Olba Healthcare stock dividend – Olba Healthcare Holdings Inc Announces 70.0 Cash Dividend

June 12, 2023

🌥️Dividends Yield

Olba Healthcare ($TSE:2689) Holdings Inc, one of the leading providers of healthcare services, announced a 70.0 JPY cash dividend on June 1, 2023. This increase in dividend payout could be a lucrative opportunity for investors interested in dividend stocks. Over the past three years, it has issued an annual dividend per share of 60.0 JPY, 60.0 JPY, and 45.0 JPY, with resulting dividend yields of 3.65%, 3.65%, and 3.51%, respectively, and an average yield of 3.6%. The ex-dividend date for the 70.0 JPY dividend is June 29, 2023.

To be eligible to receive the dividend payment, shareholders must purchase the stock prior to this date. Investors who are looking for a steady income stream and a good return on their investment should consider OLBA HEALTHCARE as an option. With this increase in cash dividend, OLBA HEALTHCARE is proving to be a reliable source of income for investors and a wise choice for those who are looking for long-term returns.

Market Price

The stock opened at JP¥1848.0 before closing at JP¥1835.0, representing a 0.8% decrease from the prior closing price of 1850.0. This marks the third consecutive quarter that OLBA HEALTHCARE has paid out a dividend to its shareholders. The dividend payment is estimated to be completed in mid-May of this year. OLBA HEALTHCARE Holdings Inc is committed to rewarding its shareholders and remains focused on creating long-term value for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Olba Healthcare. More…

| Total Revenues | Net Income | Net Margin |

| 109.06k | 1.44k | 1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Olba Healthcare. More…

| Operations | Investing | Financing |

| 1.35k | -211.81 | -1.17k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Olba Healthcare. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 41.88k | 32.1k | 1.5k |

Key Ratios Snapshot

Some of the financial key ratios for Olba Healthcare are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | 19.1% | 1.9% |

| FCF Margin | ROE | ROA |

| 1.0% | 13.4% | 3.1% |

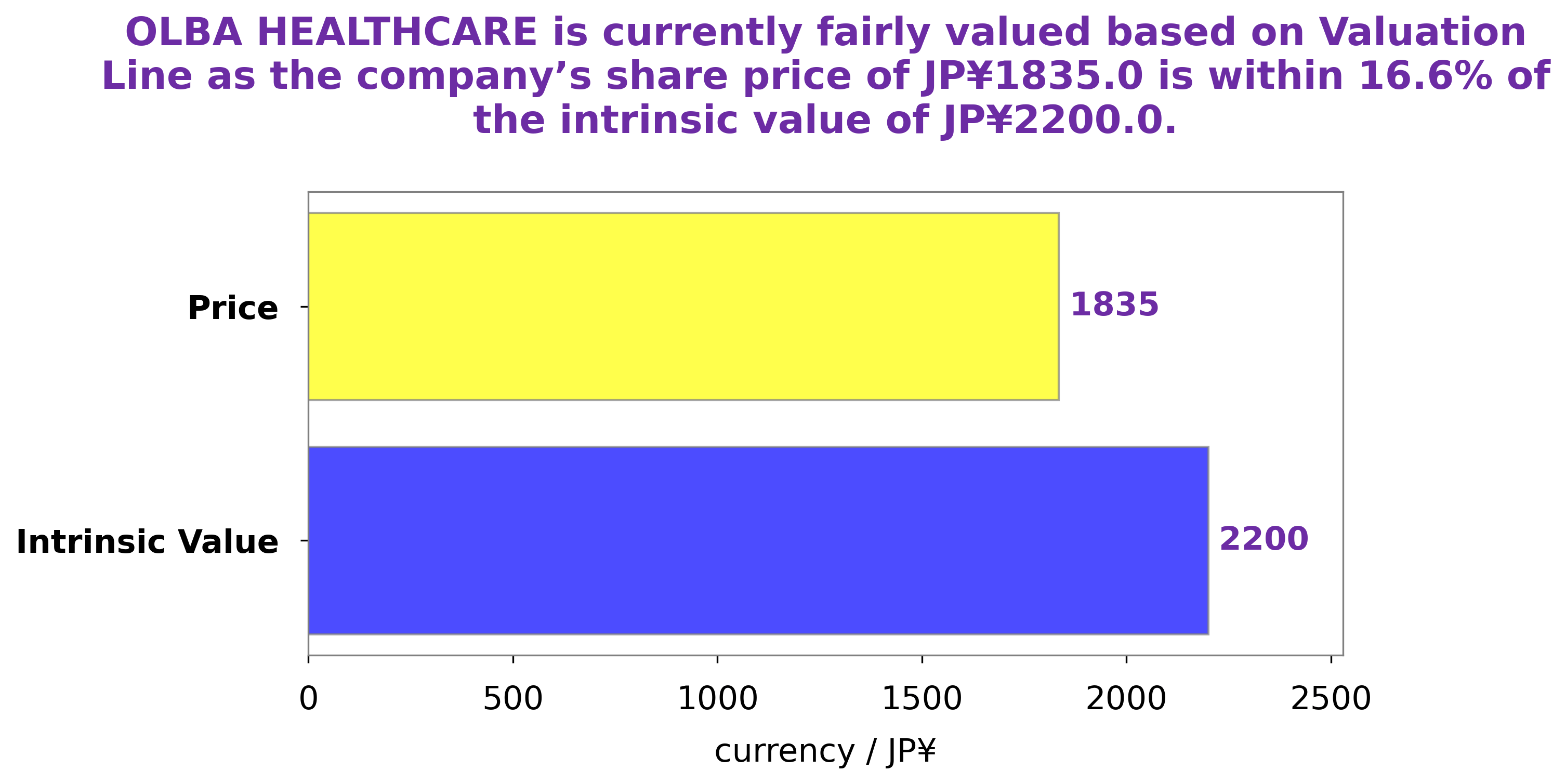

Analysis – Olba Healthcare Stock Intrinsic Value

At GoodWhale, we have conducted an analysis of OLBA HEALTHCARE‘s wellbeing. Our proprietary Valuation Line has calculated the intrinsic value of OLBA HEALTHCARE’s share to be around JP¥2200.0. Currently, the stock is being traded at JP¥1835.0, which is a fair price that is undervalued by 16.6%. Investing in OLBA HEALTHCARE at this price provides a great opportunity for investors to acquire a quality stock at a discounted price. More…

Peers

The healthcare sector has become increasingly competitive in recent years, with Olba Healthcare Holdings Inc facing a range of competitors such as BCM Alliance Bhd, Salus, and Medical Imaging Corp. All of these companies are looking to provide the best healthcare services to their customers, and they are constantly vying with each other to provide the best products and services. This competition has become increasingly intense, as all of these companies strive to be the leader in the healthcare sector.

– BCM Alliance Bhd ($KLSE:0187)

BCM Alliance Bhd is a Malaysian technology-driven company which specializes in the development of integrated circuit (IC) technology for consumer electronic and telecom industries. With its wide range of products and services, the company has been able to develop a strong market presence in the region. As of 2023, BCM Alliance Bhd has a market capitalization of 30.51M, making it one of the smaller public companies operating in Malaysia. The company’s Return on Equity (ROE) stands at -4.21%, indicating that its profitability is lower than its cost of equity. This may be a result of the company’s heavy investments in research and development for its products and services.

– Salus ($LTS:0HMV)

Salus is a global health care company specializing in the development and delivery of medical products and services. With a market cap of 148.21M as of 2023, Salus is a major player in the healthcare industry. Their Return on Equity (ROE) of 12.81% reflects their strong financial performance and successful investments in various areas, such as research and development, new product development, and marketing. Salus is committed to providing innovative, quality medical products and services to their customers, making them an attractive option for those seeking quality healthcare.

– Medical Imaging Corp ($TPEX:6637)

Imaging Corp is a medical imaging company that specializes in providing imaging services and solutions for healthcare providers. Its market cap of 1.22 billion as of 2023 reflects the company’s strong financial footing and successful growth in its industry. Additionally, Imaging Corp has also been successful in achieving a high return on equity (ROE) of 19.78%, which signifies its efficient management of resources and effective use of capital. With Imaging Corp’s robust financial performance and pioneering imaging solutions, the company is well-positioned to continue to drive growth and success for many years to come.

Summary

Investing in OLBA HEALTHCARE could be a good option for dividend investors. Over the last three years, the company has issued an annual dividend per share of 60.0 JPY, 60.0 JPY, and 45.0 JPY, resulting in a dividend yield of 3.65%, 3.65%, and 3.51%, respectively. This averages to a yield of 3.6%, which is above the market average.

Analyzing the company’s financials, one should consider the cash flows, profitability, and debt position of the company, as well as the competitive landscape in its industry. This will help determine whether investing in OLBA HEALTHCARE is worth the risk.

Recent Posts