT Sriwahana Adityakarta Tbk, and Shanghai Xintonglian Packing Co Ltd.

– Tomypak Holdings Bhd ($KLSE:7285)

Tomypak Holdings Bhd is a Malaysian company that is involved in the packaging and manufacturing of food products. The company has a market capitalization of 168.14 million as of 2022 and a return on equity of -0.75%. The company’s products are sold in Malaysia, Singapore, Indonesia, and the Philippines.

– PT Sriwahana Adityakarta Tbk ($IDX:SWAT)

Sriwahana Adityakarta Tbk is an Indonesian holding company with interests in a range of businesses, including banking, finance, property development, and mining. The company has a market capitalization of $172.09 billion as of 2022 and a return on equity of 9.34%. Sriwahana Adityakarta Tbk is a publicly traded company listed on the Indonesia Stock Exchange.

– Shanghai Xintonglian Packing Co Ltd ($SHSE:603022)

Shanghai Xintonglian Packing Co Ltd is a company that manufactures and sells packaging products. The company has a market cap of 2.02B as of 2022 and a return on equity of 3.94%. The company’s products include plastic bags, paper bags, and other packaging products. The company’s products are used in a variety of industries, including food, beverage, and pharmaceutical.

Summary

Investing in Packaging Corporation can be a strong option for dividend-seeking investors. The company has consistently increased its dividend payments for the past three years, with a dividend yield average of 3.32%. This is significantly higher than the market average and provides investors with a reliable, consistent source of income. In addition, the company’s financials have remained strong throughout the past few years, providing investors with confidence in their investment.

Recent Posts