NWN dividend – Northwest Natural Holding Pays Out $0.485 Dividend to Shareholders

April 15, 2023

Trending News ☀️

Northwest Natural Holding ($NYSE:NWN) recently announced a dividend of $0.485 per share to its shareholders. This dividend is a reflection of the performance of the company, which is a top natural gas storage and transportation provider in the United States. Northwest Natural Holding has a long-term goal to provide sustainable dividend growth, and the management believes that their latest dividend payment will contribute to this goal. The dividend payment is part of the company’s commitment to rewarding shareholders while maintaining a strong balance sheet.

Overall, Northwest Natural Holding’s dividend payment is great news for its shareholders. The company’s commitment to delivering long-term sustainable dividend growth is reassuring for current and future investors. With the latest dividend payment, Northwest Natural Holding is demonstrating its commitment to shareholders and its ability to deliver strong returns in the years to come.

Dividends – NWN dividend

This dividend aligns with the company’s traditional practice of issuing an annual dividend per share of 1.93 USD over the last 3 years. The average dividend yield from 2022 to 2022 is also 3.92%. This ensures that shareholders benefit from consistent returns, even as the company continues to expand.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NWN. More…

| Total Revenues | Net Income | Net Margin |

| 1.04k | 86.3 | 8.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NWN. More…

| Operations | Investing | Financing |

| 147.67 | -435.46 | 301.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NWN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.75k | 3.57k | 33.09 |

Key Ratios Snapshot

Some of the financial key ratios for NWN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 5.3% | 16.3% |

| FCF Margin | ROE | ROA |

| -18.5% | 9.2% | 2.2% |

Share Price

The dividend payout is in line with NWN’s commitment to its shareholders, providing a regular dividend as well as long-term capital appreciation. NWN’s current dividend yield is around 4%, one of the highest yields for utility stocks in the industry. Investors should look forward to continued dividend payments in the future as well as potential capital appreciation. Live Quote…

Analysis – NWN Stock Intrinsic Value

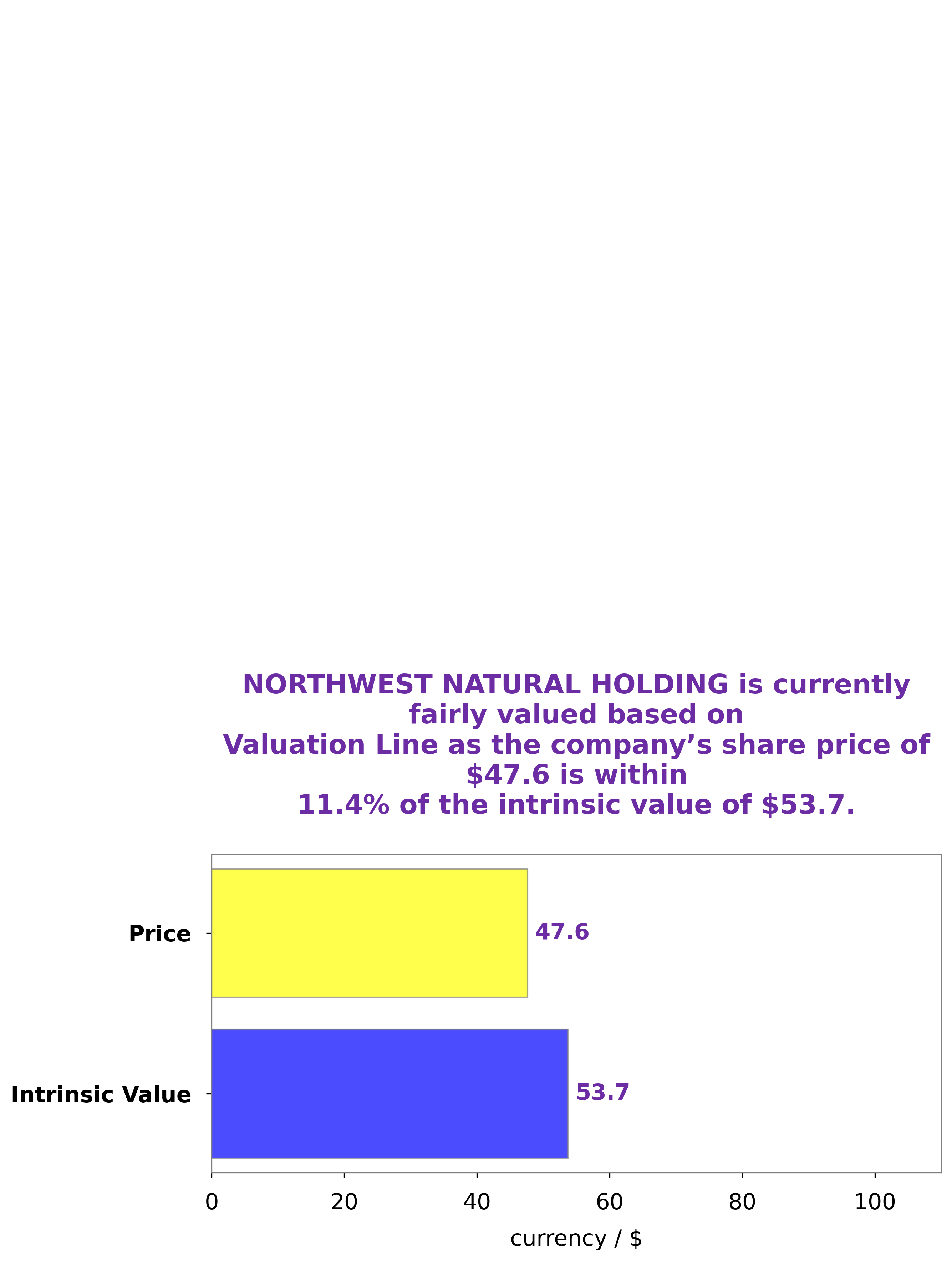

We at GoodWhale recently conducted a wellbeing analysis of NORTHWEST NATURAL HOLDING and have determined that the fair value of its shares is around $53.7. This valuation was calculated using our proprietary Valuation Line. Despite this, NORTHWEST NATURAL HOLDING stock is currently trading at $47.6, which is 11.4% lower than its fair price. This presents an opportunity for investors to buy the stock at a discounted rate and reap the rewards when the stock returns to its fair value. More…

Peers

Its competitors include RGC Resources Inc, ONE Gas Inc, and Indraprastha Gas Ltd. The company has a strong market position and is well-positioned to continue its growth.

– RGC Resources Inc ($NASDAQ:RGCO)

RGC Resources is a diversified energy services company that provides natural gas and electricity to residential, commercial, and industrial customers in Virginia, North Carolina, and South Carolina. The company also provides energy-related products and services to customers in Virginia and North Carolina. RGC Resources has a market cap of 206.32M as of 2022, a Return on Equity of -13.92%. The company has been in operation for over 100 years and is headquartered in Roanoke, Virginia.

– ONE Gas Inc ($NYSE:OGS)

Natl Gas Co is a holding company, which engages in the distribution of natural gas. It operates through the following segments: Natural Gas and Others. The Natural Gas segment offers natural gas to residential, commercial and industrial customers. The Others segment includes activities of the Company’s subsidiaries in the electricity, water and waste industries. The company was founded on December 28, 1922 and is headquartered in Buenos Aires, Argentina.

– Indraprastha Gas Ltd ($BSE:532514)

Indraprastha Gas Ltd (IGL) is an Indian natural gas distribution company. It is engaged in the business of marketing and distributing natural gas in the National Capital Region of India. IGL also has a city gas distribution network in the cities of Agra and Kanpur. The company has a customer base of over 2.6 million customers.

IGL has a market capitalization of Rs 296.1 billion as of March 31, 2022. The company has a return on equity of 17.79%. IGL is a leading player in the city gas distribution market in India. The company has a strong presence in the National Capital Region of India, with a customer base of over 2.6 million customers.

Summary

Analysts have noted positive earnings growth over the past year, and the stock has also seen a decent increase in share price over that period. Overall, NWN looks like a solid investment opportunity for those looking for steady and reliable income from dividends.

Recent Posts