PAA dividend – PLAINS ALL AMERICAN PIPELINE Announces Dividend of $0.2675 Per Share

April 8, 2023

Trending News ☀️

PLAINS ALL AMERICAN PIPELINE ($NASDAQ:PAA) is a leading midstream energy infrastructure company in North America, engaged in the transportation, storage, terminalling, and marketing of crude oil, natural gas liquids, and refined products. The company continues to actively manage its capital structure and liquidity position to ensure it is well-positioned to fund its current dividend and long-term growth strategy. This dividend reflects its commitment to returning cash to shareholders while maintaining a strong financial position.

Dividends – PAA dividend

PLAINS ALL AMERICAN PIPELINE recently announced a dividend of $0.2675 per share for the coming year. Based on this information, dividend yields from 2022 to 2022 are 7.96%, 7.96%, and 7.96%, with an average dividend yield of 7.96%. For investors looking to add dividend stocks to their portfolios, PLAINS ALL AMERICAN PIPELINE may be worth considering. With a consistent and reliable dividend yield, the company can provide investors with a steady stream of income, making it an attractive option for those looking to add a dividend stock to their portfolio.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PAA. More…

| Total Revenues | Net Income | Net Margin |

| 57.34k | 831 | 2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PAA. More…

| Operations | Investing | Financing |

| 2.41k | -526 | -1.93k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PAA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.89k | 14.57k | 14.4 |

Key Ratios Snapshot

Some of the financial key ratios for PAA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.4% | -8.2% | 3.2% |

| FCF Margin | ROE | ROA |

| 3.4% | 11.4% | 4.1% |

Stock Price

The stock opened at $12.7 on the same day and closed at $12.8, representing a 0.4% decrease from the previous closing price of $12.9. Live Quote…

Analysis

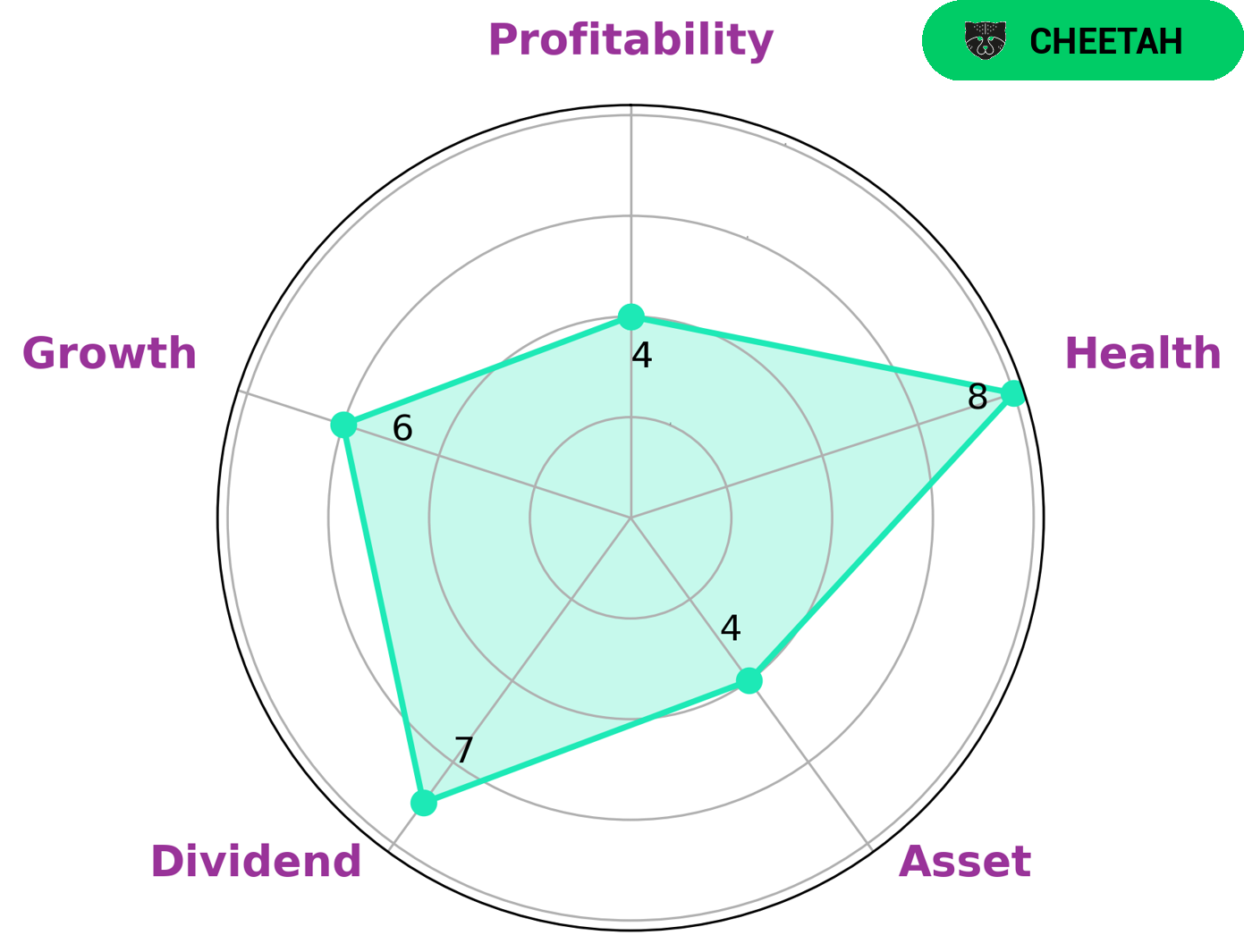

GoodWhale has analyzed the fundamentals of PLAINS ALL AMERICAN PIPELINE and classified them as ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company is attractive to investors who are looking for a high-reward investment with a higher level of risk. Upon further analysis, we can see that the company is strong in dividend and medium in asset, growth, and profitability. Additionally, PLAINS ALL AMERICAN PIPELINE has a high health score of 8/10 considering its cashflows and debt, which indicates its capability to pay off debt and fund future operations. All of these factors make PLAINS ALL AMERICAN PIPELINE an attractive option for investors seeking high returns. More…

Peers

Plains All American Pipeline LP, Plains GP Holdings LP, MPLX LP, and Valero Energy Corp are all leading companies in the oil and gas industry. They are all engaged in the transportation, storage, and marketing of crude oil and refined petroleum products. These companies have a significant impact on the global energy market.

– Plains GP Holdings LP ($NASDAQ:PAGP)

Plains GP Holdings LP is a publicly traded master limited partnership that owns and operates midstream energy infrastructure and provides logistics services for the crude oil, natural gas, and natural gas liquids industries in the United States and Canada. The company’s market cap is $2.37B as of 2022 and its ROE is 79.65%. The company is headquartered in Houston, Texas.

– MPLX LP ($NYSE:MPLX)

MPLX LP is a publicly traded master limited partnership that owns and operates a diversified portfolio of midstream energy assets. The company’s assets include crude oil and refined products pipelines, storage facilities, and terminals. MPLX LP is headquartered in Findlay, Ohio.

MPLX LP has a market cap of $32.72 billion as of 2022. The company has a return on equity of 20.4%. MPLX LP’s assets include crude oil and refined products pipelines, storage facilities, and terminals. The company is headquartered in Findlay, Ohio.

– Valero Energy Corp ($NYSE:VLO)

Valero Energy Corp is a publicly traded company with a market capitalization of $49.03 billion as of 2022. The company is engaged in the business of refining and marketing petroleum products and related services. Valero Energy Corp has a return on equity of 30.7%.

Summary

Plains All American Pipeline has declared a dividend payment of $0.2675 per share. This dividend payment is a significant increase from their last dividend payment, making it an attractive option for investors looking for a high yield. Plains All American Pipeline has a long history of paying consistent dividends, and its share price has been steadily increasing over the past several years. The company is well diversified across multiple industries and markets, and its operations are reliable and efficient. Plains All American Pipeline is known for its strong financial performance and excellent management team, making it a great choice for investors seeking a reliable source of income.

Additionally, the company has a strong dividend payout ratio, meaning that it should be able to sustain its dividend payments even if market conditions become unfavorable.

Recent Posts