Optex Group dividend – Optex Group Co Ltd Announces 20.0 Cash Dividend

June 12, 2023

🌥️Dividends Yield

Optex Group ($TSE:6914) Co Ltd recently announced a 20.0 JPY cash dividend on June 2nd, 2023. The company has issued an annual dividend per share of 36.0 JPY over the last three years, resulting in a dividend yield of 2.47%. This average dividend yield is also 2.47%, making Optex Group a great stock for dividend seekers. If you are interested in investing in dividend stocks, Optex Group should be added to your list of considerations.

The ex-dividend date is June 29th, 2023 so be sure to make note of that in your investment plan. Optex Group is an excellent choice for investors looking for a steady stream of income with low risk.

Market Price

Following the announcement, the company’s stock opened at JP¥1951.0 and closed at JP¥2010.0, up by 4.2% from its prior closing price of JP¥1929.0. This dividend marks the latest in a series of financial returns paid out to shareholders, demonstrating the company’s dedication to delivering value to its investors. The dividend payment also highlights the company’s strong financial performance, in spite of the current market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Optex Group. More…

| Total Revenues | Net Income | Net Margin |

| 54.81k | 4.75k | 9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Optex Group. More…

| Operations | Investing | Financing |

| 1.67k | -310 | -1.63k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Optex Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 63.3k | 23.57k | 1.12k |

Key Ratios Snapshot

Some of the financial key ratios for Optex Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.5% | 30.2% | 12.1% |

| FCF Margin | ROE | ROA |

| 0.5% | 10.4% | 6.5% |

Analysis

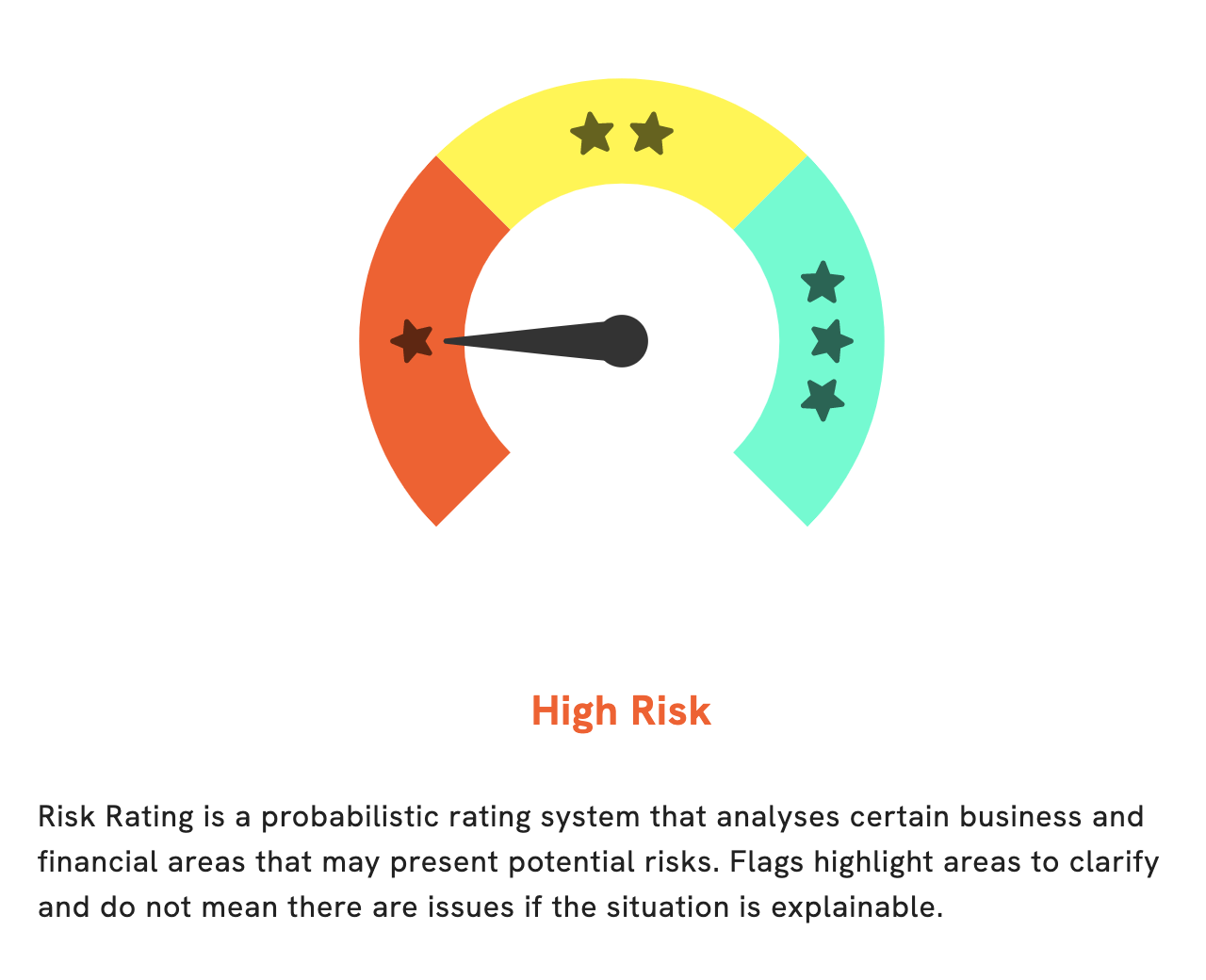

At GoodWhale, we have completed an analysis of OPTEX GROUP‘s financials. According to our Risk Rating, this is a high risk investment in terms of financial and business aspects. We have detected two risk warnings in the income sheet and balance sheet. If you’re interested in learning more about the potential risks associated with this investment, please register on GoodWhale.com and check out our detailed analysis. Our comprehensive analysis of OPTEX GROUP’s financials allows you to make an informed decision about whether this is the right investment for you. We recommend that all investors conduct their own due diligence before making any investment decisions. More…

Peers

Their products offer peace of mind to both customers and businesses who depend on reliable security solutions in various industries. As such, they face strong competition from companies such as LSI Industries Inc, Beghelli, and Shenzhen EXC-LED Technology Co Ltd who aim to provide similar services.

– LSI Industries Inc ($NASDAQ:LYTS)

LSI Industries Inc is a publicly traded company headquartered in Cincinnati, Ohio, that designs, manufactures, and markets a variety of commercial lighting products and solutions. The company’s market capitalization is currently at 363.11M, indicative of its strong performance and growth potential. Moreover, its Return on Equity (ROE) of 13.12% indicates that the company is generating a healthy return on shareholder investments.

– Beghelli ($LTS:0N6Q)

Beghelli is an Italian lighting company that specializes in providing innovative lighting systems and solutions for a variety of applications. It has a market capitalization of 47.41 million euros as of 2023, indicating the company’s size relative to its peers. Additionally, it has a negative return on equity of -5.95%, meaning that the company’s expenses are higher than the returns generated from its investments. This suggests that the company may need to reassess its operations in order to increase profits and create shareholder value.

– Shenzhen EXC-LED Technology Co Ltd ($SZSE:300889)

Shenzhen EXC-LED Technology Co Ltd is a Chinese based technology company which specializes in the design, manufacturing, and sale of industrial grade LED products. The company has a market cap of 2.3B as of 2023 and a Return on Equity of 1.22%. This is a remarkable performance for the company given the volatility in the global markets. Shenzhen EXC-LED Technology Co Ltd works with lighting manufacturers, providing customer-oriented lighting solutions as well as giving comprehensive after-sales services. The company has been investing heavily in research and development to stay ahead in the ever-evolving tech industry. With its impressive market cap and Return on Equity, Shenzhen EXC-LED Technology Co Ltd is set to become a leader in the LED industry.

Summary

Investing in OPTEX GROUP can be a smart move for those looking for a dividend stock. For the last three years, the company has issued an annual dividend of 36.0 JPY per share, resulting in an average yield of 2.47%. This yield is relatively stable, providing a reliable source of income for investors. Owing to its consistent dividend payment, OPTEX GROUP is a worthwhile consideration for those interested in securing a steady stream of income.

Recent Posts