Nvent Electric dividend yield – nVent Electric PLC Declares 0.175 Cash Dividend

April 5, 2023

Dividends Yield

On April 1st 2023, nVent Electric PLC declared a cash dividend of 0.175 USD per share. This follows the company’s annual dividend of 0.7 USD per share over the past 3 years, which has yielded an average dividend of 2.05%. Investing in stocks that provide dividends can be a great way to earn additional income, and NVENT ELECTRIC ($NYSE:NVT) may be an attractive option for those seeking an income from their investments.

The ex-dividend date for the declared dividend is April 27th, 2023. In order to be eligible to receive the dividend, investors must own the shares before this date.

Market Price

This news caused the stock to increase in value, as it opened at $43.8 and closed at $44.5, up by 3.6% from last closing price of 42.9. The company hopes the dividend will help maintain the support from its investors and shareholders. In addition, nVent Electric PLC is expecting that the dividend will be a source of income for investors and an incentive for long-term growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nvent Electric. More…

| Total Revenues | Net Income | Net Margin |

| 2.91k | 399.8 | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nvent Electric. More…

| Operations | Investing | Financing |

| 394.6 | -52.5 | -82.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nvent Electric. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.9k | 2.17k | 16.52 |

Key Ratios Snapshot

Some of the financial key ratios for Nvent Electric are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.7% | 9.8% | 17.3% |

| FCF Margin | ROE | ROA |

| 12.0% | 11.7% | 6.4% |

Analysis – Nvent Electric Intrinsic Stock Value

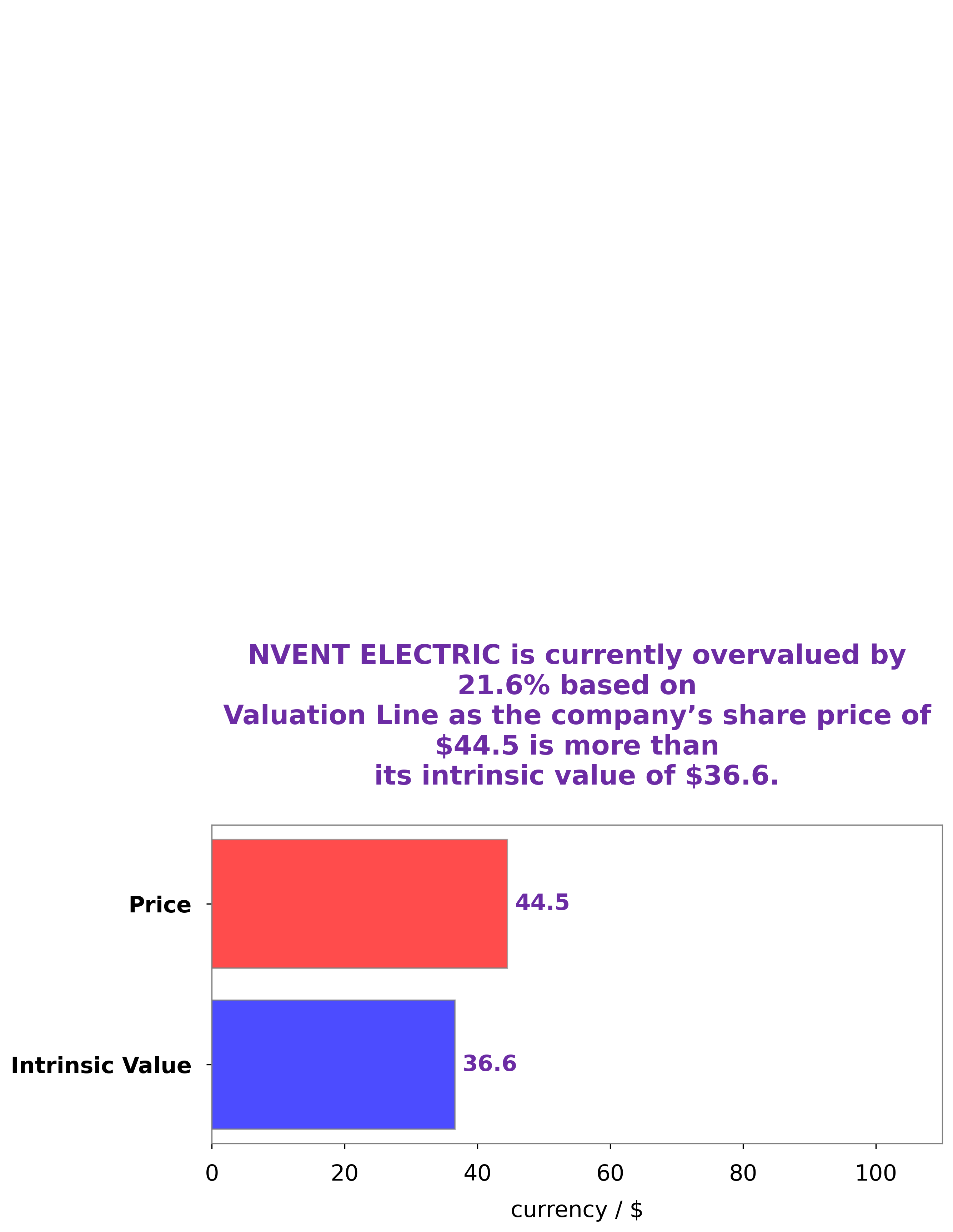

At GoodWhale, we conducted an analysis of NVENT ELECTRIC‘s wellbeing. Our proprietary Valuation Line showed that the fair value of NVENT ELECTRIC share is around $36.6. However, the current price for NVENT ELECTRIC stock is $44.5, which is overvalued by 21.7%. This discrepancy between fair value and current market price signals a potential opportunity for investors who want to capitalize on a potentially undervalued stock. More…

Peers

The company operates in over 40 countries and serves a variety of customers in the commercial, industrial and utility sectors. nVent’s products and solutions include enclosures, connectors, fasteners, thermal management products, circuit breakers and switchgear. The company has a strong presence in Europe and North America, and is expanding its operations in Asia and South America. Shenzhen Genvict Technologies Co Ltd, Easun Reyrolle Ltd, and Global Electrical Technology Corp are among nVent’s major competitors.

– Shenzhen Genvict Technologies Co Ltd ($SZSE:002869)

Shenzhen Genvict Technologies Co Ltd is a Chinese technology company that specializes in Internet of Things (IoT) solutions. The company has a market capitalization of 4.27 billion as of 2022 and a return on equity of -3.9%. The company’s products and services include IoT devices, platforms, and applications.

– Easun Reyrolle Ltd ($BSE:532751)

Easun Reyrolle Ltd is an Indian company that manufactures electrical equipment and provides engineering services. The company has a market cap of 76.99M as of 2022 and a Return on Equity of -1.46%. Easun Reyrolle Ltd is a part of the RPG Group and has its headquarters in Chennai, Tamil Nadu. The company manufactures a range of electrical products such as switchgear, power transformers, and meters. It also provides engineering services in the areas of electrical design, erection, and commissioning.

Summary

NVENT ELECTRIC is an attractive investment for those looking for steady dividend returns. Over the past three years, the company has provided an annual dividend per share of 0.7 USD, yielding an average dividend of 2.05%. This can provide investors with stability, as it is consistent and reliable.

Furthermore, the dividend is relatively high compared to the market average, making it a good option for people who are looking for a steady income stream. NVENT ELECTRIC is a safe choice for those who want to invest in stocks that provide dividends over the long term.

Recent Posts